USD/JPY holds above 139.00, heads for weekly loss

- Japanese yen weakens amid higher government bond yields.

- US Dollar Index rises 0.55% on a quiet low-volume session.

- USD/JPY heads for weekly loss despite Friday’s gains.

The rally of USD/JPY was capped by the 139.50/60 area. Near the end of the week, the pair holds firm above 139.00 supported by rising sovereign bond yields as Wall Street posts gains.

Yen down as yields move up

The Japanese yen fell across the board on Friday, weakened by rising bond yields. The US 10-year bond yield rose to 3.75%, a two-day high while the German 10-year climbed to 1.98%. In Wall Street, the Dow Jones was up by 0.46% and the Nasdaq was falling by 0.29% on a shortened session.

The US Dollar Index was up 0.55% on Friday, but still headed toward the lowest weekly close since mid-August affected by the less hawkish FOMC minutes. Next week, attention will be on the Non-farm payrolls report due on Friday.

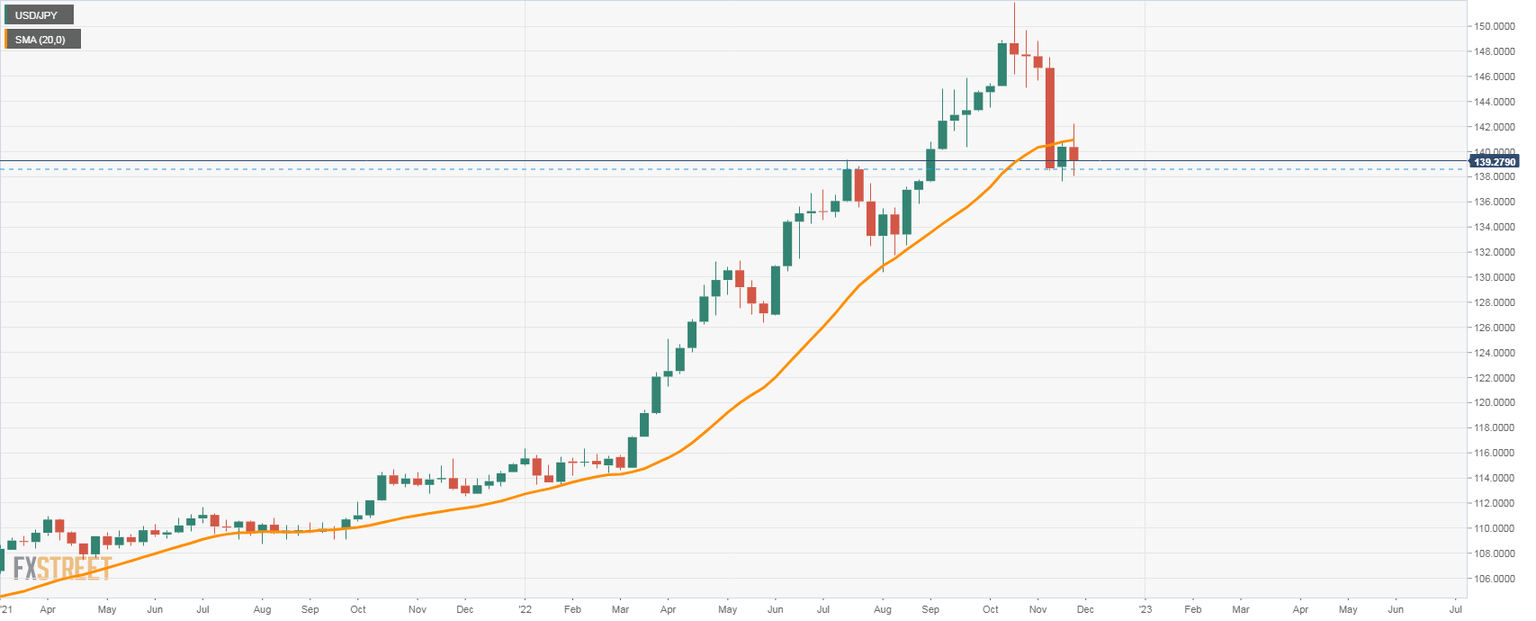

Firm below the weekly 20-SMA

The USD/JPY is about to post a weekly loss of a little more than one hundred pips. During the week it traded as high as 142.24, but then pulled back under the 20-week Simple Moving Average (SMA) that stands at 140.90.

The pair continues to move around 140.00, away from the multi-decade high it hit on October. The declines so far have been contained above 137.50. A daily close below 138.50 would increase the bearish pressure.

USD/JPY weekly chart

Technical levels

Author

Matías Salord

FXStreet

Matías started in financial markets in 2008, after graduating in Economics. He was trained in chart analysis and then became an educator. He also studied Journalism. He started writing analyses for specialized websites before joining FXStreet.