Wake Up Wall Street (SPY) (QQQ): Will Fed fright stop market surge?

Here is what you need to know on Tuesday, November 2:

November maintains its steady record-breaking start for equity markets as the flow of money is just too strong to argue against. We alluded to this yesterday, but now that earnings season is out of the way the year-end push for corporate buybacks is ramping up with a huge wall of money set to be unleashed. Clean energy stocks certainly benefit from the ongoing COP26 forum just after the G20 climate meeting in Rome and imminent stimulus from President Biden. BP of the older energy generation is not to be outdone though as surging energy prices see it add a cool billion dollars to its buyback program.

Away from energy, the continued persistence of covid is at least proving a boon for vaccine manufacturers with Pfizer (PFE) boosting its sales numbers. This is due to booster shots, more deals and shots for kids now being added to the likelihood that covid is endemic and will be added to the yearly vaccination quota globally.

The dollar is pretty flat again as yields dip slightly, 1.16 versus the euro. Gold is steady at $1,792. Bitcoin is at $63,300, a gain of 3%. US yields are slightly lower, and Oil dips to $83.30.

See forex today.

European markets are mixed, Eurostoxx is flat, FTSE +0.7% led by BP, while Dax is -0.75.

US futures are flat with the Nasdaq at -0.1%, the biggest mover.

Wall Street (SPY) (QQQ) stock news

Pfizer (PFE) jumps 3% on strong earnings and forecasts.

Tesla (TSLA): Elon Musk tweets that no deal signed with Hertz. Also, Tesla to recall up to 12,000 vehicles.

Hertz (HTZZ) says the initial demand for Teslas is very strong, says deliveries of Tesla already started in response to Elon Musk tweet-Reuters.

Avis Budget (CAR) reports earnings well ahead of estimates, up 75% premarket.

Clorox (CLX) beats estimates, up 2% premarket.

DuPont (DD) beats estimates but cuts outlook.

Simon Property (SPG): Simon says "Wow!" as it smashed EPS estimates, up 4% in premarket.

ConocoPhillips (COP) posts a strong return to profit on energy prices, no surprise!

Marathon Petroleum (MPC): copy-paste above!

Under Armour (UA) still seeing the benefits of a more flexible working environment as it raises forecasts.

Apple (AAPL) cutting back production of iPads to boost iPhone chip availability-Reuters.

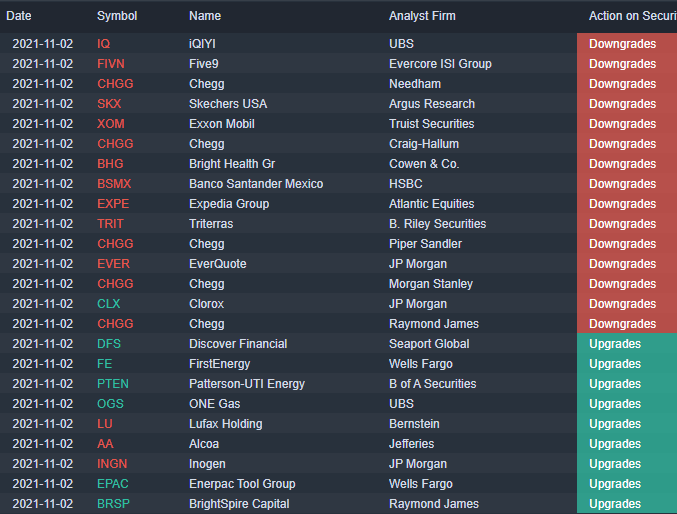

Upgrades, downgrades

Source: Benzinga Pro

Economic releases

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.