USD/TRY reaches a new all-time high and targets 31.0000

- The lira depreciates further north of 30.0000.

- Inflation rose more than estimated in January.

- H. G. Erkan resigned as CBRT Governor on Friday.

Further selling pressure keeps hurting the lira and propels USD/TRY to a new record high near 30.6000 at the beginning of the week.

USD/TRY: Never-ending uptrend?

Unsurprisingly, the Turkish currency depreciated further on Monday and bolstered the still unabated upward bias in USD/TRY, this time further north of the 30.0000 mark, and it should be a matter of some extra sessions before the pair hits the 31.0000 round level.

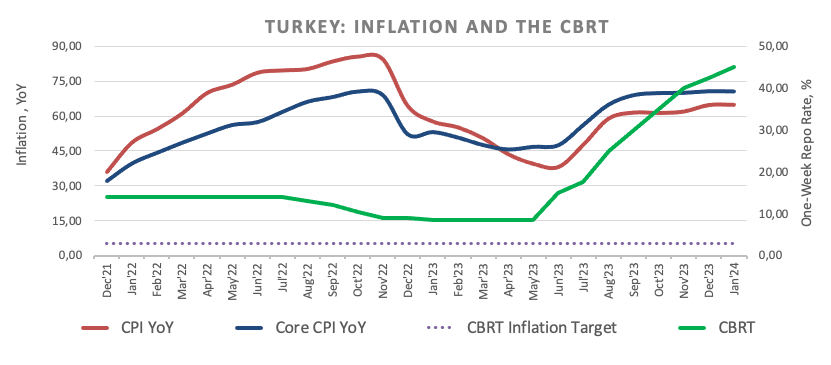

Monday’s extra upside in spot came in response to the small upside surprise in inflation figures in January, with the Consumer Price Index (CPI) rising at an annualized 64.86% and 70.5% when it comes to the Core reading. In addition, Producer Prices gained 44.20% over the last twelve months.

Contributing to the (endless?) sour sentiment around the lira, H. G. Erkan stepped down as CBRT Governor on Friday, paving the way for Deputy Governor F. Karahan to be the new face in the realm of the central bank.

Of note is that USD/TRY posted monthly losses in just two months since 2022 (November 2022 and August 2023), while the Lira lost more than 140% in that same period vs. the US Dollar.

USD/TRY levels to watch

So far, USD/TRY advances 0.26% at 30.5523 and faces the next up-barrier at the 31.0000 round level. On the downside, provisional support comes at the 55-day and 100-day SMAs at 29.4791 and 28.7549, respectively, all prior to the more significant 200-day SMA at 26.5923.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.