USD/JPY Price Analysis: Bulls and bears in battle between key territories

- USD/JPY bias remains bearish and a fade on rallies could be in store.

- Bulls eye a move towards 137.50 and then a break of 138.00.

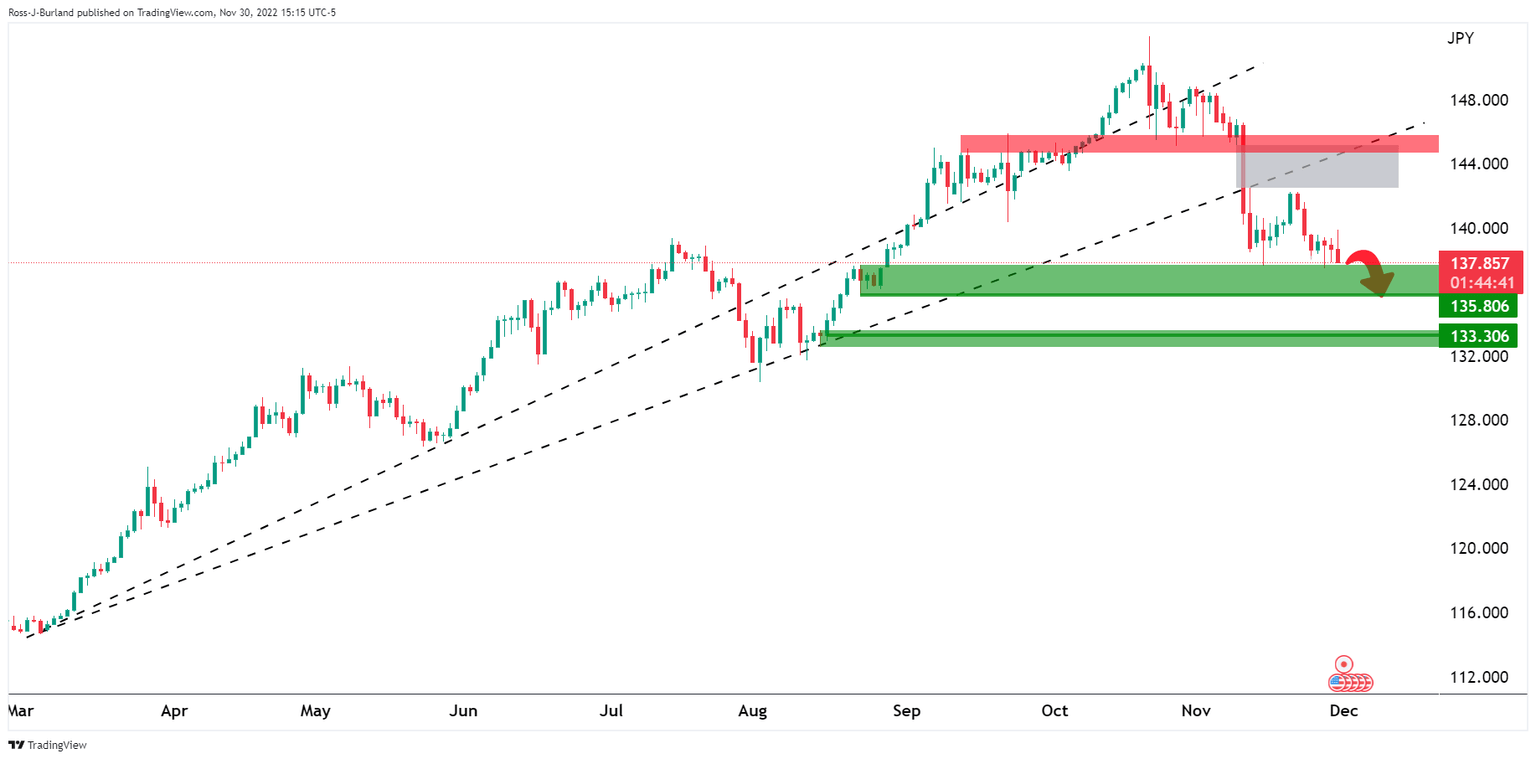

As per the prior analysis, USD/JPY Price Analysis: Bears eye a break of key support structures, USD/JPY sank into the proposed area of support as the following will illustrate:

USD/JPY prior analysis

USD/JPY was trading on the back side of the daily trend lines which exposed 135.80 on the downside and below.

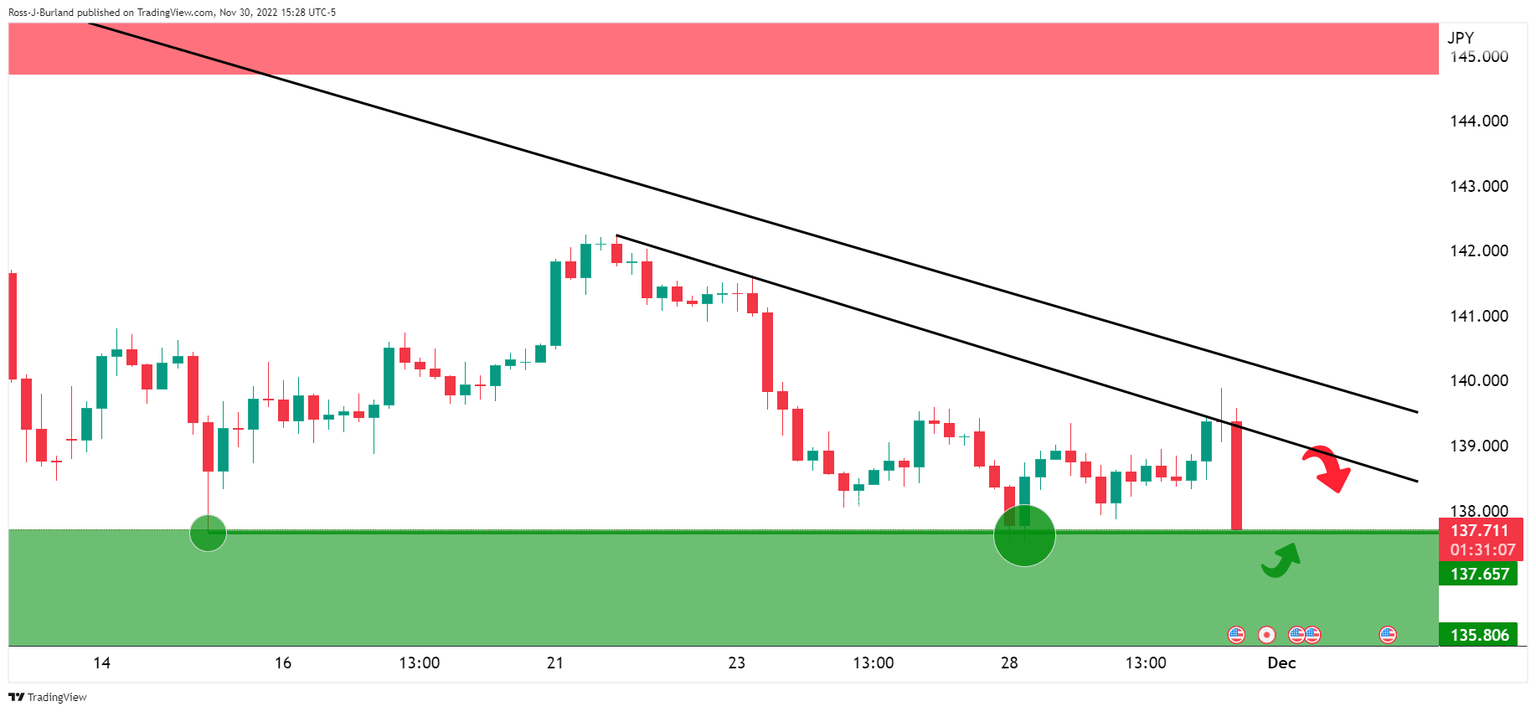

The bears were embarking on an equal low as seen more easily on the following zoomed-in chart:

It was stated that there would be liquidity in here that could lead to a move back into the horizontal resistance. However, it was stated, that so long as the 139 area held, the emphasis would remain on the downside. A break of 135.80 opened risk to the lower end of the 133 area:

USD/JPY update

Bulls now eye 137.50:

The price could now be embarking on a move beyond 138.00 but resistance needs to give. While on the front side of the micro trendlines, the bias remains bearish and a fade on rallies could be in store.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.