Wake Up Wall Street (SPY) (QQQ): BBBY bloodbath hits meme stocks as indices stall

Here is what you need to know on Friday, August 19:

Bed Bath & Beyond (BBBY) caused a commotion on Thursday as news emerged of retail favorite Ryan Cohen's RC Ventures selling its stake in BBBY. Ryan Cohen chairs GameStop (GME), the original of the species when it comes to meme stocks. BBBY cratered afterhours and is down 40% (the author is short and long puts). Outside of the meme space, momentum is beginning to wane as this rally gets longer in the tooth. Futures are lower on Friday with some decent sell option flows expected on the expiration day. Risk aversion is growing with some profit taking and the high-risk side hitting the Nasdaq index. Bitcoin falling 7% is also hitting risk appetites, and we note the recent pretty high correlation between Bitcoin and the Nasdaq. Bitcoin is currently down 7% to $21,400.

Oil is at $89, a slight fall from Thursday as yields rose overnight. Gold is also lower at $1,751, and the dollar index is higher at 108 on yields rising and some risk aversion flows.

European markets are mixed: Eurostoxx -0.5%, FTSE flat, and Dax -0.5%

US futures are also lower: S&P -0.9%, Nasdaq -1% and Dow -0.7%.

Wall Street top news (QQQ)(SPY)

Yields rise globally, Germany up 13bps, US up nearly 10bps on ten-year yields

Bed Bath and Beyond (BBBY): Ryan Cohen investment firm sells its stake, and shares collapse.

Deere (DE) cuts guidance, falls 5%.

Foot Locker (FL) gains on earnings beat and new CEO.

Weber (WEBR) up on retail meme interest.

Applied Materials (AMAT) beats on earnings.

Home Depot (HD) outlines a share repurchase plan.

Bill.com (BILL) is up on strong earnings.

General Motors (GM) reinstates dividends.

Meta Platforms (META) forecasts were lowered by Morgan Stanley.

Wayfair (W) announced cuts to the workforce.

GameStop (GME) down 10%.

Madison Square Garden (MSGE) up on revenue beat.

Upgrades and downgrades

Source: WSJ.com

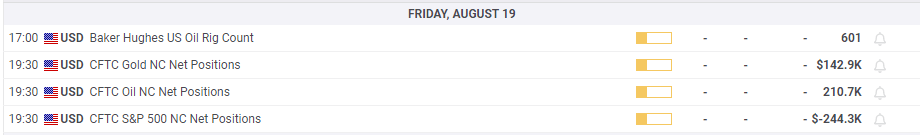

Economic releases

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.