WTI languishes above $40.50 lows amid unfavourable risk flows

- WTI trades lower as a function of the broader risk-off market tone, although is off $40.50 lows.

- Today’s OPEC+ JMMC largely went under the radar, with focus on the end of month official OPEC+.

WTI crude currently trades just above $41.00, above lows closer to $40.50, but still with losses of around $0.30 on the day or about 0.7%.

Crude conforms to risk-off flows

A broader tone of risk-off that has permeated global financial markets today has also weighed on crude oil markets. Broadly speaking, the downside seen in global equity and commodity markets initially seemed to be a technical correction/profit-taking following yesterday’s Moderna vaccine news inspired gains, however, soft US retail sales data at 13:30 is likely also not helping.

Supply-side developments seem not to have shifted the radar much for crude oil markets; the OPEC+ Joint Ministerial Monitoring Committee (JMMC) met today. Their meeting, which proceeds the all-important end-of-month official OEPC+ meeting, failed to yield a recommendation, but recent reports suggest that there is broad support amongst OPEC+ for at least a 3-month extension to the current 7.4M BPD in output cuts agreed to by the cartel.

Looking ahead, crude oil market focus now shifts to US inventories, with private weekly API inventory data out at 21:30GMT tonight, ahead of official inventories numbers from the US EIA on Wednesday at 15:30GMT.

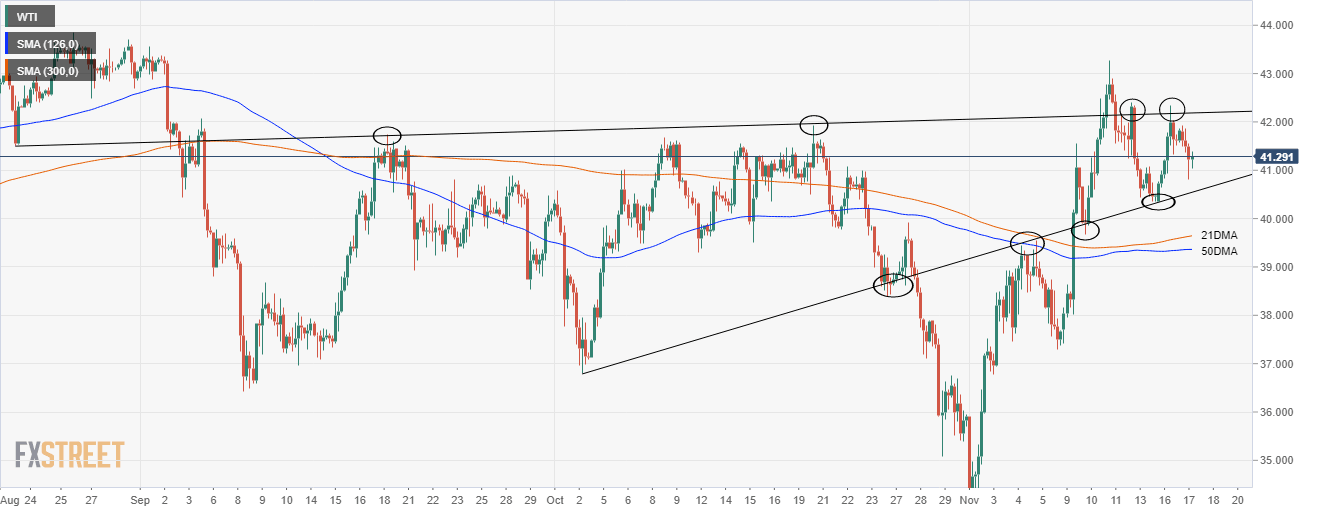

WTI continues consolidation between trendlines

WTI continues to consolidate between two long-term uptrends. To the upside is a trendline linking the 21 August low and the 18 September, 20 October, 12 and 16 November highs (all between $41.50 and $42.00), and looks set to come into play just above the psychological $42.00 level, which itself WTI has struggled to rally above over the last three months. To the downside, is a trendline linking the 2, 26 October, lows, the 4 and 5 November highs and 13 November lows. This trendline ought to come into play well before support at the $41.00 and the 13 November low at $40.06.

Looking at WTI through a shorter-term lens, Tuesday’s lows around $40.50 ought to offer the most immediate support, while Tuesday’s highs just above $41.50 will offer the most immediate resistance.

WTI four-hour chart

Author

Joel Frank

Independent Analyst

Joel Frank is an economics graduate from the University of Birmingham and has worked as a full-time financial market analyst since 2018, specialising in the coverage of how developments in the global economy impact financial asset