Will the Nasdaq 100’s relief rally hold or is a sharp decline inevitable? [Video]

![Will the Nasdaq 100’s relief rally hold or is a sharp decline inevitable? [Video]](https://editorial.fxstreet.com/images/Markets/Equities/Nasdaq/new-york-stock-exchange-18404353_XtraLarge.jpg)

Watch the free-preview video below extracted from the WLGC session before the market opens on 23 Jul 2024 to find out the following:

-

How might the rotation of funds into small-cap stocks and the Dow Jones affect the Nasdaq 100?

-

How can we spot the exhaustion of the downward momentum and hidden demand?

-

Why could more weakness be ahead in the Nasdaq 100 and what to expect next?

-

And a lot more…

Market environment

The bullish vs. bearish setup is 510 to 85 from the screenshot of my stock screener below.

The ongoing rotation from the Nasdaq 100 & S&P500 into the Russell 2000 as mentioned in last week’s email is further manifested in yesterday’s price action among the indices.

Despite the weakness reflected in the major indices, there is still no shortage of bullish setups (510 bullish setups vs. 85 bearish setups) thanks to the market rotation.

Three stocks ready to soar

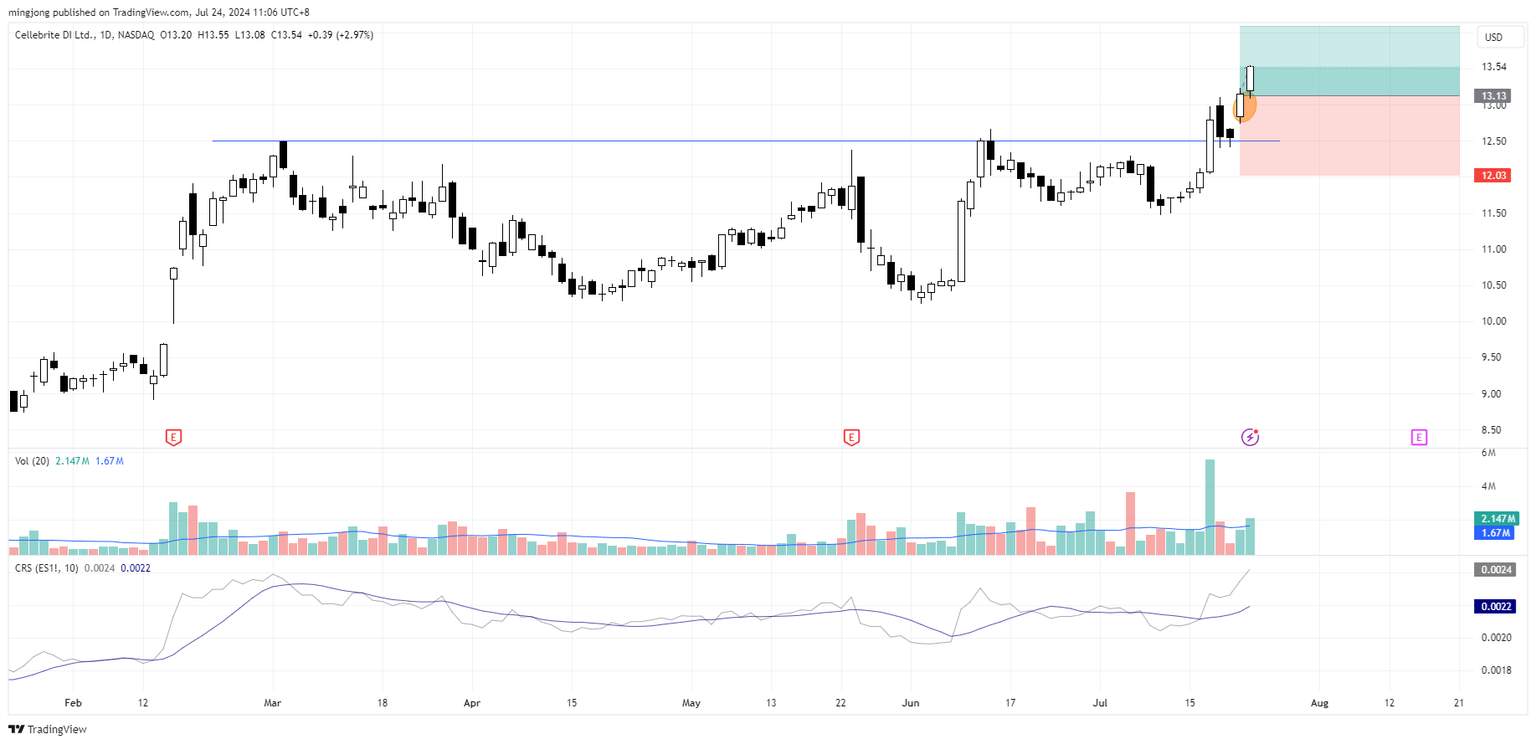

5 “low-hanging fruits” trade entries setups CLBT, TPC + 19 actionable setups CVNA were discussed during the live session before the market open (BMO).

CLBT

TPC

CVNA

Author

Ming Jong Tey

Independent Analyst

Ming Jong Tey has been trading since 2008. He started his learning journey from technical analysis (indicators, Fibonacci, etc...) to value investing. Throughout his journey, he develops an interest in price action with chart pattern trading.