Wake Up Wall Street (SPY) (QQQ): CPI hot, stocks not, rally shot

Here is what you need to know on Thursday, July 14:

The equity market held up well on Wednesday after the CPI number also held up well. In truth, the CPI number was shockingly high, coming in well above expectations on both metrics. Equities reacted as you would expect on the number with the Nasdaq and S&P 500 falling about 2% in the ten minutes after the release. From then on a counterintuitive rally ensued, and the main indices more or less ended the day flat.

Bond yields ticked up but not dramatically so. Money markets have moved to price in a near certainty now of a 100-basis-point hike from the Fed in July. The Bank of Canada may have made their job easier by leaking the possibility essentially when they did their own 100 bps hike. Now Fed funds futures are pricing an 84.5% chance of a 100 bps hike in July. Last week that probability was dead zero, and a 75-basis-point hike was at 99%. The bond market has been caught off guard again, and the 2-year/10-year yield curve inverted further into negative territory and is following on in the same vein this morning.

US 10Y-US 2Y yield curve

Corporate earnings season is up and running now with JPMorgan and Morgan Stanley both missing on top and bottom lines. JPMorgan increased provisions for bad debts, and Morgan Stanley said it was hit by reduced investment banking revenue. JPMorgan CEO Jamie Dimon reiterated his comments from a few weeks ago when he said he sees a hurricane coming for the US economy. This is the start of earnings deterioration we have been speaking of in our weekly preview articles now for some time. This will be the next leg lower for equities. Analyst forecasts are way too high and need to come down by 20% on average for S&P 500 earnings.

Back to inflation, the so-called reasoning behind Wednesday's move was the fact that the far end of the curve is flattening as the US will enter recession by 2023 and the Fed will pivot and cut rates. Exactly why this is good news is bizarre to me, but that argument has already been questioned by the PPI report just out showing another surge in input prices. Inflation was transitory, they said, then it was demand-led. Well, that seems unlikely in my view.

The dollar remains kingpin as the euro remains a basket case, while Italy looks to join the UK in ditching its leader. The dollar index is at 108.78 now. Gold is lower at $1,710, and oil is much lower on recession fears, back to $94 now. Bitcoin yet again clings to $20,000.

European markets are lower: Eurostoxx: -1.7%, FTSE -1.5% and Dax -1.5%.

US futures are also lower: S&P -1.2%, Dow -1.4% and Nasdaq -0.8%.

Wall Street top news (QQQ) (SPY)

PPI 11.3% versus 10.7% expected.

Money markets price in more rate hikes globally, Fed 100 bps now at over 80% probability.

JPMorgan (JPM) misses EPS and revenue.

Morgan Stanley (MS) also misses top and bottom lines.

Netflix (NFLX) picks Microsoft (MSFT) to help with its advertising platform.

Taiwan Semiconductor (TSM) beats on revenue and EPS.

Ericsson (ERIC) misses earnings on strong component costs. Read across for many tech companies.

Twitter (TWTR) rises on lawsuit versus Elon Musk.

Conagra (CAG), food producer, defensive stock, says margins are shrinking. Earnings in line.

Upgrades and downgrades

Source: WSJ.com

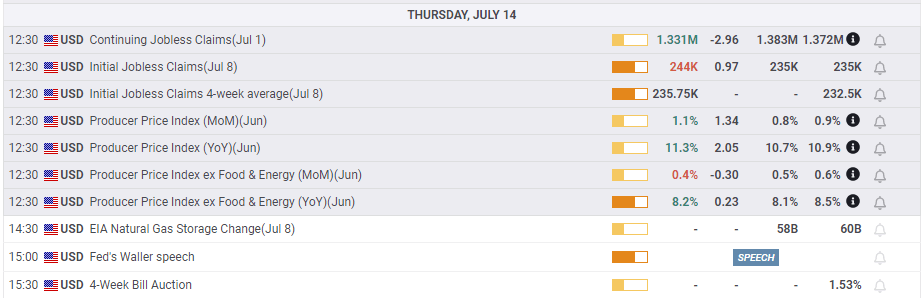

Economic releases

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.