Wake Up Wall Street (SPY) (QQQ): Oil the focus as inflation woes could continue

Here is what you need to know on Thursday, October 6:

Equity markets remain on the up and up after a massive two-day rally earlier this week. That was expected to retreat on Wednesday, and initial signs were not good with most indices being down 2% in the first half of the day. Concerns over oil prices and the effect on inflation naturally hit sentiment, but traders returned from lunch in a bullish mood and lifted stocks to close almost flat on the day. This morning it is more of the same with futures once again indicating a lower open while yields tick higher. It is likely to be a low-volume day ahead of the big employment report on Friday. That will then set the pivot brigade up as hopes are high for a slowdown.

The dollar is higher this morning as risk assets retreat. The dollar index is at 111.51. Oil is calm but still elevated at $87.71, while Bitcoin is steady at $20,200. Gold trades at $1,718, little changed.

European markets are lower: Eurostoxx -0.65, FTSE -0.7%, and Dax -0.3%.

US futures are lower: S&P, Nasdaq, and dow making my job of typing easier by all being down 0.4%.

Wall Street top news (SPY) (QQQ)

White House to release more oil from strategic reserve after OPEC cuts.

WSJ reports White House may ease sanctions on Venezuela to tap more oil exports.

Apollo (APO), Twitter (TWTR): Apollo and Sixth Street are no longer in talks with Elon Musk over Twitter financing.

Blackrock (BLK): Louisana will pull $794 million out of its funds, according to the state Treasurer.

General Electric (GE) laying off workers at onshore wind unit.

Shell Oil (SHEL) says Q3 profit will be pressured by falling margins.

Conagra (CAG) up 2% on earnings.

Peloton (PTON) cutting more jobs, CEO Barry McCarthy tells WSJ it has another 6 months to sort itself out or may not be viable as a standalone firm.

Eli Lilly (LLY): Diabetes drug gets FDA fast track.

Upgrades and downgrades

Source: WSJ.com

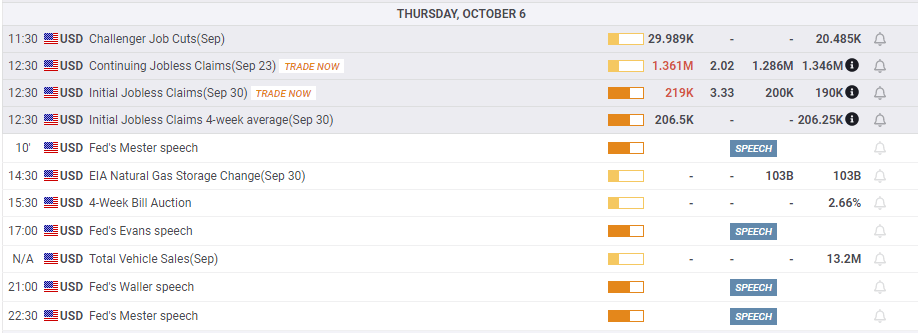

Economic releases

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.