USD/MXN hits a three-week low as the greenback slides despite solid US Consumer data

- USD/MXN falls as the US Dollar weakens across the board.

- US Consumer confidence improved but failed to underpin the US Dollar.

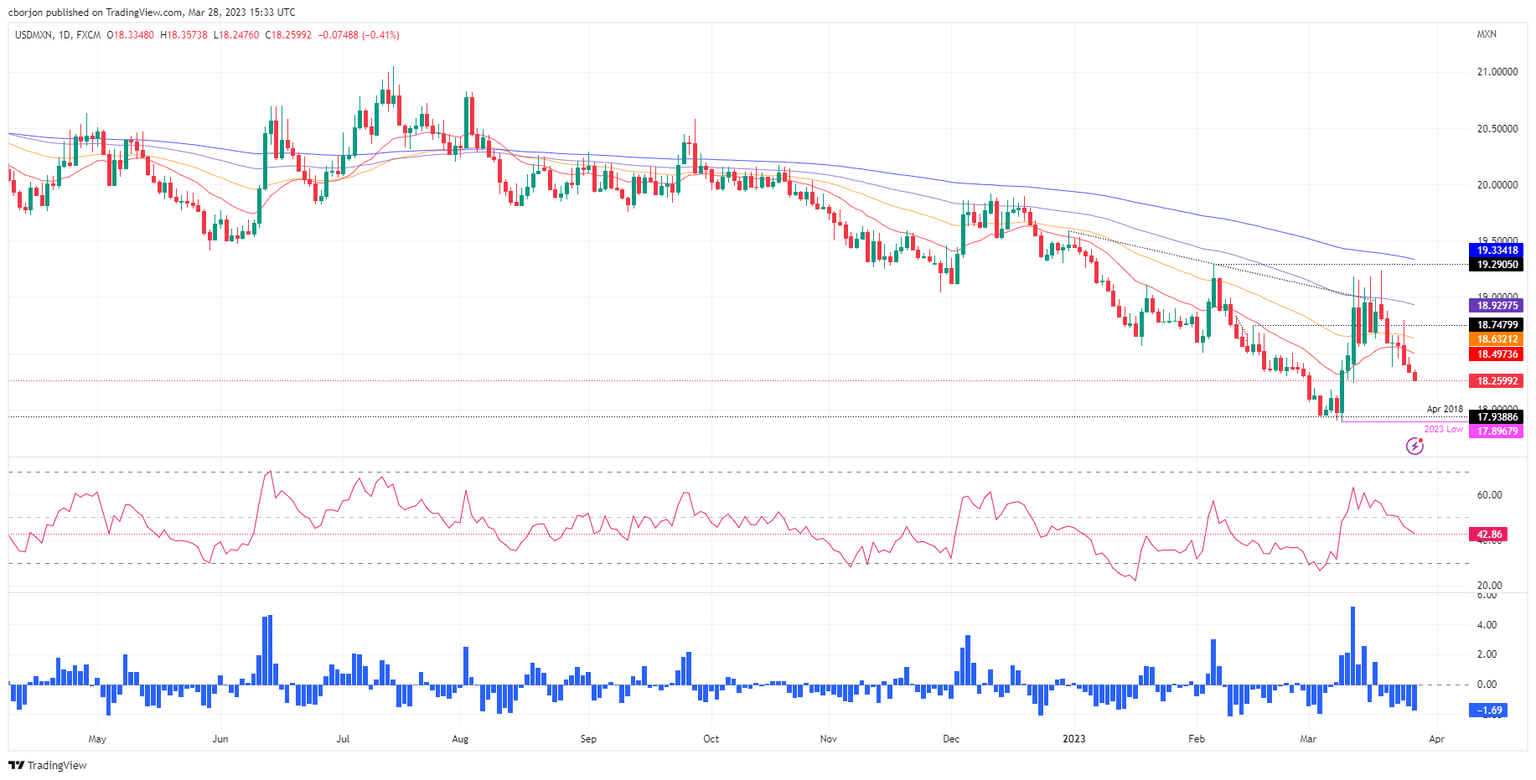

- USD/MXN Price Analysis: Remains downward biased but could shift neutral above 18.50.

USD/MXN dropped and extended its losses to a three-week low in early trading during the New York session. US equities are mixed, while the greenback continues to tumble as market expectations for a rate cut in 2023 persist. Therefore, the USD/MXN s trading at 18.2631 after hitting a high of 18.3573.

CB Consumer Confidence exceeded estimates, but the US Dollar didn’t blink

Traders’ sentiments remain fragile. Economic data in the United States (US) was mixed, with the Conference Board (CB) Consumer Confidence rising to 104.2 from 103.4 in February. “Driven by an uptick in expectations, consumer confidence improved somewhat in March but remains below the average level seen in 2022,” said Ataman Ozyildirim, senior director of economics at the Conference Board.

Further details of the survey revealed that the Present Situation Index declined to 151.1 from 153, and the Consumer Expectations Index rose to 74 from 70.4

In early data, the House Price Index rose 0.2% MoM in January vs. a drop of 0.6% estimated, data showed from the US Federal Housing Finance Agency showed on Tuesday. At the same time, the S&P/Case-Shiller Home Price Index arrived at 2.5% on a yearly basis in January, down from 4.6% in the prior month.

USD/MXN traders ignored most US data. Consumer confidence improvement barely moved the pair, which is still pushing lower, with sellers eyeing 18.20. The US Dollar Index (DXY), a gauge of the buck’s value vs. a basket of peers, tumbles 0.30%, at 102.518

US Treasury bond yields are recovering some ground, with 2s gaining four bps at 4.039%. The 10-year benchmark note rate is at 3.556%.

On the Mexican front, the lack of data keeps traders leaning on sentiment and expectations for a 25 bps rate hike by Banxico (Bank of Mexico) on March 30. That would lift rates from 11% to 11.25%.

USD/MXN Technical analysis

The USD/MXN remains downward biased after briefly testing the 19.00 mark after the banking crisis in the US. Since then, the USD/MXN pair dropped below the 50 and 20-day Exponential Moving Averages (EMAs), setting the stage for further downside. The Relative Strength Index (RSI) and the Rate of Change (RoC) suggest that sellers gather momentum. That said, the USD/MXN first support would be 18.0000, followed by the YTD low at 17.8967. In an alternate scenario, and the less likely to occur, if buyers reclaim 18.5000, that would exacerbate a rally to 19.0000.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.