Canada Unemployment Rate rises to 6.8% in December vs. 6.6% expected

- The Unemployment Rate in Canada rose at a faster pace than expected in December.

- USD/CAD continues to trade in a tight range below 1.3900.

The Unemployment Rate in Canada rose to 6.8% in December from 6.5% in November, the data published by Statistics Canada showed on Friday. This reading came in worse than the market expectation of 6.6%. On a monthly basis, the Net Change in Employment was +8.2K, compared to analysts' estimate of -5K.

In this period, Average Hourly Wages rose by 3.7% on a yearly basis, compared to 4% in November, while the Participation Rate rose to 65.4% from 65.1%.

Market reaction to Canada employment data

These data failed to trigger a noticeable market reaction. At the time of press, USD/CAD was virtually unchanged on the day at 1.3868.

This section below was published as a preview of the Canada employment data at 11:19 GMT.

Canada Employment Overview

The Canadian labour market data for December is due for release today at 13:30 GMT. Statistics Canada is expected to show that there was a reduction in the labor force as 5K workers were fired, against hiring of 53.6K job-seekers in November. The Unemployment Rate is seen rising to 6.6% from the prior release of 6.5%.

Signs of a slowdown in the job market are expected to be unfavorable for the Canadian Dollar (CAD), as they could boost the need of interest rate cuts by the Bank of Canada (BoC) in the near term. The Canadian central bank held interest rates steady at 2.25% in its last two monetary policy meetings and stated that the current policy is appropriate to keep inflation close to the 2% target, while supporting the economy through this period of structural adjustment.

Apart from the job data, investors will also focus on Average Hourly Wages data, a key measure of wage growth. The wage growth measure rose at an annualized pace of 4% in November.

How could the Canadian employment data affect USD/CAD?

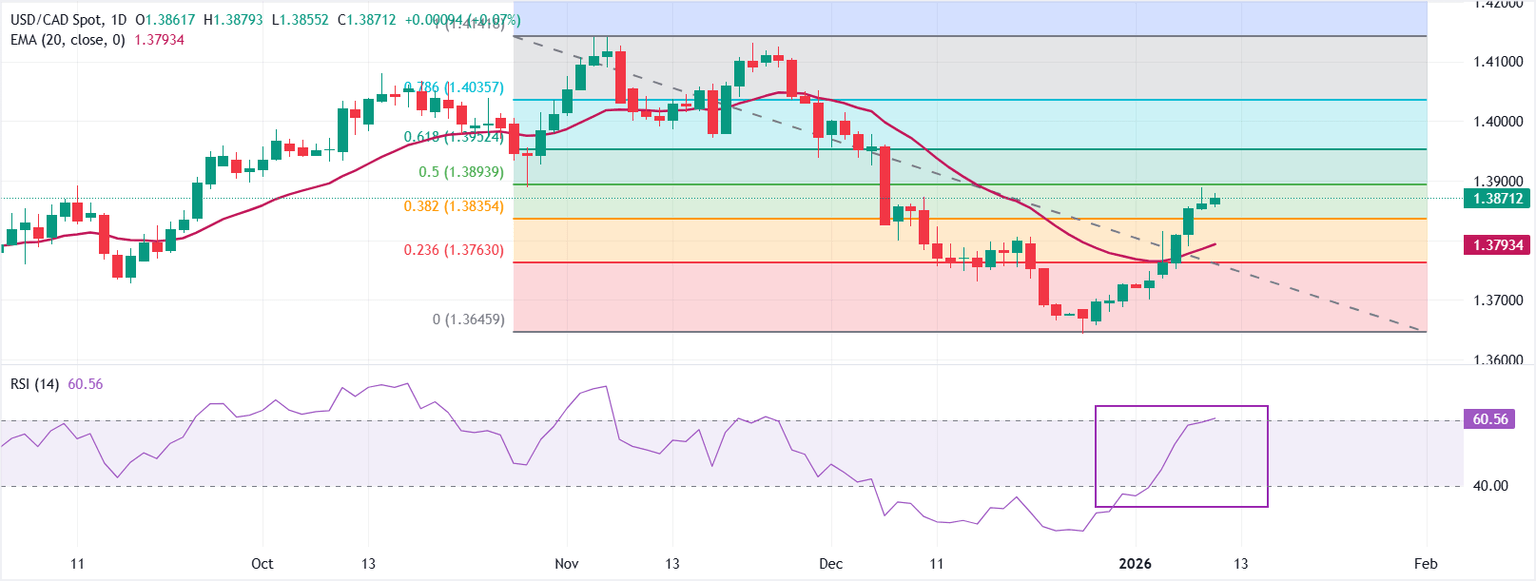

USD/CAD extends its two-week-long rally to near 1.3871 on Friday ahead of the US NFP data release. The 20-day Exponential Moving Average (EMA) has turned higher to 1.3793, and the pair holds above it, preserving a near-term bullish bias.

The 14-day Relative Strength Index (RSI) at 60 (bullish) confirms improving momentum without overbought pressure.

Measured from the 1.4142 high to the 1.3646 low, the pair has risen to near the 50% Fibonacci retracement at 1.3894. A daily close above the same would extend the rebound toward the 61.8% Fibonacci retracement at 1.3952. On the contrary, the upside bias could fizzle out if it failed to break above 1.3894, which might lead to a correction toward the 23.6% Fibonacci retracement at 1.3763.

(The technical analysis of this story was written with the help of an AI tool.)

Employment FAQs

Labor market conditions are a key element to assess the health of an economy and thus a key driver for currency valuation. High employment, or low unemployment, has positive implications for consumer spending and thus economic growth, boosting the value of the local currency. Moreover, a very tight labor market – a situation in which there is a shortage of workers to fill open positions – can also have implications on inflation levels and thus monetary policy as low labor supply and high demand leads to higher wages.

The pace at which salaries are growing in an economy is key for policymakers. High wage growth means that households have more money to spend, usually leading to price increases in consumer goods. In contrast to more volatile sources of inflation such as energy prices, wage growth is seen as a key component of underlying and persisting inflation as salary increases are unlikely to be undone. Central banks around the world pay close attention to wage growth data when deciding on monetary policy.

The weight that each central bank assigns to labor market conditions depends on its objectives. Some central banks explicitly have mandates related to the labor market beyond controlling inflation levels. The US Federal Reserve (Fed), for example, has the dual mandate of promoting maximum employment and stable prices. Meanwhile, the European Central Bank’s (ECB) sole mandate is to keep inflation under control. Still, and despite whatever mandates they have, labor market conditions are an important factor for policymakers given its significance as a gauge of the health of the economy and their direct relationship to inflation.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.