Wake Up Wall Street (SPY) (QQQ): Omi can this market rally?

Here is what you need to know on Monday, December 6:

Equity markets look set to start the week on a positively nervous note as investors look for more information on the omicron variant. We do feel the market reaction to omicron is overdone, markets needed a correction, omicron just provided the excuse. Tech remains highly elevated and therefore highly risky in the current environment. Risk assets remain exactly that as witnessed by Bitcoin over the weekend. $40,000 just about held and the bounce is on but for how long? Powell punched a hole in transitory and tapering last week and added to Vix elevation. The Fed is likely to remain on course to now complete its tapering by early Q2 2022, nearly a full quarter ahead of prior expectations. This one in particular has got equity markets in a tailspin. We have noted the strong correlation between the Fed balance sheet and the S&P 500 before so can this correlation end peacefully? We wait with bated breath but certainly, the yield curve flattening is not a positive.

The dollar is a touch stronger this morning as currency safe havens lose ground. Eurodollar is 1.1292 now. Oil is 3% higher at $68.32 and Gold steady at $1778. Bitcoin was anything but steady over the weekend but is now back to $48,500.

See forex today

European markets are higher: EuroStoxx +0.7%, FTSE +1.1% and Dax +0.5%.

US futures are also higher apart from tech: S&P +0.35, Nasdaq -0.4% and Dow +0.7%.

Wall Street (SPY) (QQQ) stock news

Rivian (RIVN) catches a host of research notes as the blackout ends. see more.

Tesla (TSLA), Elon sells more stock as TSLA teeters near $1,000. see more.

Didi (DIDI) delisting news hits other Chinese names hard.

Alibaba (BABA) names a new CFO.

Lucid (LCID) gets a subpoena from SEC, see more.

Nvidia (NVDA), EU pauses investigation due to more info needed. FTC issued a suit last week. See more.

Kohls (KSS) Engine Capital urges the sale or separation of eCommerce business-Reuters.

Snowflake (SNOW) Credit Suisse raises the price target.

Coinbase (COIN) down 6% premarket on bitcoin wobbles.

AMC offering new NFT but shares fall further, down 3% premarket.

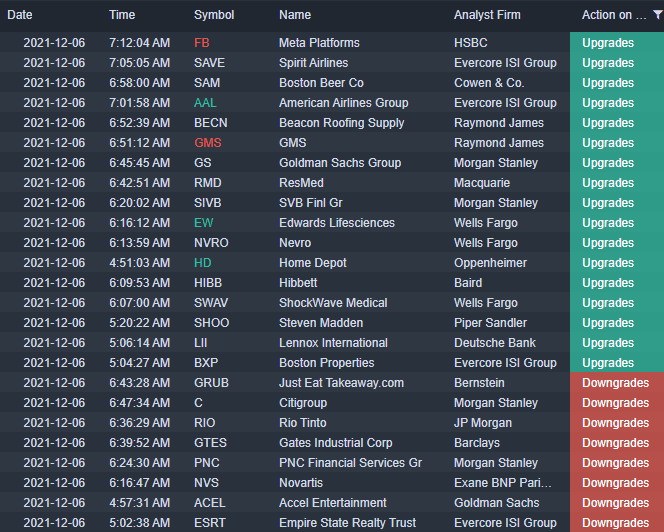

Upgrades and downgrades

Source: Benzinga Pro

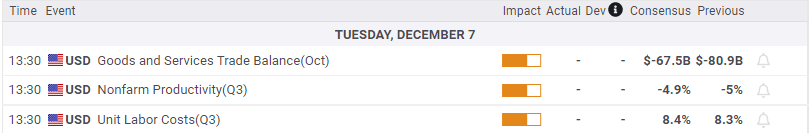

Economic releases

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.