Wake Up Wall Street (SPY) (QQQ): Have we seen the Powell plunge?

Here is what you need to know on Tuesday, November 23:

Equity markets took a dislike to Chairman Powell's renewed term last night despite this being widely expected. This may just have been the case of investors looking for an excuse to sell some steam after another strong recent rally. Tech stocks were not impressed by rising bond yields, but really this is a sideshow. That is not the driver here: profit-taking is. There is too much froth in tech stocks, so profit-taking was inevitable. Zoom (ZM) continued on where Peloton left off, that of a lockdown darling dumping now that economies have reopened. We warned of this in our weekly preview. At least Zoom (ZM) delivered strong earnings unlike Peloton (PTON), but revenue growth slowed, which is what investors focused on.

The dollar finally looks to have a down day as it retraces to $1.1253 versus the euro, and Oil is higher after falling yesterday in anticipation of the US tapping its strategic reserve. Oil is at $77.20 now. Gold is at $1,786, and Bitcoin is slightly higher at $56,780.

See forex today

European markets are mixed: Eurosox -0.3%, FTSE +0.2% and Dax -0.7%. Expect Europe to struggle as lockdowns are reintroduced.

US futures are flat with the Nasdaq at -0.1%, the biggest index mover.

Wall Street stock news

Zoom (ZM) beats on top and bottom lines, but revenue growth slows. Stock down 8%. Nvidia revenue growth also slowed, but that did not hurt it. Interesting!

Lucid Motors (LCID) sank 7% as EV stocks suffer, see more.

Tesla (TSLA) hires a former SEC attorney.

Abercrombie (ANF) falls 4% premarket despite beating on the top and bottom lines.

XPeng (XPEV) reports a loss but revenue is ahead of expectations. Up 3% premarket.

Best Buy (BBY) drops 10% premarket on lower forecasts for the holiday season.

Apple (AAPL) gets a fine from Italian antitrust as does Amazon (AMZN), see more.

Urban Outfitters (URBN) beats on top and bottom lines but is down 11% premarket.

GameStop (GME) popped 8% on Mondays. Is it back? see more.

Dicks Sporting Goods (DKS) smashed EPS, $3.19 versus $1.97 expected. Up 1% premarket.

Dollar Tree (DLTR) is in line on EPS, beats on revenue, but stock falls 1%.

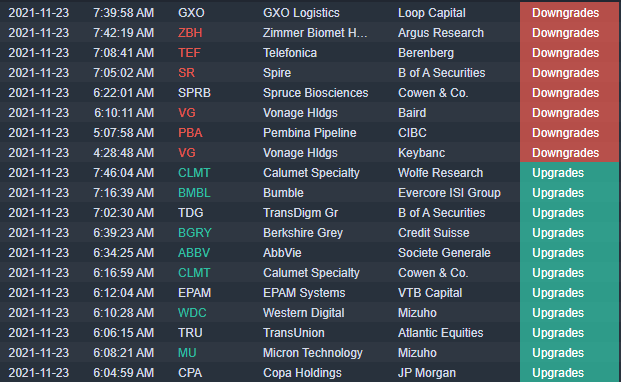

Upgrades and downgrades

Source: Benzinga Pro

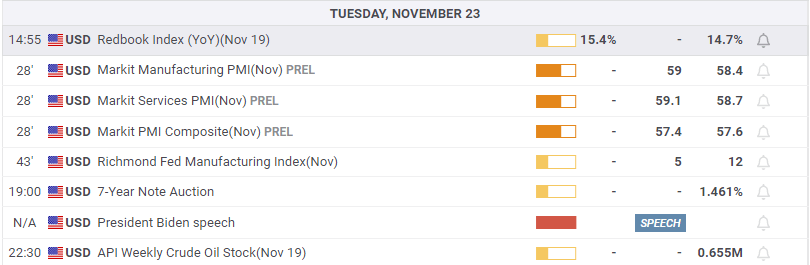

Economic releases

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.