USD/JPY Price analysis: Bears eye a break of key support structures

- USD/JPY bears are moving in following Fed Powell speech.

- A break of 135.80 opens risk to the lower end of the 133 area.

The US Dollar fell on Wednesday after Federal Reserve Chairman Jerome Powell said that the US central bank could scale back the pace of its interest rate hikes "as soon as December."

This has given the yen a boost and is seeing USD/JPY take on prior equal lows. A break here could make for a significant shift in the pair for the days ahead as the following illustrates:

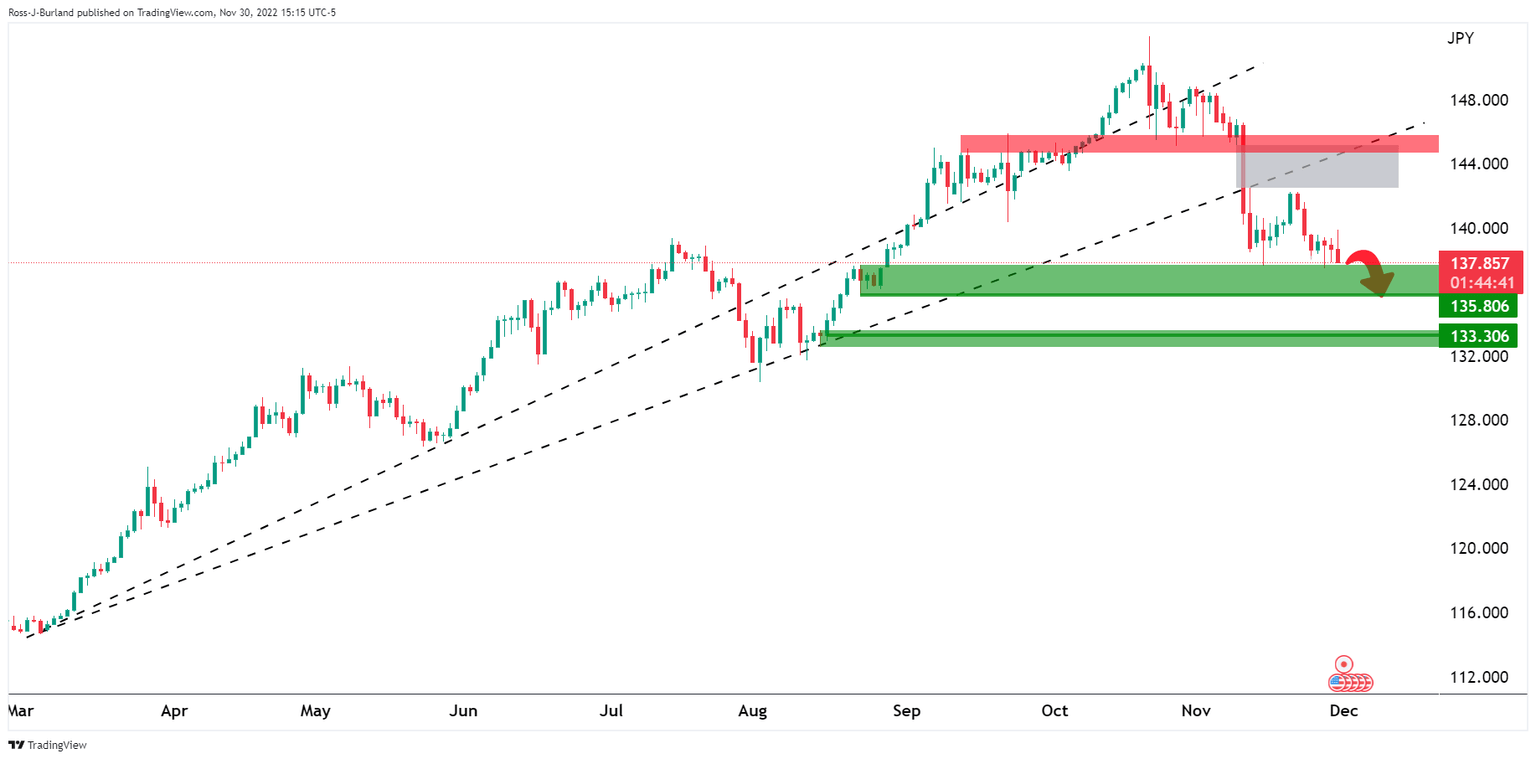

USD/JPY daily chart

USD/JPY is trading on the back side of the daily trend lines which exposes 135.80 on the downside.

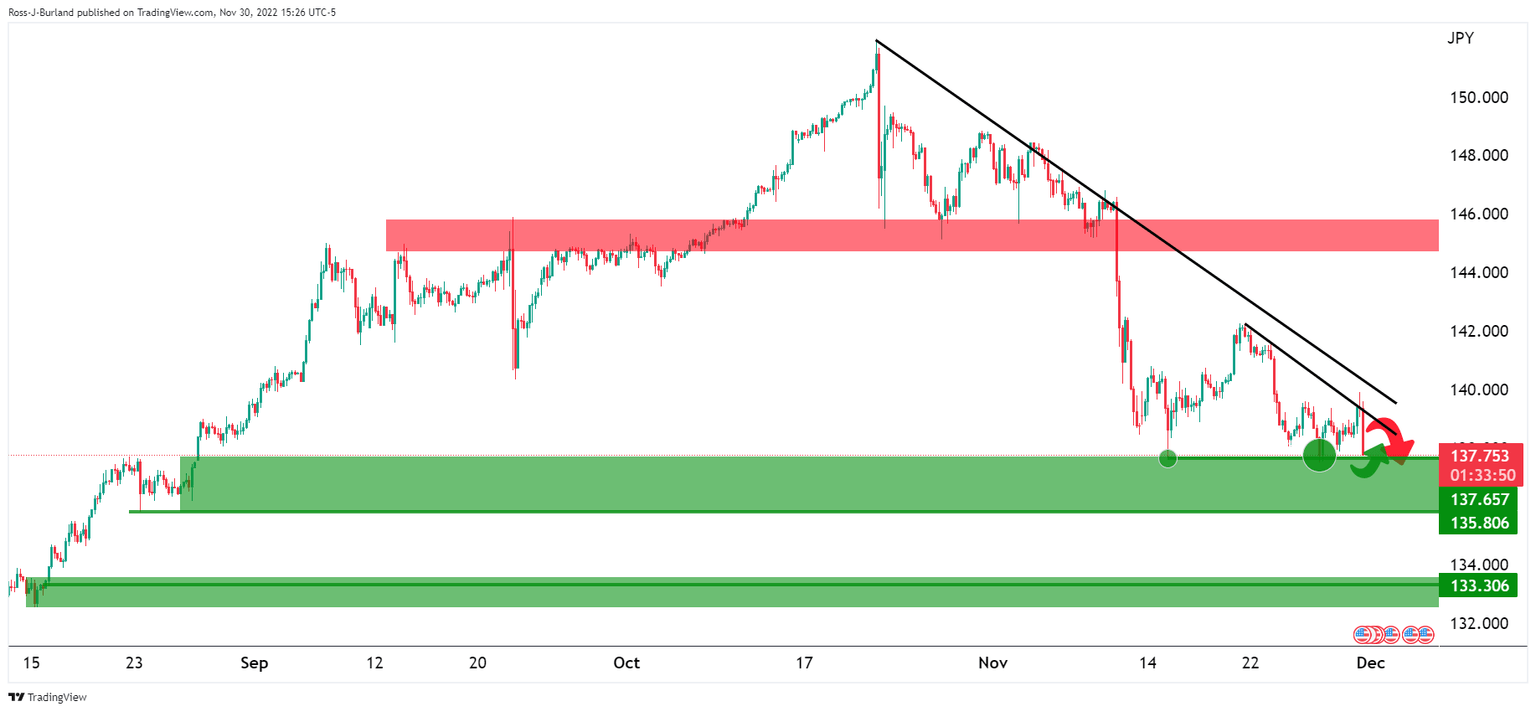

USD/JPY H4 charts

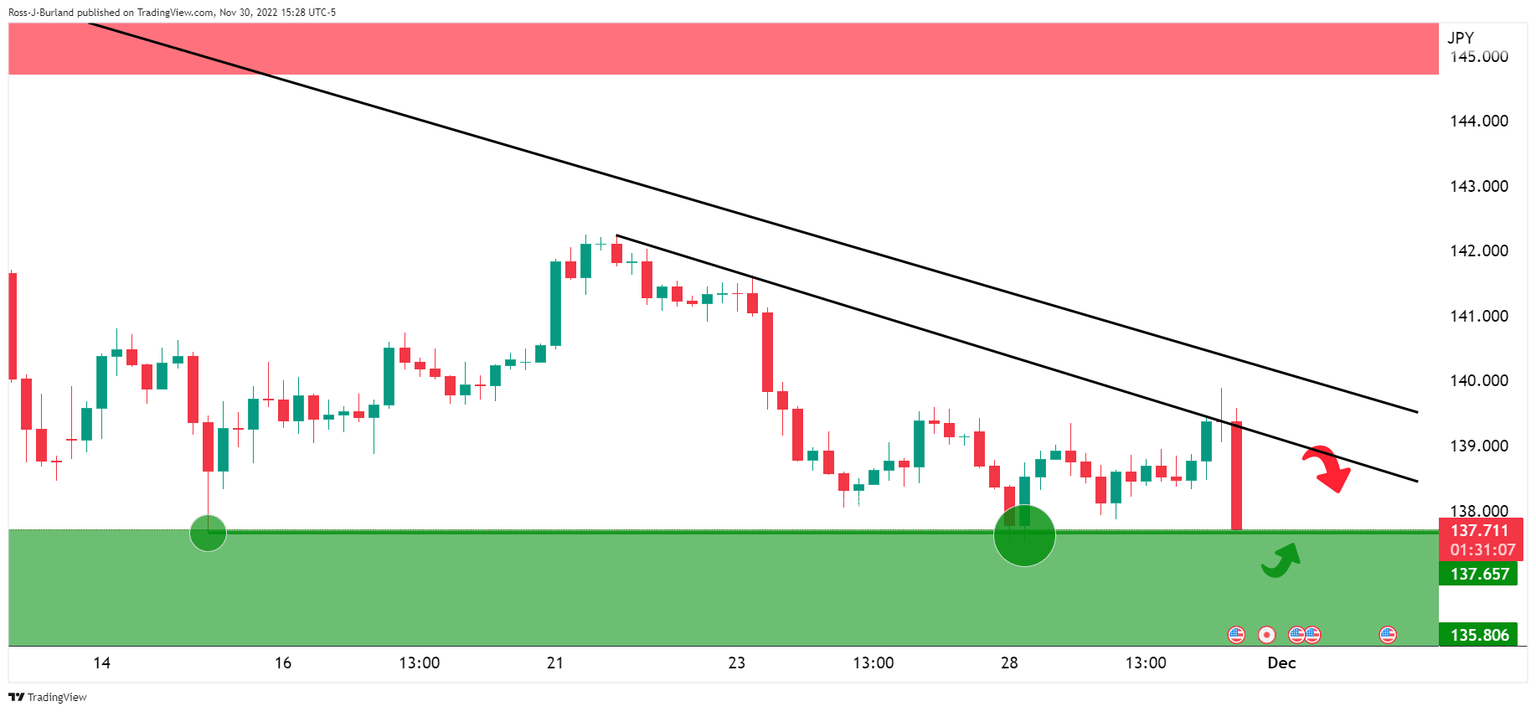

The bears are embarking on an equal low as seen more easily on the following zoomed-in chart:

There will be liquidity in here that could lead to a move back into the horizontal resistance in the sessions to follow. So long as the 139 area holds, the emphasis will remain on the downside. A break of 135.80 opens risk to the lower end of the 133 area.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.