USD/MXN Technical analysis: Dollar rebounds from key technical support, MXN rally over?

- The Mexican peso holds a bullish tone against the US Dollar, but it lost strength on Monday.

- USD/MXN rebounds from lowest in almost three months.

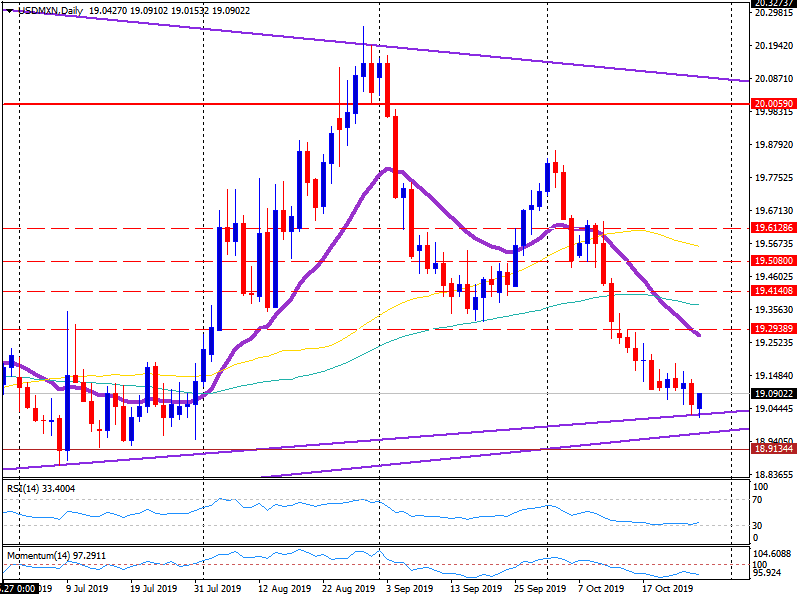

The USD/MXN pair bottomed earlier today at 19.01, the lowest intraday level since July 31, and then rebounded. It is trading around 19.10, having the best performance in four weeks.

Price bounced to the upside near a critical support area: 19.00, and two long-term bullish trendlines. A consolidation below 19.00 would clear the way to more losses and expose 2019 lows near 18.75.

The rebound from such a strong barrier could favor further gains ahead for the Greenback. The next resistance is located at 19.15/20 followed by the key 19.30 (horizontal level / 20-day moving average). If the pair drops back toward 19.00 before the end of the day it would suggest the Mexican peso remains strong.

USD/MXN daily chart

Author

Matías Salord

FXStreet

Matías started in financial markets in 2008, after graduating in Economics. He was trained in chart analysis and then became an educator. He also studied Journalism. He started writing analyses for specialized websites before joining FXStreet.