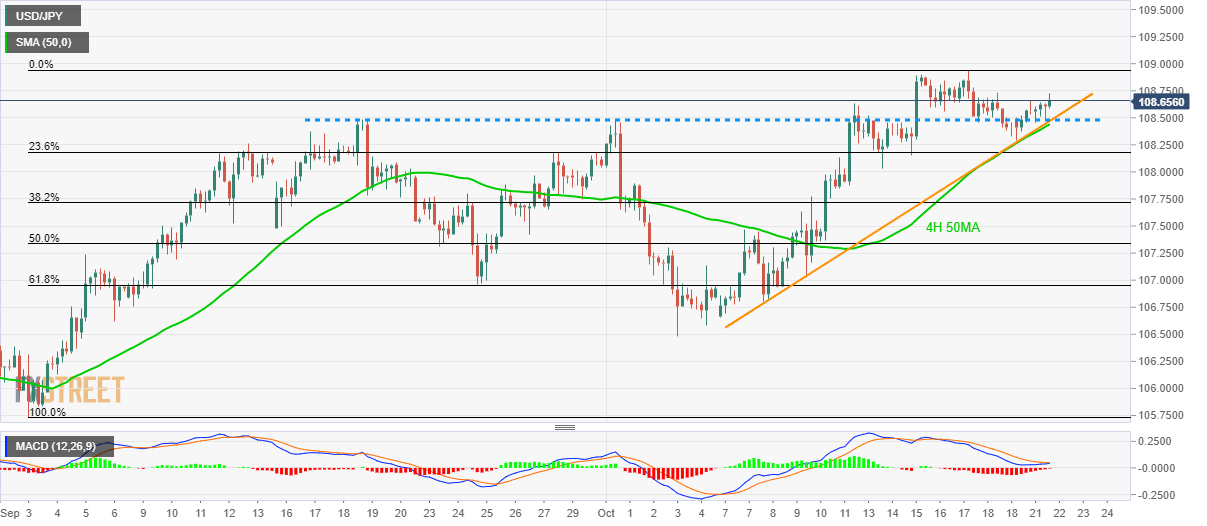

USD/JPY technical analysis: Firm above two-week-old rising trendline, 4H 50MA

- USD/JPY takes the bids towards monthly high.

- Highs marked during September month and October 01 add strength to the support confluence.

With its U-turn from near-term key support confluence, USD/JPY flashes 108.65 as a quote during early Tuesday.

Prices are likely to challenge monthly high surrounding 109.00 in order to challenge August month's top near 109.30.

On the downside, 50-hour simple moving average on the four-hour chart (4H 50MA), two-week-old rising trend-line, and highs marked during September month and October 01 around 108.50/45 become the key to watch.

Should there be increased selling pressure below 108.45, 108.00 and 107.50 could entertain bears ahead of challenging them with 61.8% Fibonacci Retracement of September-October declines, at 106.95.

It’s worth pointing out that the pair’s extended weakness past-106.95 could eye 106.50 and September month low close to 105.70.

USD/JPY 4-hour chart

Trend: bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.