West Pharmaceutical Services (WST) bullish daily cycle

West Pharmaceutical Services, Inc. (NYSE:WST) is a designer and manufacturer of injectable pharmaceutical packaging and delivery systems. The Elliott Wave structure based on the 2023 daily cycle will be explored in this article.

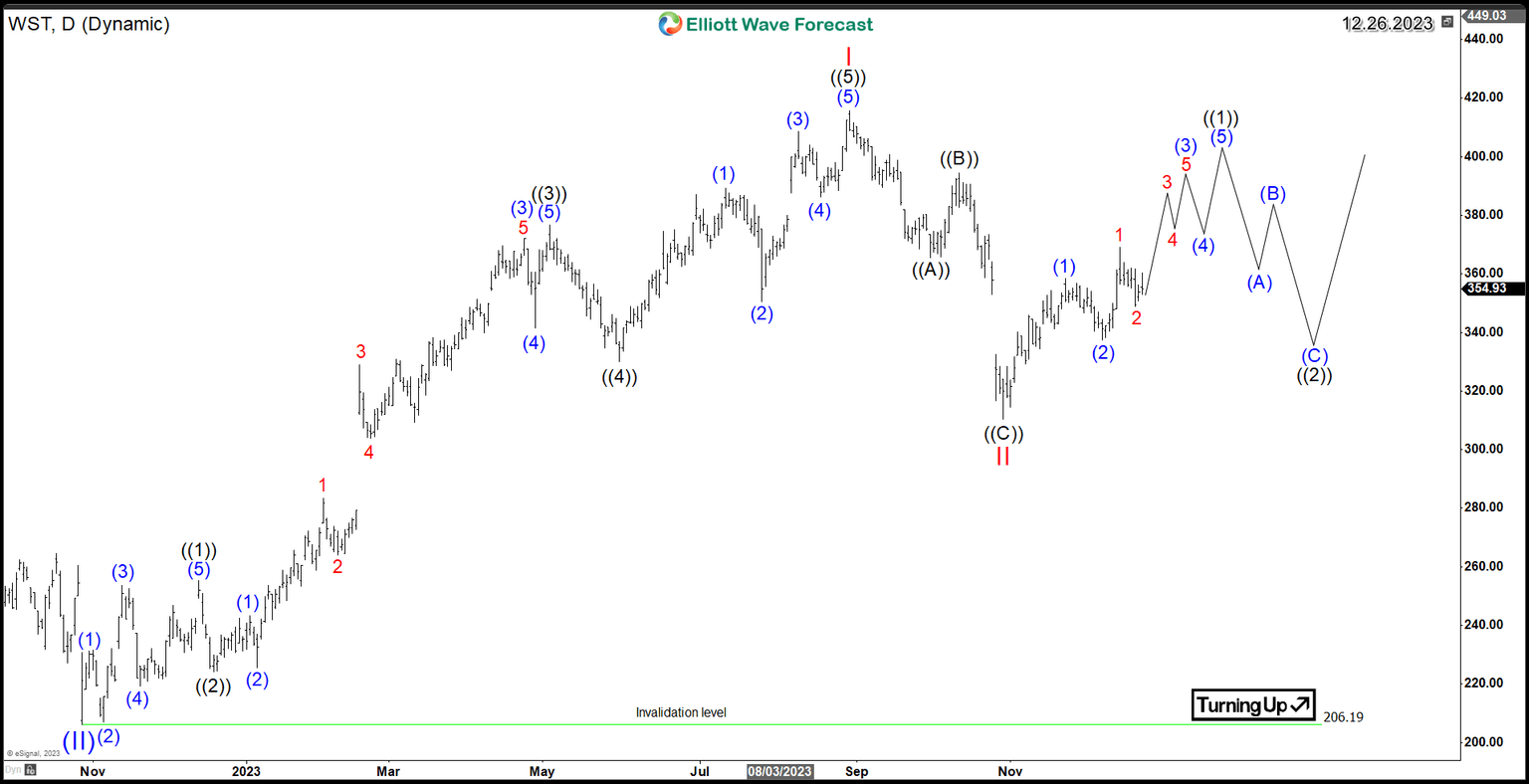

Since the 55% decline from its 2021 peak, WST found a major low in October 2022 before reversing to the upside. Since then, the stock has seen a 100% rally unfold within a clear impulsive 5-wave advance. This initial move, labeled as wave I, established the new bullish daily trend for the stock and will support the price to stay above $206.

Following a corrective decline from its August 2023 peak within a 3-wave Zigzag structure, the stock reached the equal legs area of $333 – $314, where wave II can be called completed. It could have started the next leg to the upside. To confirm this path, WST needs to establish a new 5-wave advance from its October 2023 low, and short-term pullbacks need to remain corrective above $310.4. As long as these conditions are met, the stock will be looking to rally above its $415 peak and create a new bullish sequence, which will allow more upside within the daily cycle next year.

WST daily chart 12.26.2023 (zigzag correction)

Alternatively, if the rally from the October low remains corrective within 3 swings and fails to break above $415, then WST could be facing a another type of correction within wave II. The stock could see another 3-swing lower part of a larger Double Three structure (WXY) and would need more time to finish the move to the downside in wave II before the next leg higher takes place.

WST daily chart 12.26.2023 (double three correction)

In conclusion, WST’s daily cycle is expected to remain supported for a new rally to take place above $415 next year. However, the mid-term path could vary depending on the short-term structure taking place, as the risk of another correction lower remains present as long as the stock stays below its August 2023 peak.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com