USD/MXN edges towards 17.0000 amid US data, ahead of Fed minutes

- US Housing Starts for July show positive momentum, indicating stabilization in the housing market post-Fed tightening.

- USD/MXN remains subdued despite the Greenback’s rise, with the DXY index gaining 0.12% influenced by rising US Treasury yields.

- Market eagerly awaits Fed meeting minutes for clarity on the central bank’s stance, with recent speeches hinting at a neutral shift.

USD/MXN trims some of its Tuesday’s losses amid overall US Dollar (USD) weakness across the FX board, as data from the United States was mixed, while traders brace for the release of the latest US Federal Reserve (Fed) meeting minutes. Hence, the USD/MXN is trading at 17.0697 after hitting a daily high of 17.1568.

Mexican Peso’s gains limited despite US Dollar’s broad weakness; housing and industrial data in focus

A risk-off impulse was not an excuse for the Mexican Peso (MXN) to appreciate further. US data revealed by the US Census Bureau showed the housing market continues to stabilize amidst 525 basis points of tightening by the Fed. Housing Starts for July rose by 3.9% MoM at a rate of 1.452 million exceeding June’s -11.7% plunge, which was downward revised from -8%. Further data showed that Building Permits climbed 0.1% in July, exceeding June -3.7% plunge.

Although the data was positive, the USD/MXN had a muted reaction. The Fed revealed that Industrial Production in the US grew 1% in July in month-over-months (MoM) figures, exceeding June’s drop, while annually based, plummeted -0.2%.

Aside from this, investors are flocking to the Greenback, which has shifted upwards, gaining 0.12%, as shown by the US Dollar Index (DXY) standing at 103.321, influenced by US Treasury bond yields resuming their uptrend.

Traders’ focus shifts towards the release of the latest Fed meeting minutes. Investors are looking for clear signs that could reassure the Fed’s tightening cycle has ended. The latest Fed speeches have shown that officials are turning neutral, as previous hawks members like Atlanta Fed President Raphael Bostic and Philadelphia Fed President Patrick Harker said no more increases were needed.

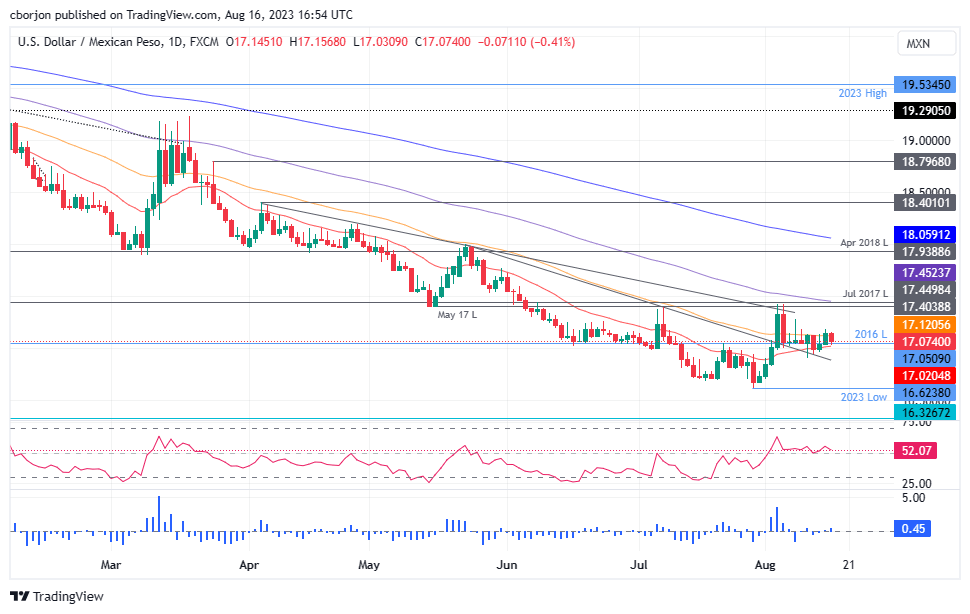

USD/MXN Price Analysis: Technical outlook

The daily chart portrays the USD/MXN consolidated within 17.0000/17.150000, unable to break above or below the range decisively. The lack of economic data from Mexico, and the interest rate differential, keeps the pair from rallying sharply. Nevertheless, it should be said that the daily Moving Averages (DMAs) are closing into the spot price, putting at risk the previous downtrend. If USD/MXN breaches the top of the range, the next stop would be the 100-DMA at 17.4525 before challenging the psychological 18.00 figure. If USD/MXN sellers reclaim 17.0000, a re-test of the year-to-date (YTD) low of 16.6238 is on the cards.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.