USD/JPY Price Analysis: Retests 116.00 on breaking weekly support but bulls stay hopeful

- USD/JPY consolidates the heaviest daily gains in six weeks near five-year top.

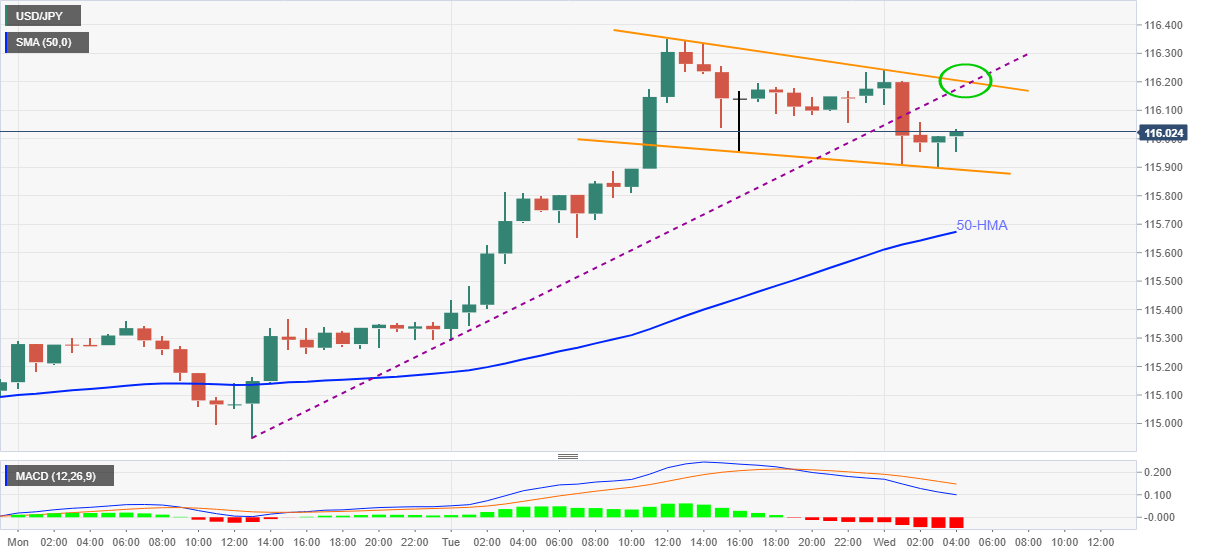

- Bullish flag, sustained trading above 50-HMA keeps buyers hopeful.

- Bears may wait for downside break of November’s top, 116.20 acts as the key resistance.

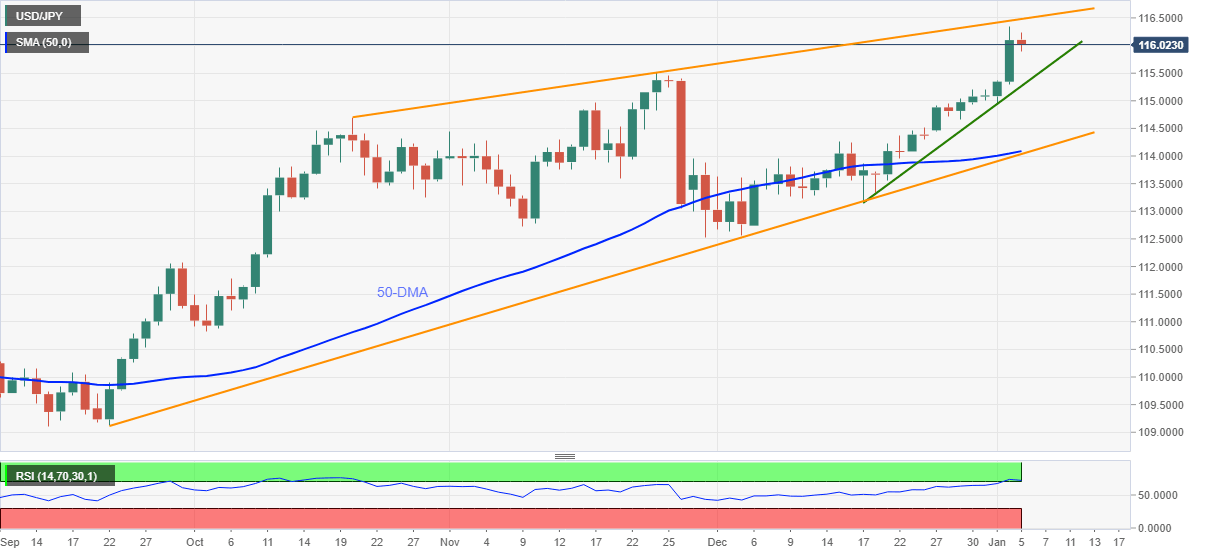

- Overbought RSI triggered pullback on D1, 114.00 is crucial support.

USD/JPY pulls back from five-year high to retest 116.00, down 0.06% intraday heading into Wednesday‘s European session.

In doing so, the yen pair seesaws inside a short-term bull-flag chart pattern amid overbought RSI on the daily and bearish MACD signals on the hourly formations. That said, the quote’s latest weakness could be linked to a downside break of the weekly support line, now resistance.

It’s worth noting that the stated flag’s support line near 115.90 restricts the quote’s immediate downside ahead of the 50-HMA level of 115.67.

Meanwhile, a convergence of the previous support and flag’s upper line, near 116.20, appears a tough nut to crack for the USD/JPY bulls.

USD/JPY: Hourly chart

In contrast to the hourly chart, the daily play suggests that the USD/JPY bulls are running out of steam, per overbought RSI, around an upward sloping trend line from October around 116.50.

The pullback moves, however, remain less worrisome until breaking a two-week-old support line near 115.25.

Even so, the USD/JPY pair seller remains cautious until the quote stays beyond 50-DMA and an upward sloping trend line from September, close to 114.00.

To sum up, USD/JPY traders are seeking fresh clues around the multi-day top.

USD/JPY: Daily chart

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.