Wake Up Wall Street (SPY) (QQQ): Traders return to busy earnings week

Here is what you need to know on Tuesday, January 17:

Traders return today after a long weekend in the US, and initial signs are for a muted start to the week. Data overnight from China was positive, but we failed to see a positive push forward from commodities. Europe then added to the bullish sentiment with a strong ZEW from Germany, but again the market shrugged its shoulders and went all "meh". With a big earnings season upon us perhaps that should come as no surprise. This week we get the end of the investment banks today with Morgan Stanley (MS) and Goldman (GS). Then it is onto the regional and commercial banks. Netflix (NFLX) opens the tech season on Thursday.

The US Dollar is a touch weaker in thin trading at 102.16 for the Dollar Index as we await the Bank of Japan. Gold is also lower at $1,912, and Oil has now spiked above $80 to $80.47, as perhaps a late reaction to the strong ZEW and Chinese data.

European markets: mixed, FTSE, CAC, DAX, and Eurostoxx all trading just around flat.

US futures: all lower by -0.2%.

Wall Street top news

German ZEW is much better than expected.

China's GDP, retail sales and unemployment are all better than expected.

Morgan Stanley (MS): in line EPS, beats on revenue.

Goldman Sachs (GS) big miss on EPS and revenue.

Reuters headlines

Activision Blizzard Inc (ATVI) & Microsoft Corp (MSFT): Microsoft is likely to receive an EU antitrust warning about its $69 billion bid for "Call of Duty" maker Activision Blizzard, people familiar with the matter said, that could pose another challenge to completing the deal.

AbbVie Inc & Eli Lilly and Co (ABBV): The pharmaceutical companies have withdrawn from Britain's voluntary medicines pricing agreement, an industry body said on Monday.

Alibaba Group Holding Ltd (BABA): Billionaire investor Ryan Cohen has built a stake in China's Alibaba Group worth hundreds of millions of dollars and is pushing the e-commerce giant to increase and speed up share buybacks, people familiar with the matter said on Monday.

Credit Suisse Group AG (CS) & UBS Group AG: UBS has no interest in buying fellow Swiss lender Credit Suisse, the bank's Chairman Colm Kelleher said in a interview published on Saturday.

Manchester United PLC (MANU): The company set out a dazzling Davos shop front this week, but insisted its lounge was to entertain clients and partners rather than to attract buyers for the English soccer club.

Pfizer Inc (PFE): Chinese authorities have acknowledged that supplies of Paxlovid are still insufficient to meet demand, even as Pfizer CEO Albert Bourla said last week that thousands of courses of the treatment were shipped to the country last year and in the past couple of weeks millions more were shipped.

Rio Tinto PLC (RIO): The miner said that China's reopening from COVID-19 restrictions is set to raise near-term risks of labour and supply-chain shortages, while it also flagged a strong start to iron ore shipments for 2023.

Upgrades and downgrades

Upgrades

|

COMPANY |

TICKER |

BROKERAGE FIRM |

RATINGS CHANGE |

PRICE TARGET |

|---|---|---|---|---|

|

AvalonBay |

AVB |

Truist |

Hold>>Buy |

$186>>$190 |

|

Cadence Design |

CDNS |

Atlantic Equities |

Neutral>>Overweight |

$200 |

|

Church & Dwight |

CHD |

Morgan Stanley |

Equal-Weight>>Overweight |

$82>>$91 |

|

Church & Dwight |

CHD |

Credit Suisse |

Neutral>>Outperform |

$85>>$95 |

|

Dun & Bradstreet |

DNB |

BofA Securities |

Neutral>>Buy |

$15.5 |

|

Equity Residential |

EQR |

Truist |

Hold>>Buy |

$68 |

|

World Wrestling |

WWE |

Wells Fargo |

Underweight>>Equal Weight |

$52>>$100 |

|

Valero Energy |

VLO |

BMO Capital Markets |

Market Perform>>Outperform |

$135>>$160 |

Downgrades

|

COMPANY |

TICKER |

BROKERAGE FIRM |

RATINGS CHANGE |

PRICE TARGET |

|---|---|---|---|---|

|

A.O. Smith |

AOS |

Loop Capital |

Buy>>Hold |

$67>>$65 |

|

Americold Realty Trust |

COLD |

Truist |

Buy>>Hold |

$34 |

|

Extra Space Storage |

EXR |

Truist |

Buy>>Hold |

$175>>$160 |

|

Lions Gate Entertainment |

LGF.A |

Truist |

Buy>>Hold |

$11>>$8 |

|

Kimco Realty |

KIM |

Truist |

Buy>>Hold |

$25>>$24 |

|

Mid-America Aptmt |

MAA |

Truist |

Buy>>Hold |

$176>>$167 |

|

First Advantage Corp. |

FA |

BofA Securities |

Buy>>Neutral |

$14.5 |

|

Pfizer |

PFE |

Wells Fargo |

Overweight>>Equal Weight |

$54>>$50 |

Source: WSJ.com

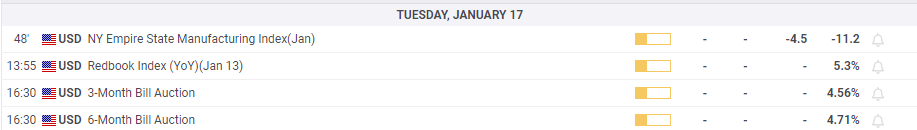

Economic releases

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.