USD/JPY on the high end above 150.40 as Greenback finds bidders

- USD/JPY rallied from an early Thursday dip.

- The pair remains bolstered above 150.00 after US PMIs mixed.

- Next week sees Japan CPI and US GDP, PCE figures.

USD/JPY dip and rallied on Thursday, etching in a low of 150.02 before recovering into the 150.60 region after US PMIs came in mixed but overall pointed to the upside. With the brunt of the week’s data releases out of the way, USD/JPY traders will be pivoting to look ahead to next week’s hefty economic calendar.

Forex Today: Markets maintain their focus on rate cut bets

The US Purchasing Managers Index (PMI) mixed on Thursday, with the S&P Global Services PMI for February dipping to 51.3 versus the forecast decline to 52.0 from 52.5. The Manufacturing component unexpectedly rose to 51.5 versus the forecast downtick to 50.5 from January’s 50.7, and the Manufacturing PMI rebound helped to ringfence declines in the Composite PMI, which printed at 51.4 MoM for February compared to the previous month’s 52.0.

Read more: US S&P Global Manufacturing PMI improves to 51.5

With Japan coming back to the market fold after taking the day off to celebrate Japanese Emperor Naruhito’s birthday, a federally-observed holiday, USD/JPY markets return in full just in time to see Friday’s Federal Reserve (Fed) Monetary Policy Report before shuttering for the weekend.

Next week sees Japan’s National Consumer Price Index (CPI) early Tuesday, followed by US Gross Domestic Product (GDP) figures on Wednesday. Japan’s National CPI excluding Fresh Food is expected to recede further to 1.8% for the year ended January compared to the previous period’s 2.3%.

On the US side, annualized GDP for 2023’s fourth quarter is expected to hold steady at 3.3%.

Next Thursday sees Japanese Retail Sales early in the day before US Personal Consumption Expenditure (PCE) Price Index figures land on markets. Japanese Retail Sales are expected to rebound to 2.3% from 2.1% YoY in January, while the Core US PCE Price Index is forecast to heat up to 0.4% MoM versus the previous 0.2%.

USD/JPY technical outlook

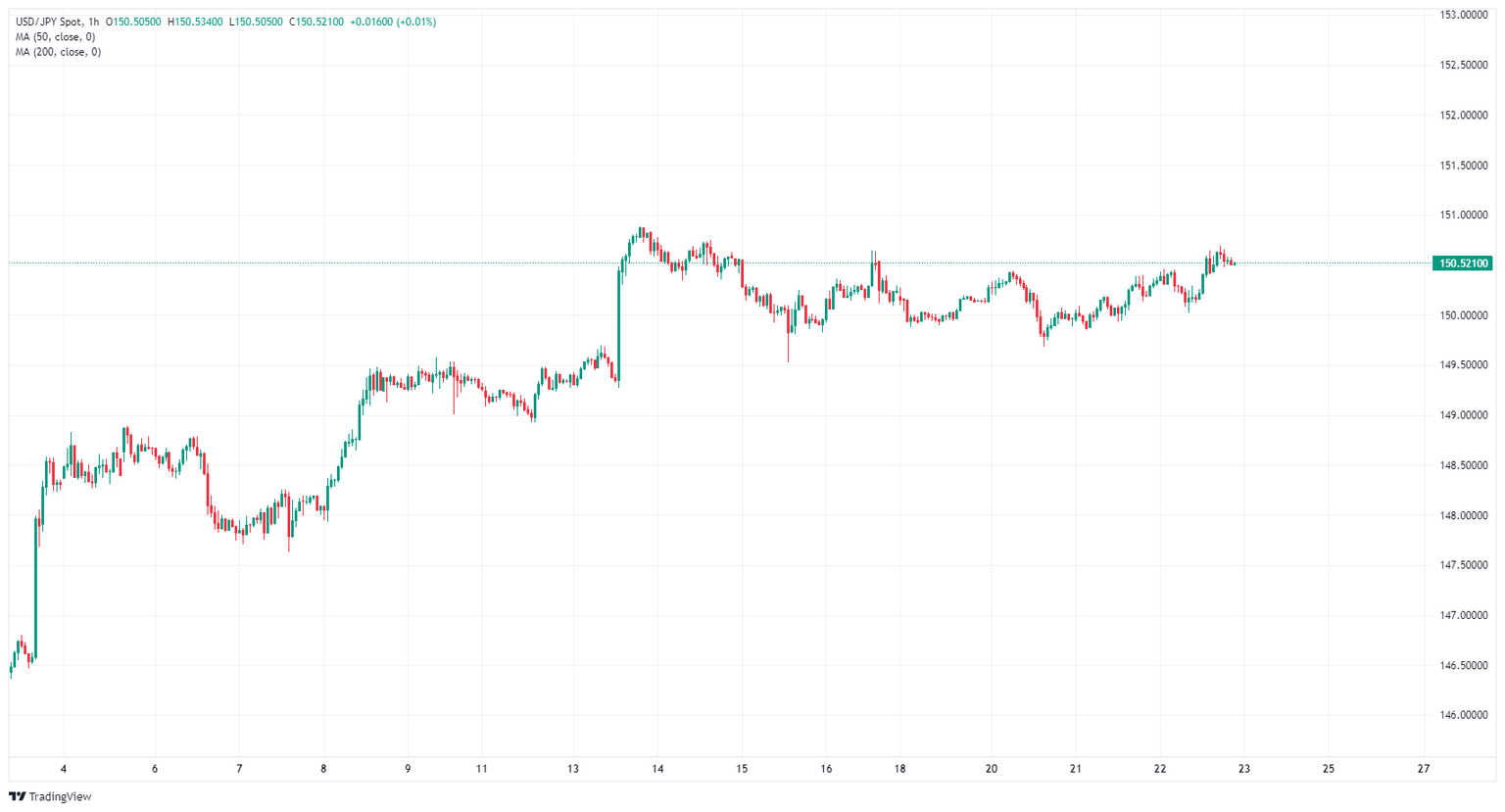

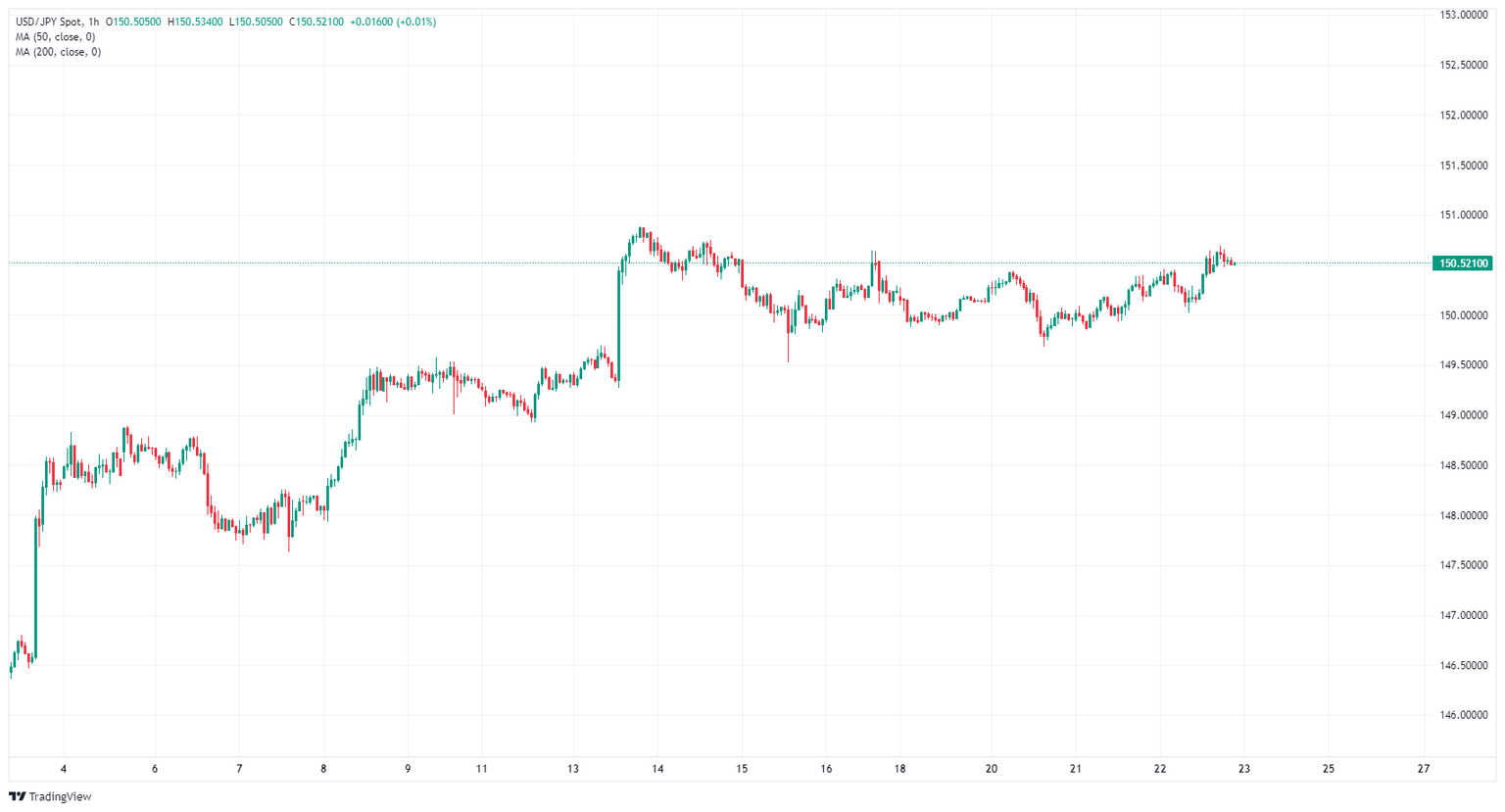

USD/JPY has seen a thin bullish lift since bottoming out on Monday at 149.68, and the pair recovered to the high side of the 150.00 handle before running into familiar technical resistance near 150.50.

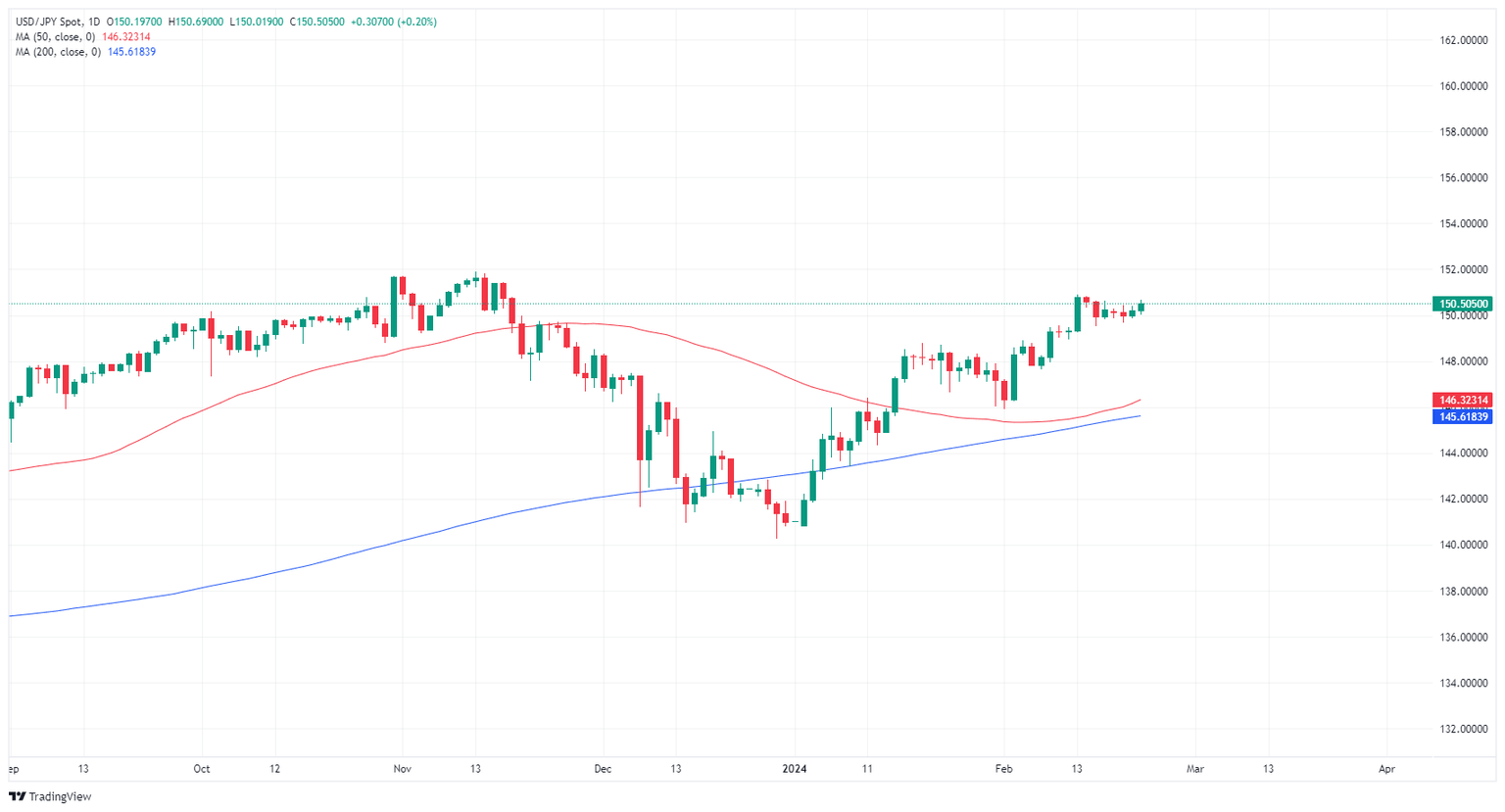

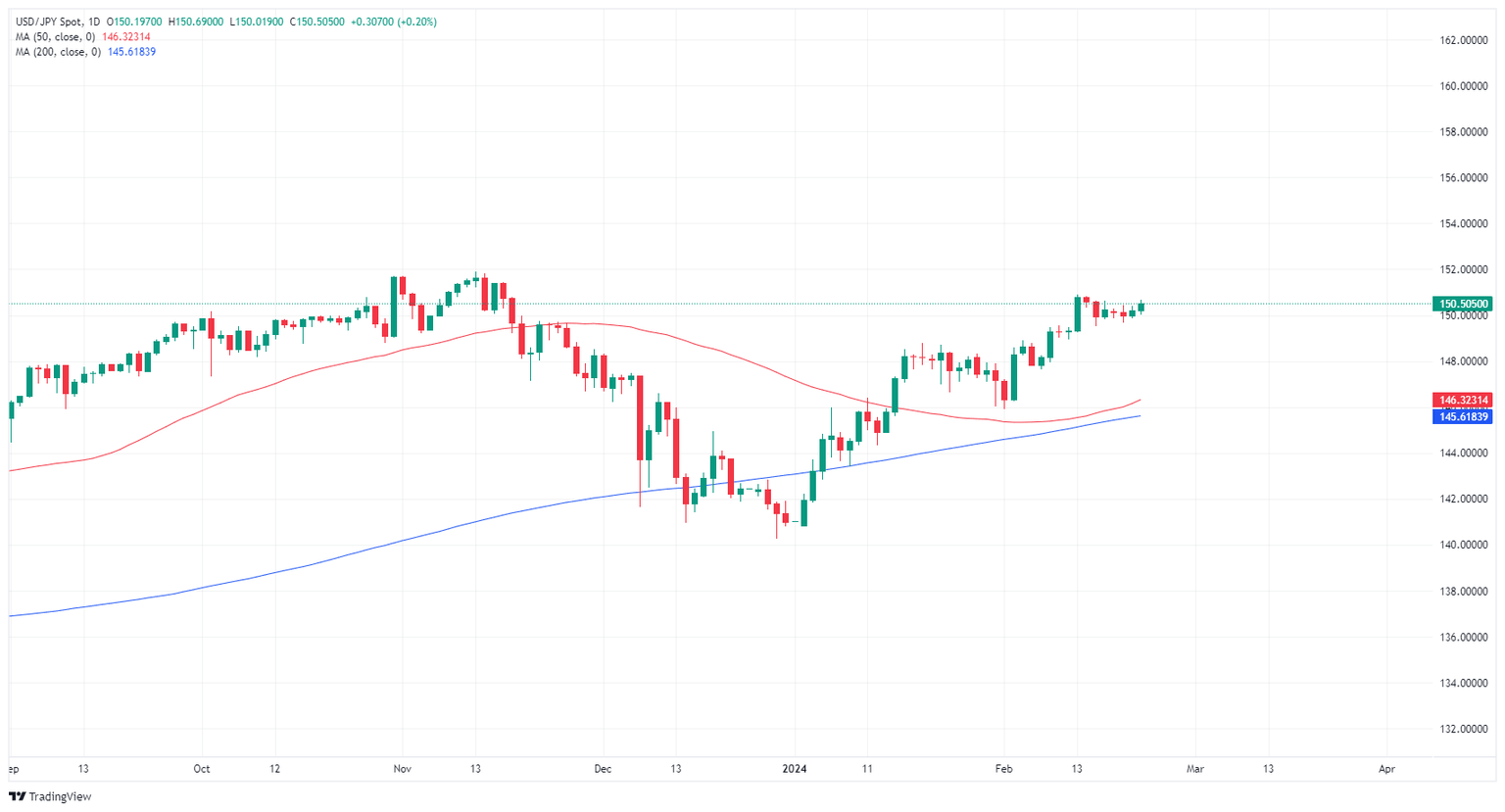

The USD/JPY pair has closed flat or bullish six consecutive trading weeks and is on pace to chalk in a seventh straight green week. The pair continues to extend a recovery from the major swing low into 140.25, and bulls will be looking to gather enough steam to drag the USD/JPY back into the 152.00 handle, a level buyers failed to break in last November’s surge, stopping at 151.91.

USD/JPY hourly chart

USD/JPY daily chart

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.