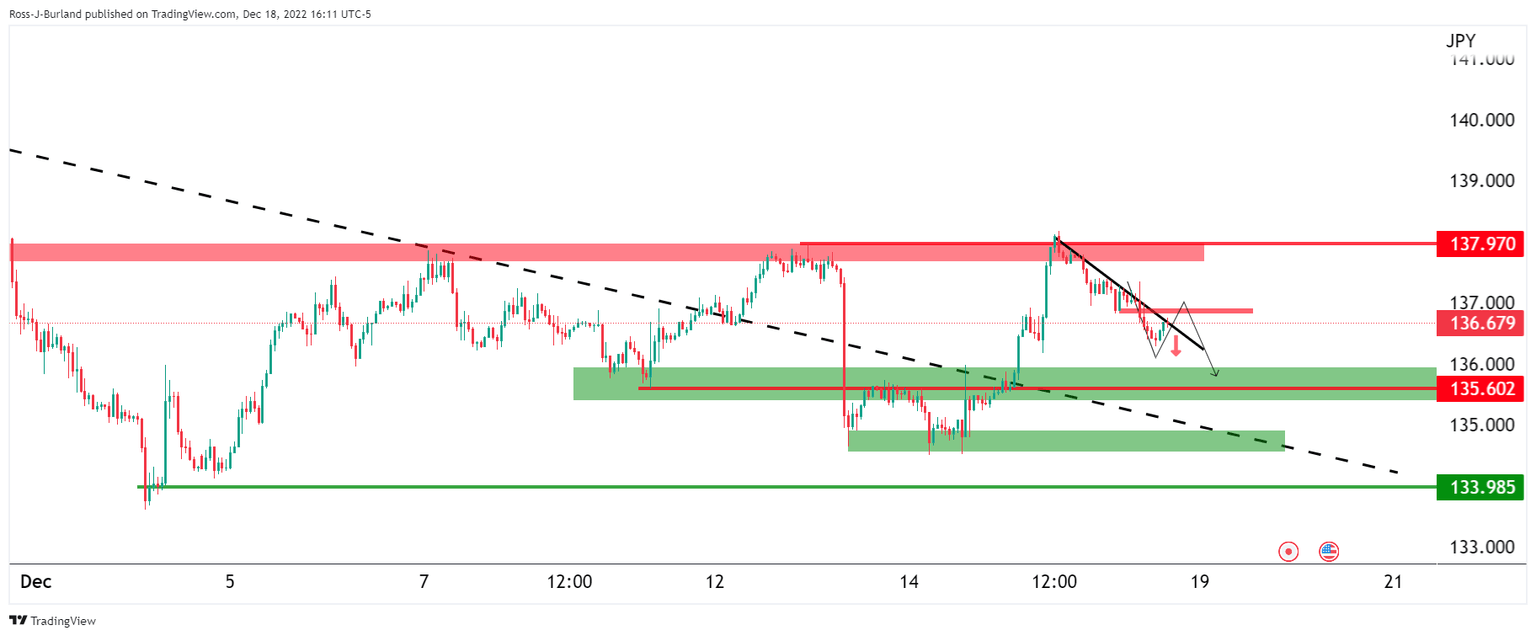

USD/JPY Price Analysis: Bears in control below trendline resistance

- USD/JPY's M-formation on the 4-hour chart is compelling.

- While below the trendline resistance, the bias is firmly weighed to the downside.

The speculation that the Bank of Japan will tweak its ultra-loose monetary policy under a new central bank governor next year has given the yen a boost as per the prior pre-open analysis:

USD/JPY prior analysis

USD/JPY update

USD/JPY was rejected at the trendline and was printing a low of 135.85 the low prior to a correction of the gap.

USD/JPY H4 chart

The M-formation on the 4-hour chart is compelling. This is a reversion pattern that is drawing the price back towards the neckline of the formation between 136.50 and 137.00. While below the trendline resistance, the fact that the December 15 bearing bar's support was broken, the bias is firmly weighed to the downside.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.