USD/TRY: Off weekly highs, holds above 8.30 ahead of Turkish central bank decision

- USD/TRY eases off weekly highs ahead of the key CBRT rate decision.

- The CBRT to hold rates at 19% for the second meeting in a row.

- The central bank chief said last month that inflation had reached its peak.

USD/TRY is posting small gains around 8.3250 so far this Thursday, consolidating its retreat from one-week highs of 8.3705 reached on Wednesday.

However, the upside in the spot remains limited amid renewed broad-based US dollar, as Treasury yields resume the decline ahead of the weekly jobless claims data.

Meanwhile, the Turkish lira remains on the back foot ahead of the Central Bank of the Republic of Turkey (CBRT) monetary policy meeting due later today at 1100GMT.

The new central bank Governor Sahap Kavcioglu is likely to hold the fire by keeping the key rates unchanged at 19% for the second straight meeting.

The CBRT chief said last month that he sees inflation peaking in April, adding that the pace of price gains would start dropping to 12.2% by the end of 2021.

Kavcioglu has pledged to maintain the tight policy until the bank’s 5% inflation target is achieved.

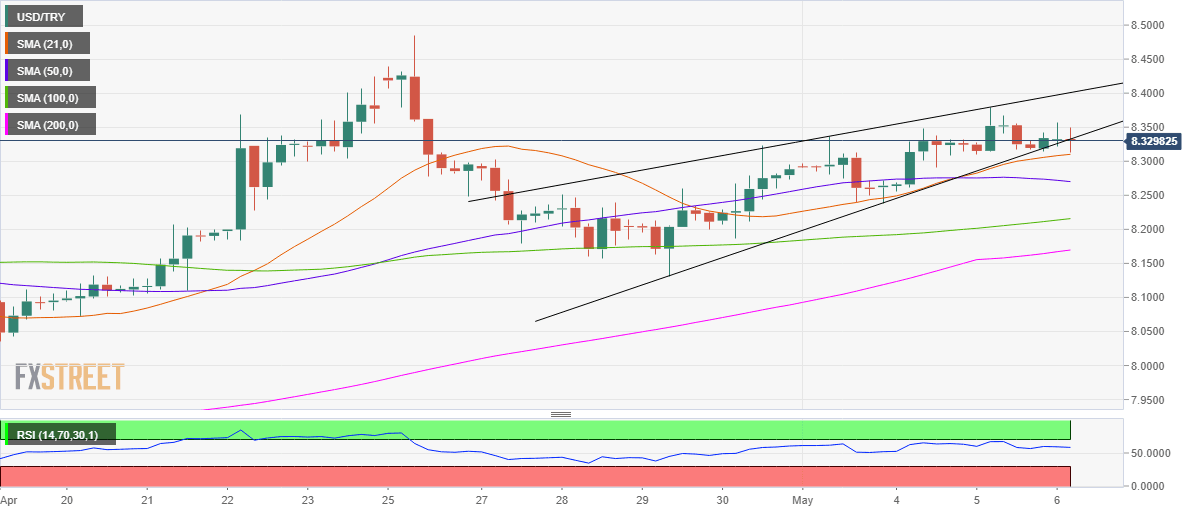

USD/TRY: Four-hour chart

Ahead of the CBRT outcome, the spot is on the verge of confirming a rising wedge breakdown on the four-hour chart.

At the time of writing, the 21-simple moving average (SMA) at 8.3099 has contained the downside attempts.

If the rising wedge pattern gets confirmed, the bears would charge in and take out the 21-SMA support, exposing the mildly bearish 50-SMA at 8.2700.

Alternatively, the buyers could retest the daily highs at 8.3567 should the bullish RSI come in support of them.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.