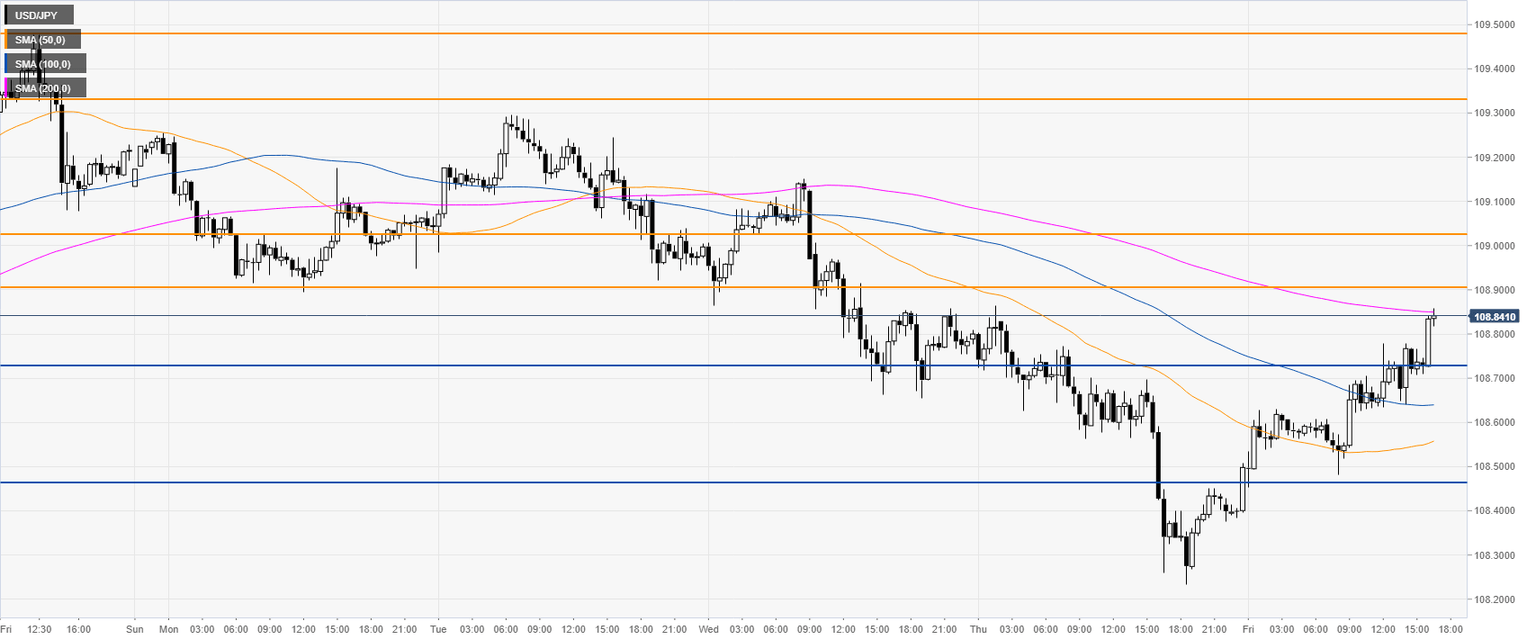

USD/JPY Technical Analysis: Greenback rebounds from November lows, trading above 108.70 level

- USD/JPY is trading at daily highs into the London close this Friday.

- The level to beat for bulls is the 108.90/109.03 resistance zone.

USD/JPY daily chart

USD/JPY four-hour chart

USD/JPY 30-minute chart

Additional key levels

Author

Flavio Tosti

Independent Analyst