USD/MXN falls below $18.50 on upbeat Mexican Retail Sales, tight US jobs data

- US Initial Jobless Claims continued their downward trend, portraying a tight labor market.

- Retail Sales in Mexico exceeded estimates and bolstered the Mexican Peso.

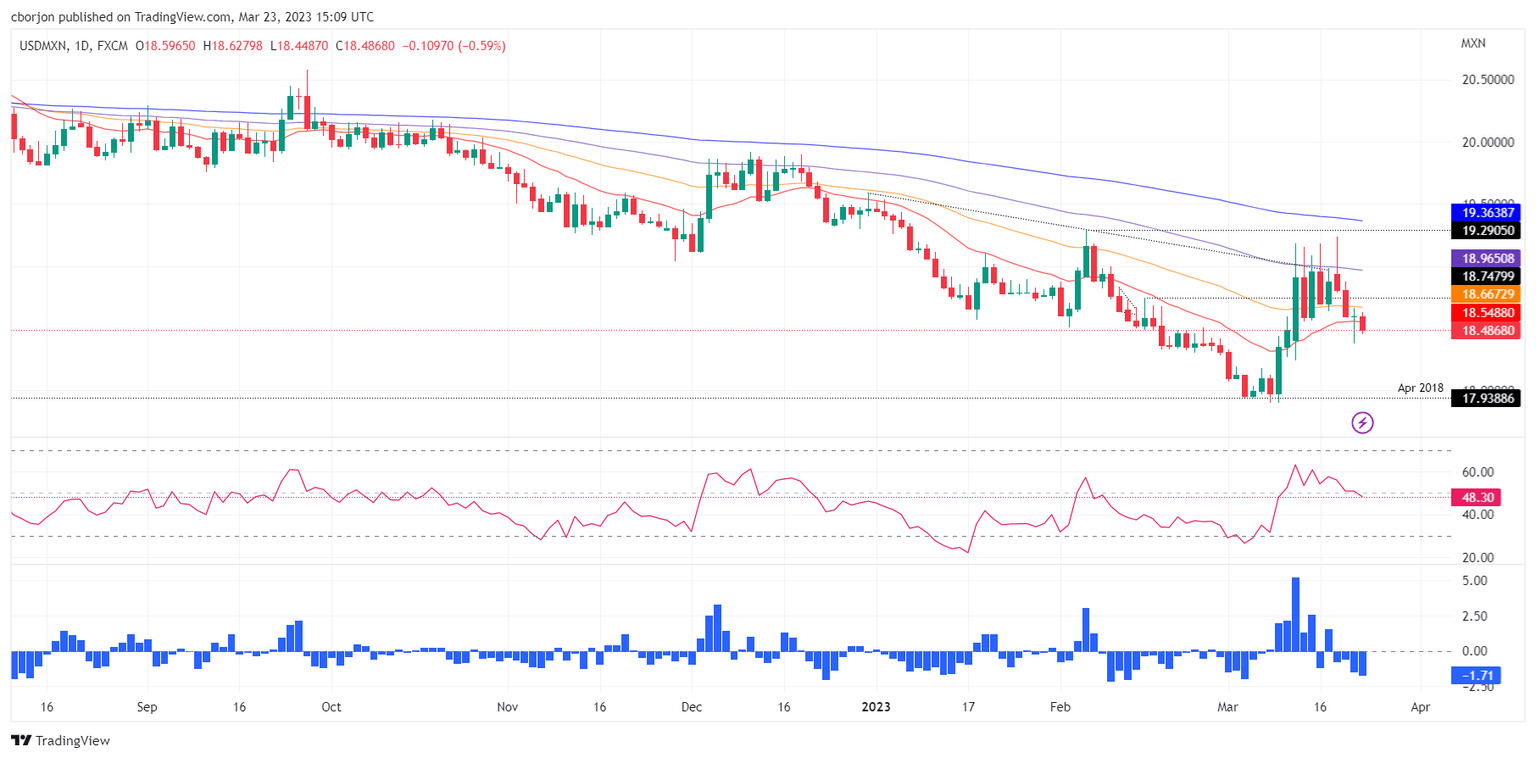

- USD/MXN Price Analysis: Could resume its bearish bias below $18.50.

The Mexican Peso (MXN) recovers against the US Dollar (USD) as the USD/MXN registers losses of 0.57% and stumbles below the 20-day EMA. Following the US Federal Reserve’s (Fed) decision to tighten monetary conditions, a risk-on impulse keeps the emerging country currency underpinned at around $18.50. At the time of writing, the USD/MXN is trading at 18.4868.

US bond yield fall as investors expect a less hawkish Fed

Wall Street is trading with solid gains after the US Treasury Secretary Janet Yellen rattled investors after saying that the United States (US) government is not planning to introduce blanket insurance to all depositors. Contrarily, Fed Chair Jerome Powell said that the banking system is solid after the Fed took steps to provide liquidity to the markets.

Unemployment claims for the week ending on March 18 fell by 1,000, warranting further tightening by the Fed amidst a tight labor market. The US Department of Labor (DoL) revealed that 191,000 Americans filled for aid after being laid off, contrary to the expected jump of 201,000 as reported by the consensus. At the same time, the Chicago Fed National Activity Index for February plunged to -0.19 vs. the prior’s month 0.23

Consequently, US Treasury bond yields continue to fall, weighed by investors expecting an additional rate hike by the Fed and then a pause. The 2-year bond yield dropped to 3.90%, down one bps, while the 10-year bond yield climbed to 3.464%. That undermined the greenback, with the US Dollar Index (DXY) falling 0.33% at 102.187.

On the Mexican front, Retail Sales in January jumped 1.6% from December, as the national statistics agency (INEGI) reported. Annually based, sales rose 5.3%.

Additionally, Mid-month inflation for March rose 0.15% MoM, less than estimates of 0.28%, while the YoY reading decelerated to 7.12%, from the prior’s 7.76%. Core inflation on its annual and monthly readings was unchanged for the same period.

USD/MXN Technical analysis

On Wednesday, the USD/MXN failed to close below the 20-day Exponential Moving Average (EMA) of 18.5524 and formed a dragonfly doji, which could open the door for further upside. Though USD/MXN traders need to reclaim the 18.8769, the pair could head up toward the $19.00 barrier. On the other hand, if the USD/MXN closes below $18.50, that would pave the way for further losses. The USD/MXN first support would be the March 23 low of 18.3776, followed by the March 13 low of 18.4487, ahead of testing the YTD low at 17.8967.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.