Wake Up Wall Street (SPY) (QQQ): Markets trade lightly before Thanksgiving turkey

Here is what you need to know on Wednesday, November 23:

Equity markets continued the upbeat mood on Tuesday with more gains for the main indices. The drop in bond yields helped as did some recent retail earnings which continued to show resilience from the US consumer. The volume though was light in this shortened week, and that will remain the theme today. We are likely to see some profit-taking ahead of the long weekend and some headwinds could add to this. News from China is not positive with more covid lockdowns putting the reopening trade under pressure.

Oil has spiked as The Wall Street Journal's report was denied by the Saudi government. This is inflationary although it has since fallen as the EU looks to put a low cap on Russian oil. The EU gas cap is put at a very high level. Apple (APPL) looks to be in trouble with reports of major disruptions and protests at its Foxconn-owned supplier factory. Finally, we will get FOMC minutes later. Given how hawkish Powell was in the press conference, there is no reason to expect the minutes to be much different.

This morning sees oil continue its rocky ride back below $78 now. The Dollar Index is just a touch lower to 106.96. Gold is trading at $1,735, and Bitcoin has risen to $16,500.

European markets are quiet, the Eurostoxx is -0.3%, while all others are flat.

US futures are all trading flat.

Wall Street top news

EU rumoured to put a cap of $65 to $70 on Russian oil.

Apple (AAPL): Reuters reports protests at Foxconn factory.

Deere (DE) posts strong earnings.

HP (HPQ) announces large job cuts.

Manchester United (MANU) up on talk of selling the club.

Guess (GES) down on weak outlook.

Credit Suisse (CS) down on capital raise plans.

Reuters headlines

Nordstrom (JWN): The company said on Tuesday net sales at its eponymous retail stores fell 3.4% in its third quarter

ConocoPhillips (COP) & Sempra Energy (SRE): Sempra Energy said on Tuesday that ConocoPhillips will buy five million tonnes per annum of liquefied natural gas (LNG)

Alibaba Group (BABA): Debt-laden Chinese conglomerate Fosun International is seeking to offload a minority stake in Alibaba Group's logistics arm Cainiao.

Berkshire Hathaway (BRKB): The investment company owned by Warren Buffett has sold 3.23 million Hong Kong-listed shares of electric vehicle maker BYD for HK$630.33 million, a stock exchange filing showed.

Tesla (TSLA) Chief Executive Elon Musk said that South Korea was among its top candidate locations for a factory it plans to build in Asia for making electric vehicles (EVs), according to South Korea's presidential office.

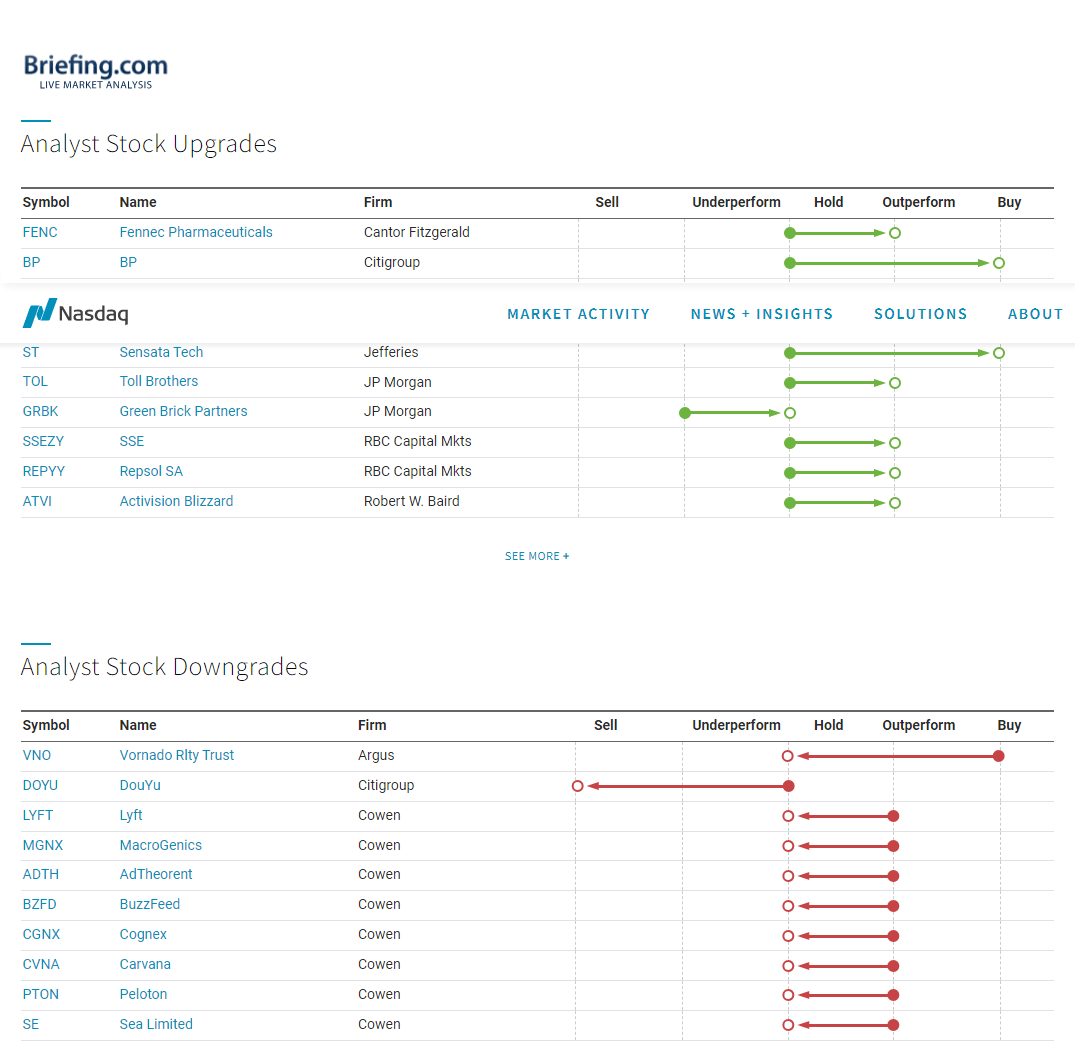

Upgrades and downgrades

Source: Nasdaq.com

Economic releases

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.