When is Aussie CPI and how might AUD/USD be affected?

Australia’s third quarter Consumer Price Index will be released at the top of the hour, 00.30 GMT, whereby food, dwellings, electricity and domestic holidays are expected to continue driving headline inflation higher, though various state government energy rebates should provide an offset, the extent of which is highly uncertain, as analysts at Westpac argued.

Hence, Westpac anticipates 1.1% and 1.5% rises for the headline and trimmed mean CPI measures, respectively (market forecast: 1.6% and 1.5% respectively), taking the headline’s annual pace to 6.5% (market 7.0%).

Meanwhile, analysts at TD Securities expect a more dovish headline CPI print due to the significant offset from the rebates and lower pump prices. ''However, trimmed-mean CPI may stay elevated at 1.6% QoQ as broader price pressures are still brewing, especially in the housing and food categories. Unless trimmed-mean inflation is strongly higher, we expect the Bank to stick with 25bps hikes until March 2023.''

How might AUD/USD react?

The sentiment around the Federal Reserve monetary tightening and the policy direction of top trading partner China after President Xi Jinping have seen a lot of volatility in the price with the ATR picking up to over 100 pips for any given day. Therefore we could see some heightened volatility.

If the data comes in hot, given that the Reserve Bank of Australia only delivered a smaller-than-expected 25 basis point rate hike earlier this month, then there could be prospects of stronger action next time around that will only feed into the bullish AUD playbook.

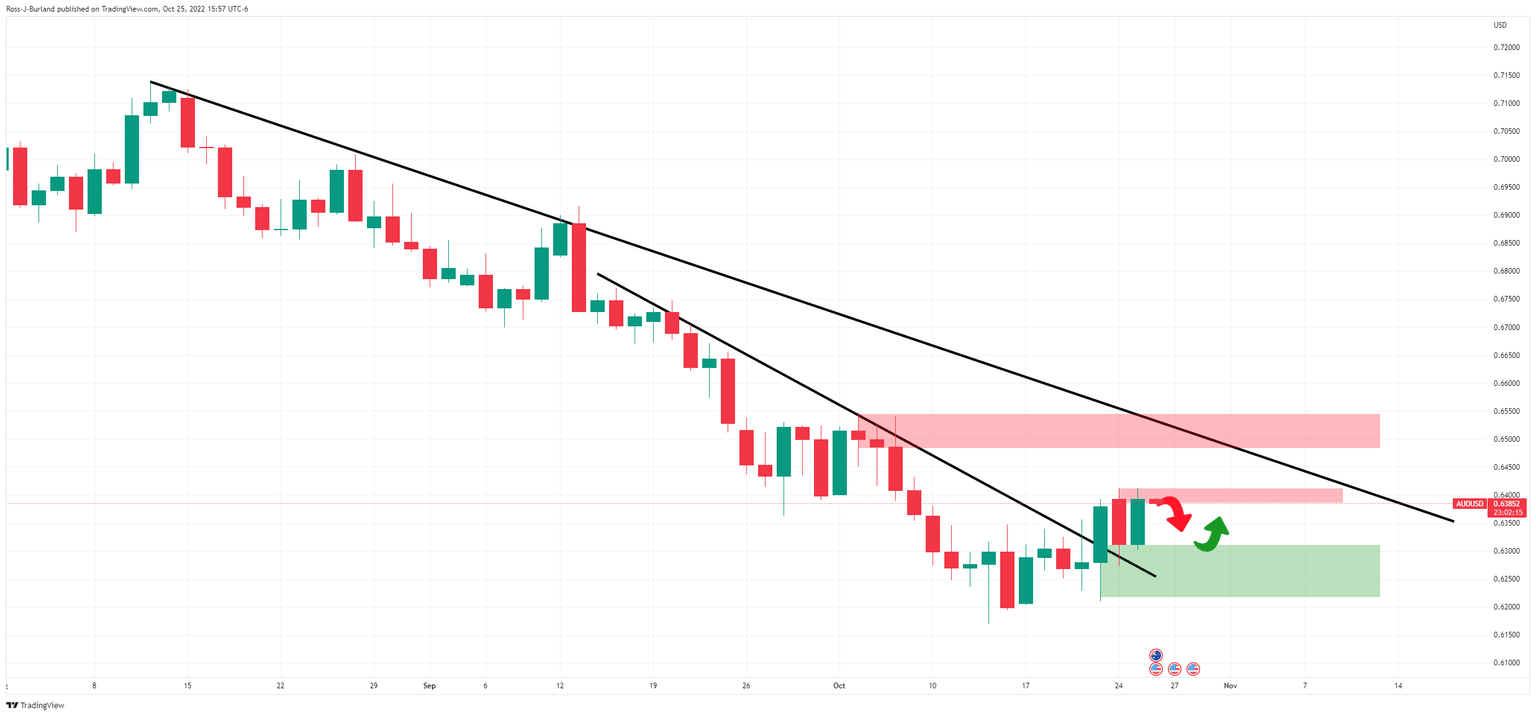

The daily chart is neutral with both the upside and downside to play for at this juncture. However, the double top on the hourly chart shows the price under pressure:

AUD/USD H1 chart

The price is coiling within a geometrical pattern and is forming an M-top with prospects of a move into mitigating the price imbalance of the hourly impulse towards trendline support.

About Aussie CPI

The Consumer Price Index released by the RBA and republished by the Australian Bureau of Statistics is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The trimmed mean is calculated as the weighted mean of the central 70% of the quarterly price change distribution of all CPI components, with the annual rates based on compounded quarterly calculations.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.