When is the German IFO survey and how it could affect EUR/USD?

The German IFO Business Survey Overview

The German IFO survey for May is due for release later today at 0800 GMT. The headline IFO Business Climate Index is seen firmer at 78.3 versus 74.3 previous.

The Current Assessment sub-index is seen arriving at 80.0 this month, while the IFO Expectations Index – indicating firms’ projections for the next six months – is likely to come in at 75.0 in the reported month vs. 69.4 last.

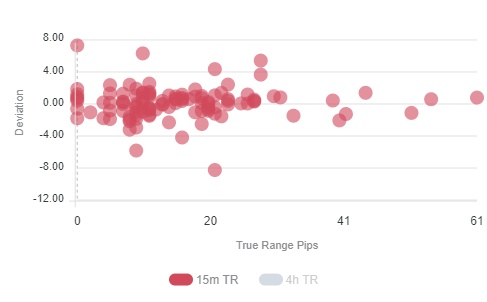

Deviation impact on EUR/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 3 and 30 pips in deviations up to 3.0 to -4.2, although in some cases, if notable enough, a deviation can fuel movements of up to 60 pips.

How could affect EUR/USD?

According to Haresh Menghani, Analyst at FXStreet, “From a technical perspective, the pair last week once again faced rejection near the very important 200-day SMA. A subsequent slide below the 1.0900-mark points to the emergence of some fresh selling. Hence, some follow-through weakness, towards the 1.0845 horizontal support, now looks a distinct possibility. Some follow-through selling has the potential to drag the pair back towards the 1.0800 mark.”

“On the flip side, any meaningful positive move back above the 1.0900 mark now seems to confront some fresh supply near the 1.0945-50 region. Bulls might then aim towards challenging the trading range resistance, around 1.0975 region, en-route the 1.1000 mark. A convincing break through the 200-day SMA, currently near the 1.1010-15 region, will negate any near-term bearish outlook and set the stage for a further near-term appreciating move,” Haresh adds.

Key notes

EUR/USD: Bulls need a better-than-expected German IFO Expectations Figure

Coronavirus update: Germany’s reproduction rate ticks higher to 0.94, still below 1.0 key level

Forex Today: Dollar in demand amid high Sino-American tensions, thin liquidity expected

About the German IFO Business Climate

This German business sentiment index released by the CESifo Group is closely watched as an early indicator of current conditions and business expectations in Germany. The Institute surveys more than 7,000 enterprises on their assessment of the business situation and their short-term planning. The positive economic growth anticipates bullish movements for the EUR, while a low reading is seen as negative (or bearish).

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.