WTI holds in supply zone, eyes on correction to 21-day EMA

- US oil takes a breather in the resistance zone with a focus on a correction.

- US dollar slumps to fresh lows, but commodities remain on backfoot.

WTI was ending the North American day flat on Tuesday and had travelled between a low of $65.43 and a high of $66.49.

The US dollar has edged lower on Tuesday to print 89.5350 for a fresh 4-1/2 month lows against a basket of peers in the DXY.

Nevertheless, the commodities complex was down on the day according to the CRB index that fell 0.26% by the close on Wall Street.

Meanwhile, the price of oil has been supported by tempered expectations of an early return of oil exporter Iran to international crude markets as well as prospects of unprecedented demand from the global economic recovery.

Indirect negotiations between the United States and Iran are due to resume in Vienna this week. Talks were given another life after Tehran and the UN nuclear agency extended a monitoring agreement on the Middle Eastern country's atomic programme.

Overall, the market is approaching the seasonal peak in demand, and analysts argue that it will be in a much stronger position to handle any additional oil.

WTI technical analysis

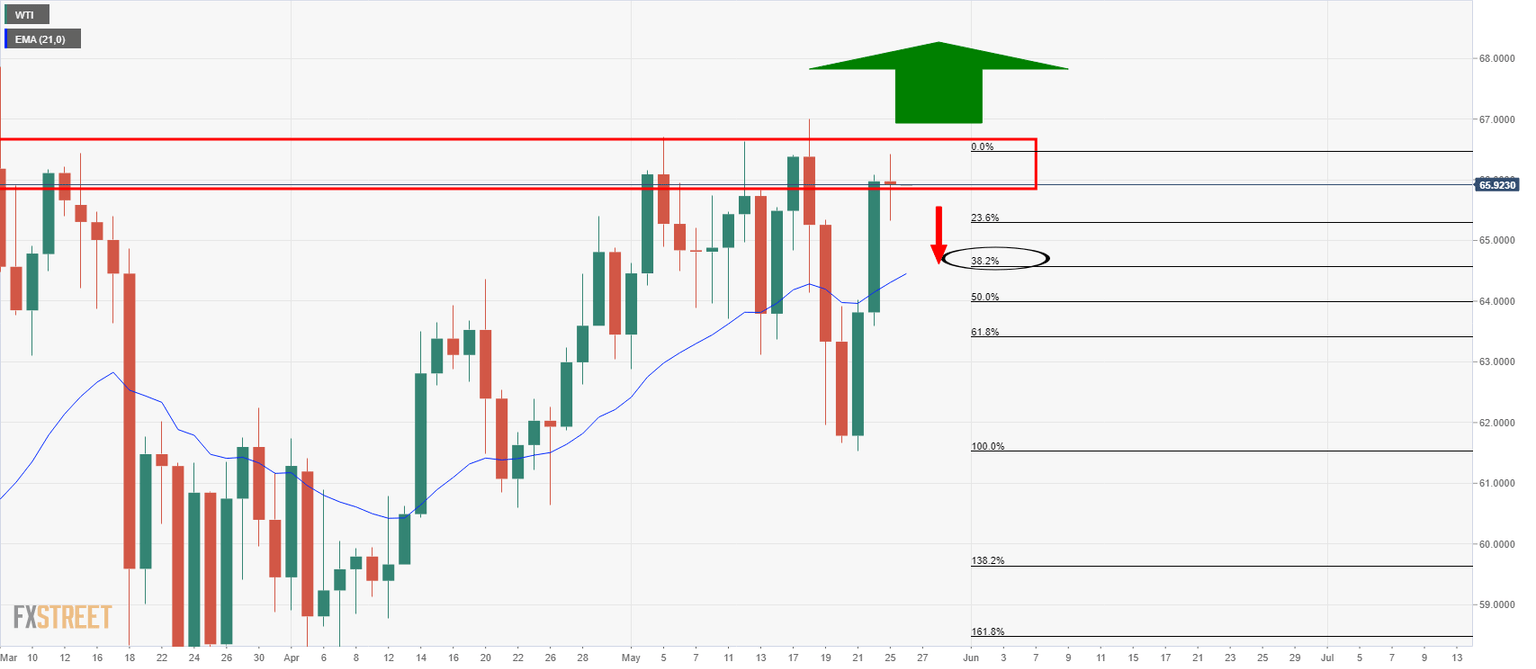

We saw the last bullish impulse has extended back into resistance territory on the daily chart and has been capped near to the prior highs of 66.99.

However, a move higher will open the potential for a significant continuation. On the other hand, a correction would be expected in the near term.

A 38.2% Fibonacci of the daily bullish impulse comes in at 64.57 meeting the 21-day EMA.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.