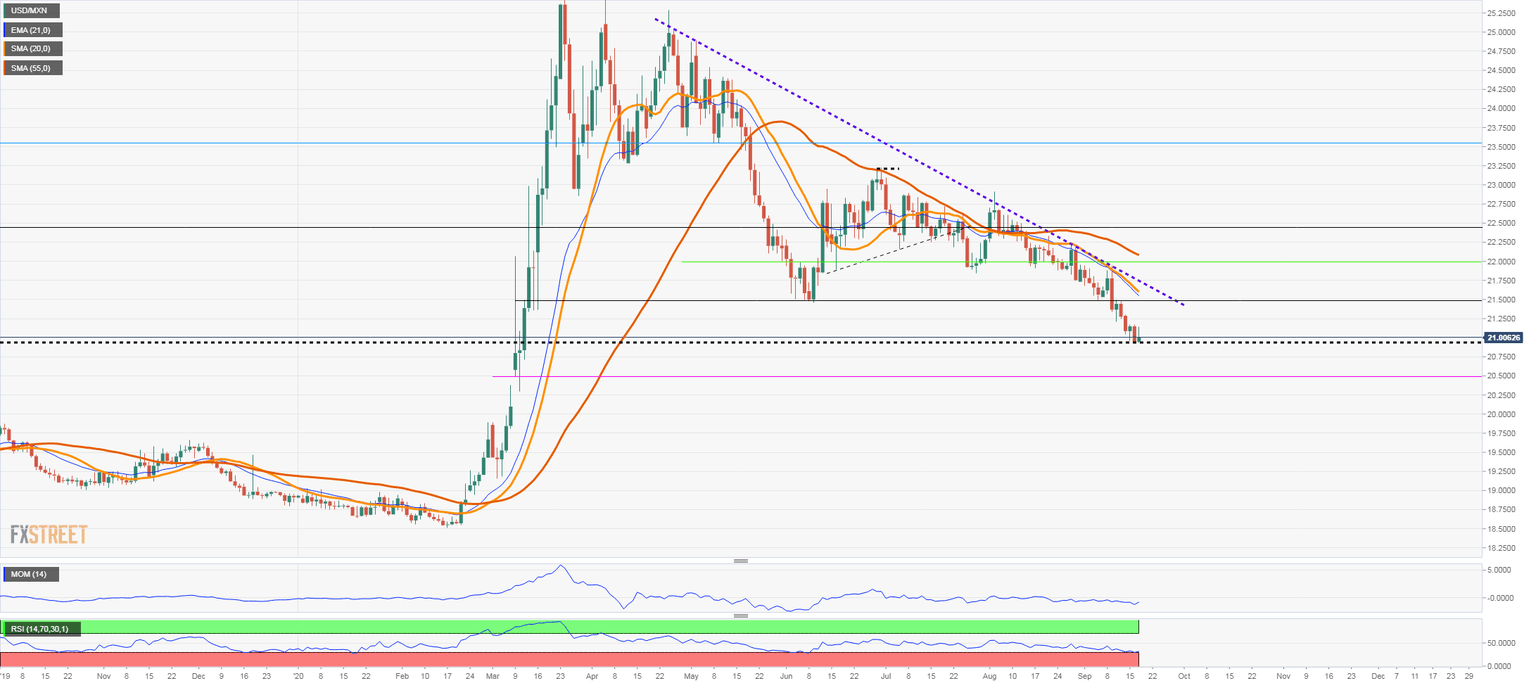

USD/MXN Price Analysis: Bearish momentum intact as it keeps testing 20.95/21.00

- Mexican peso holds positive bias versus the US dollar.

- USD/MXN hits target at 21.00 after breaking 21.50, now looks for 20.95.

The USD/MXN continues to move to the downside and fell to 20.91, reaching the lowest since March. It has been falling constantly since the beginning of August, accelerating after breaking 21.50.

Currently, the pair is testing the 20.95/21.00 support band. A consolidation below could clear the way to more losses with the next support seen at 20.65 and 20.50.

On the upside, immediate resistance in USD/MXN is seen at 21.15, followed then by the strong 21.50. The negative bias will remain in place as long as it holds below the downtrend line, today at 21.75.

USD/MXN daily chart

Author

Matías Salord

FXStreet

Matías started in financial markets in 2008, after graduating in Economics. He was trained in chart analysis and then became an educator. He also studied Journalism. He started writing analyses for specialized websites before joining FXStreet.