USD/JPY bulls testing bear's commitments at critical resistance

- USD/JPY bulls are chipping away into deep resistance in the 111 area.

- The US dollar is the focus with Fed speakers dictating the trajectory.

Rising from a low of 110.57, USD/JPY is currently trading at 110.92 and is higher by 0.29% at the time of writing. The pair is, however, failing to convince at the highs of the day, 111.10, meeting critical resistance.

The US dollar jumped last week after the Fed surprised markets last week when it announced policymakers are forecasting two interest rate hikes in 2023.

The rhetoric mattered because it invalidates the most standard structural bearish USD narrative.

The premise that ultra-loose Fed policy effectively guarantees trend USD depreciation was ruptured last week, but the rally has been nipped in the bud this week as Fed officials back peddle.

Yesterday, for instance, Federal Reserve Chair Jerome Powell said that the central bank won't raise rates on fear of inflation.

He reiterated to Congress that rising inflation is likely temporary and showed no signs of being in a hurry to tighten monetary policy.

Therefore, the arguments for a broad-based, persistent USD rally are not yet compelling.

Powell argued that price pressures should ease their own and that they are due to a "perfect storm" of rising demand for goods and services and bottlenecks in supplying them pertaining to the recovery in economic activity in a post covid world.

Looking to the curve which matters for USD/JPY, it is uneven with front-end differentials moving in favour of the USD but longer-term ones subsiding.

As for domestic catalysts from Japan, the Bank of Japan Governor Kuroda has seemingly shot down any notions of adjusting its YCC, which sank JGB yields.

Policymakers have to be happy with the recent yen weakness that has come along with the flatter curve.

Meanwhile, from a positioning point of view, JPY net short positions trended lower for a fourth week ahead of last week’s Fed and BoJ policy meetings.

Speculators have held net short JPY positions since early March.

Overall, cheap money and well-supported stock markets have lessened safe-haven demand for the yen.

USD/JPY technical analysis

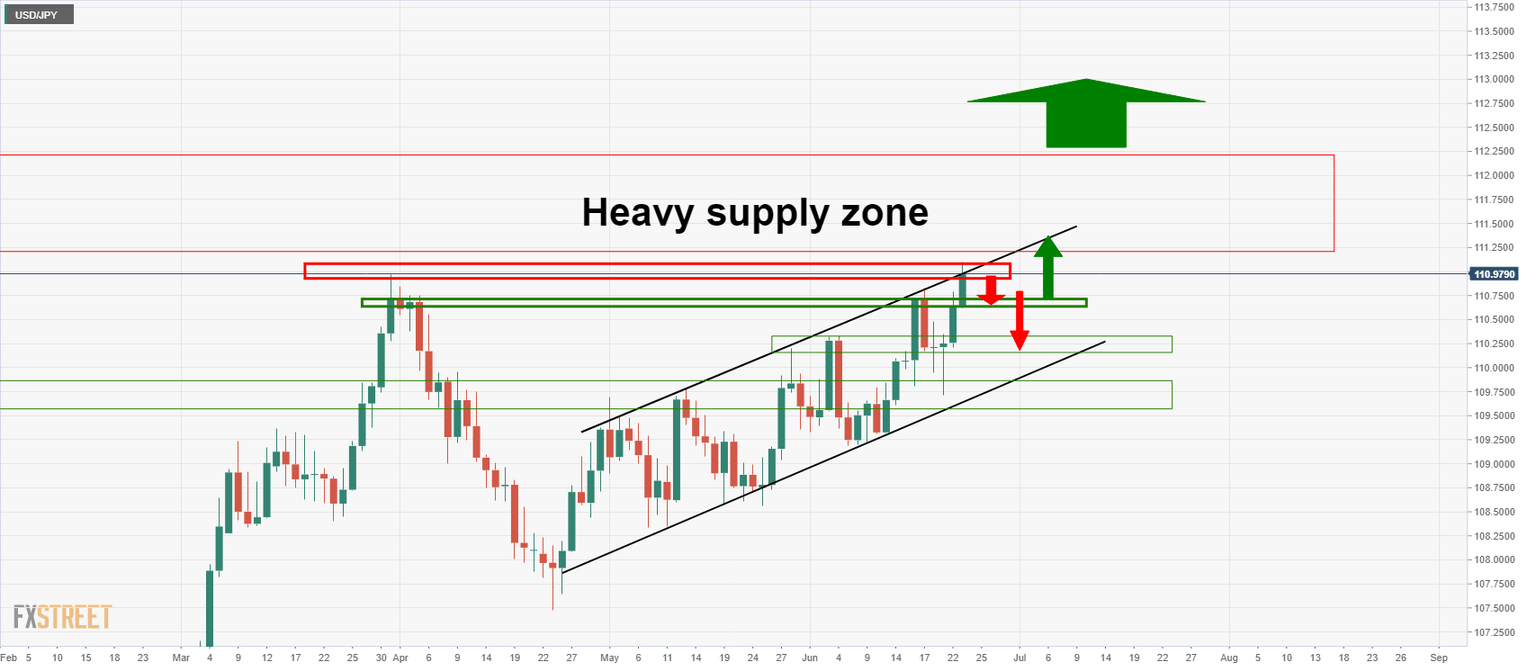

The price is testing the bearish commitments at a critical resistance area on a daily chart in the 111 level.

Zooming in, we can see that there are prospects for a pullback to test the support structure before an onward continuation.

Failures there, however, could open prospects of a test of the 110 level and lower.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.