USD/JPY extending bullish correction to test bearish commitments at 110.00

- USD/JPY bulls in play and take on the hourly resistance with eye son the daily resistance.

- The US dollar is finding support on a number of counts.

At the time of writing, USD/JPY is trading near the highs of the day and up 0.11% so far.

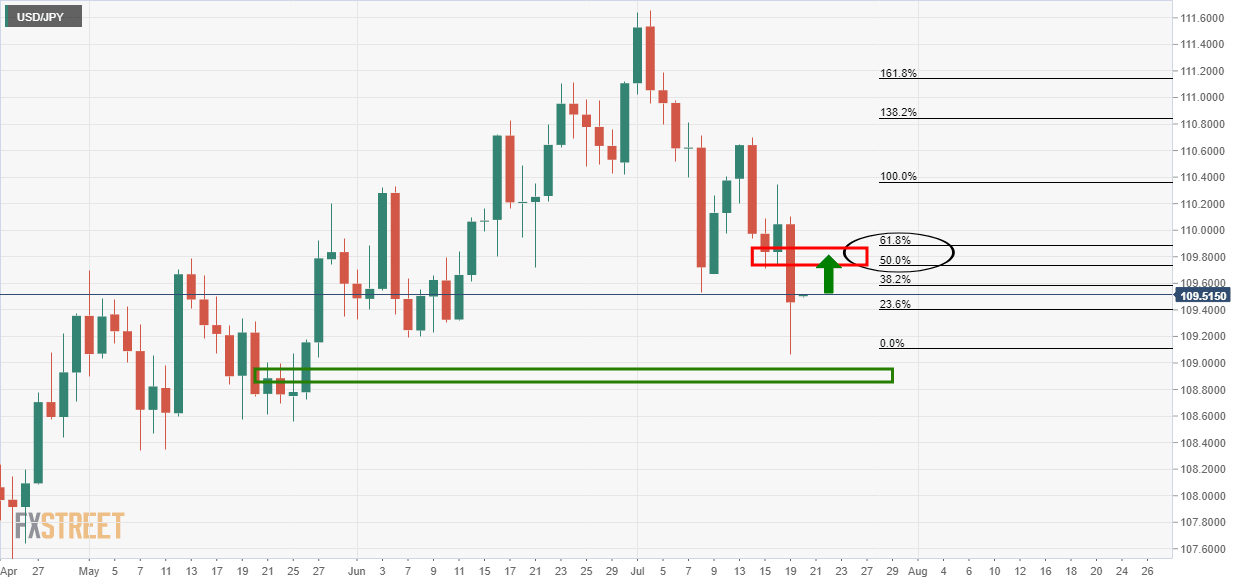

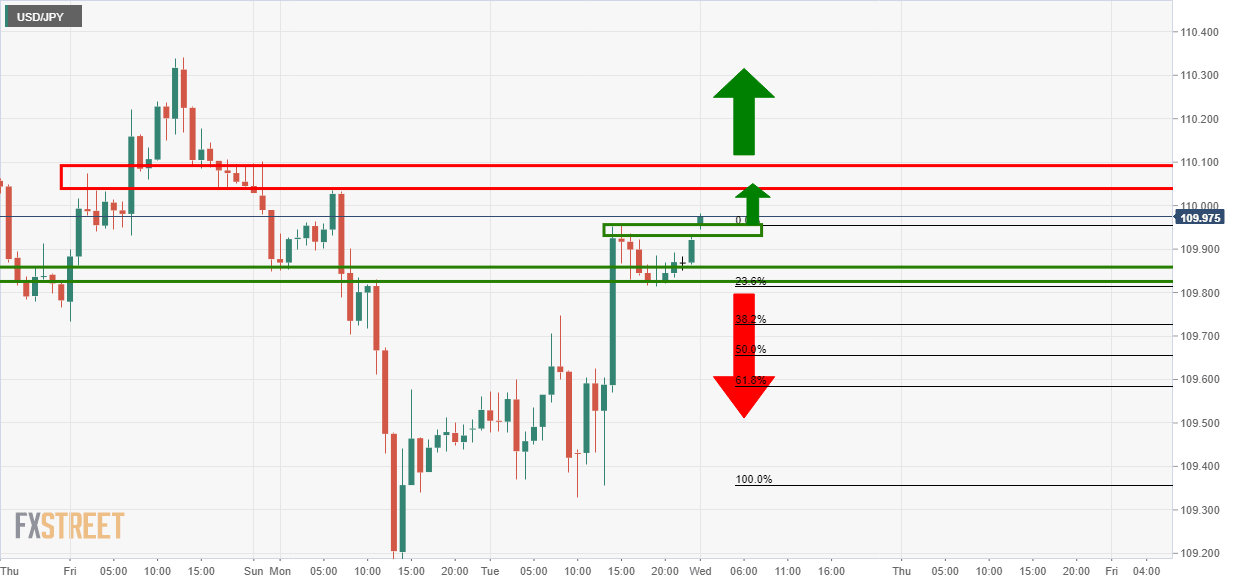

USD/JPY has rallied from a low of 109.78 to a high of 109.97 completing a 61.8% Fibonacci retracement from the lows and setting the pair up in good stead for firmer grounds.

Markets firmed overnight on comments from Fed Reserve Chair Jerome Powell that showed he was not concerned with the current level of inflation, indicating monetary policy will remain supportive.

Consequently, equity markets bounced back into positive territory the comments also drove up Treasury yields, supporting an already buoyant US dollar that rose against most G10 currencies over the day.

Wall Street's main indexes all rose by more than 1.5%, with the Dow ahead of the others. Yields on US 10-year Treasuries came off a new five-month low.

The closely watched 2-year government bond yields closed flat at 0.20%, and 10-year bond yields rose from 1.17% to 1.22%.

This helped to send USD/JPY higher by 0.4% to 109.85, (the 61.8% Fibo) aided by the rebound in US yields.

A measure of its value against six major currencies rose to 93.17 DXY, a three-month high.

Data showing US housing starts rose 6.3% to a seasonally adjusted annual rate of 1.643 million units last month had little reaction from the FX market.

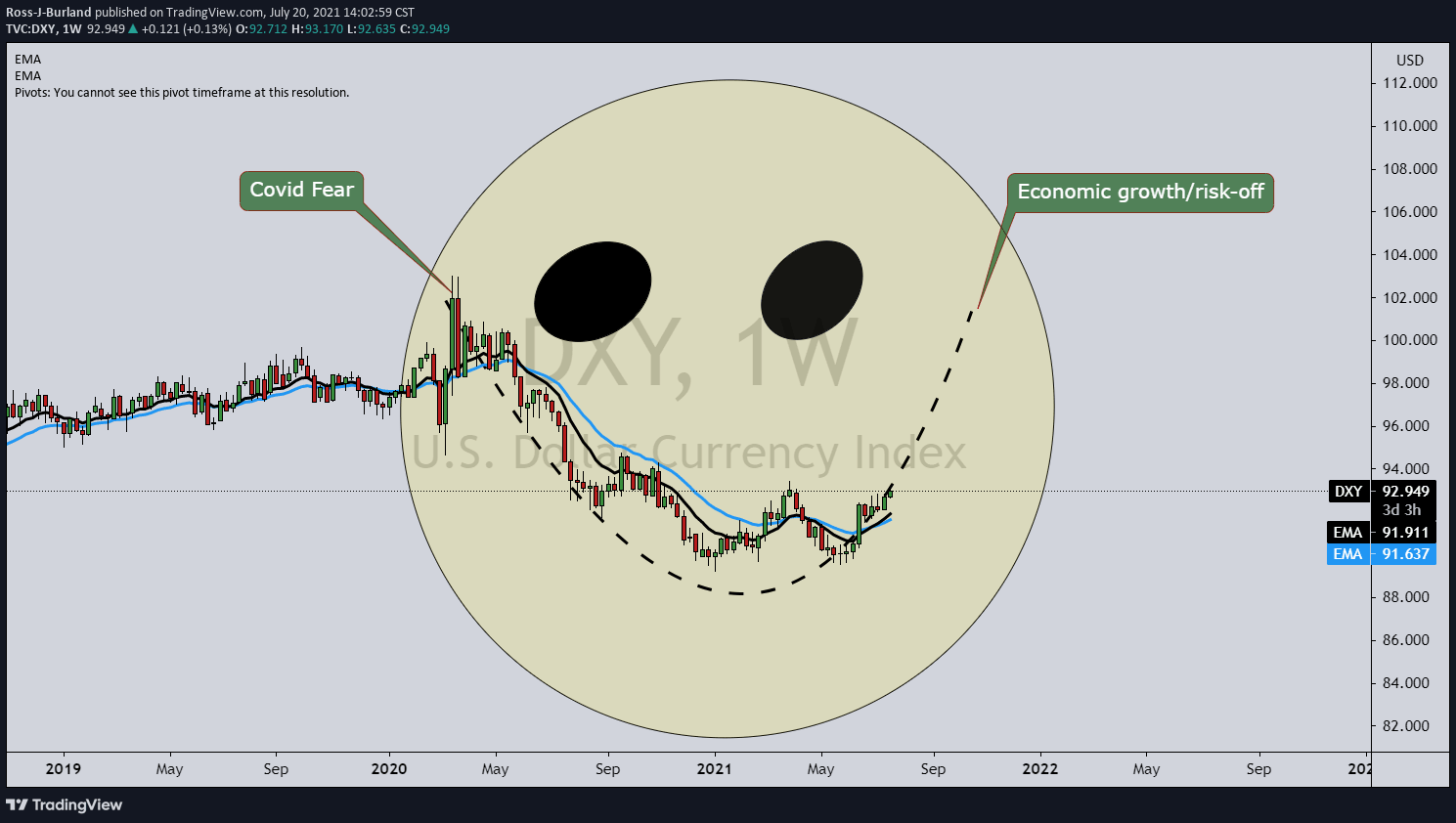

US dollar smile theory in play

Meanwhile, the US dollar smile theory has gained traction of late.

That is to say, the dollar is benefitting from risk-off flows pertaining to the delta variant spread as well as strong US data.

The data are feeding into increased dollar bullishness as the Fed continues to take tentative steps towards tapering.

As for the covid fears, further studies are showing that the one sot vaccines may not be enough to combat the delta variant which could underpin both the yen, on the crosses, and US dollar.

Risk-off: bioRxiv study shows J&J vaccine may be less effective against Delta covid variant

USD/JPY technical analysis

As per the prior session's analysis, it was warned that the bears were pressing against not only weekly support but were likely hamstrung by the bullish market structure, as follows:

...the correction has been very sharp and with little in the way of deceleration on the way to the 38.2% Fibo.

This rings alarm bells.

Not only that, the M-formation is a bullish formation that would be expected to attract bids into the neckline of the pattern and prior daily lows in the 109.70/80 area.

Therefore, a deeper correction to the 50% mean reversion or even the 61.8% Fibonacci could be on the cards for the meanwhile, nullifying the hourly bearish prospects:

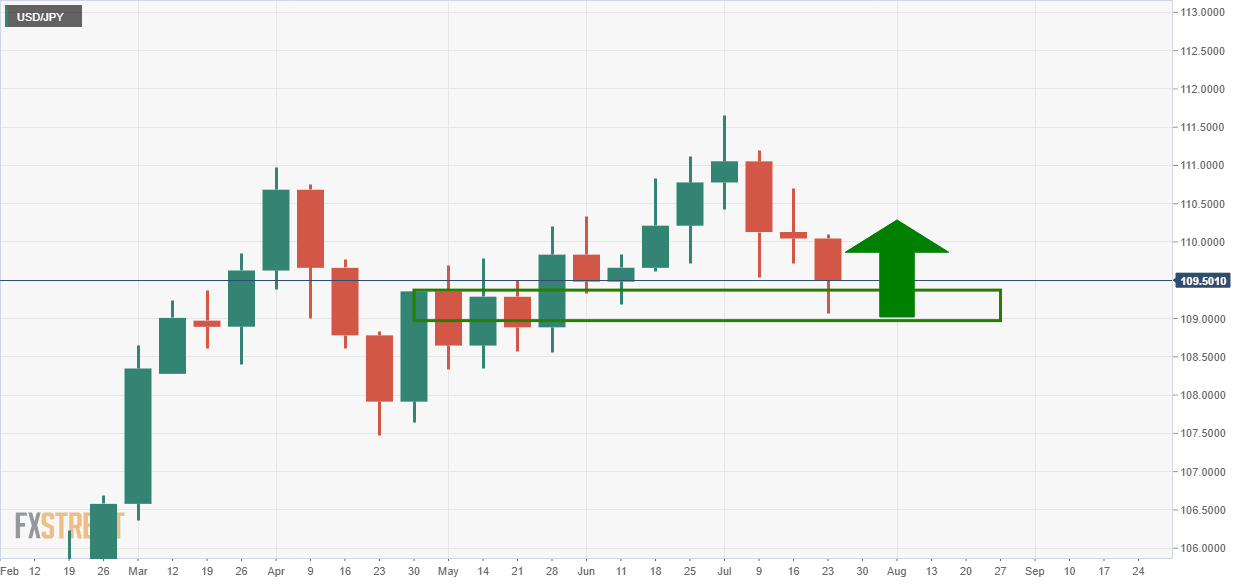

Moreover, selling at weekly support is not the most favourable prospect:

Live analysis, daily chart

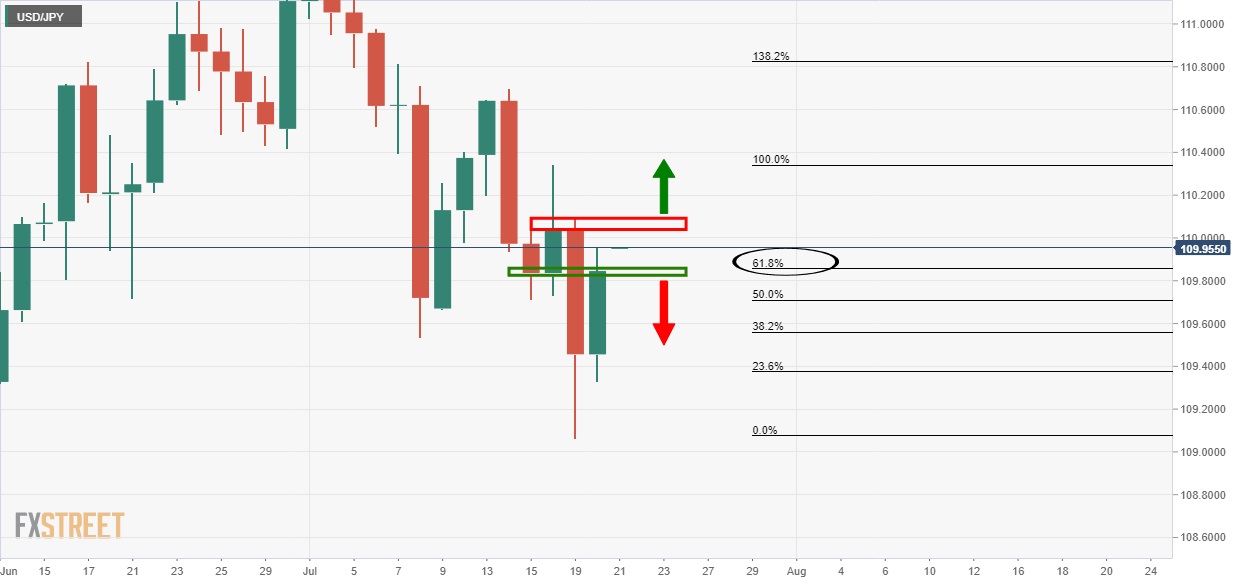

As illustrated, the price is now creating a new support structure and met the 61.8% Fibonacci retracement.

This raises prospects of an upside continuation considering it breached the M0formarons neckline resistance at 109.70.

From an hourly perspective, the price has just breached the hourly resistance which is also laying the foundations for an onward trajectory for the day ahead:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.