USD/JPY bears are back in charge

- USD/JPY sliding in the Tokyo opening hour in a risk-off setting.

- Risk-off remains the driving force in Asia but the dollar stays under pressure.

USD/JPY is currently trading at 107.95 and down around 0.1% on the day after sliding from a high of 108.14 to a low of 107.87.

The risk-off mood continues in the Asian session with the Nikkei down some 1.4%.

The US dollar was picking up a bid overnight as the correlation between it and the stock market remained negative.

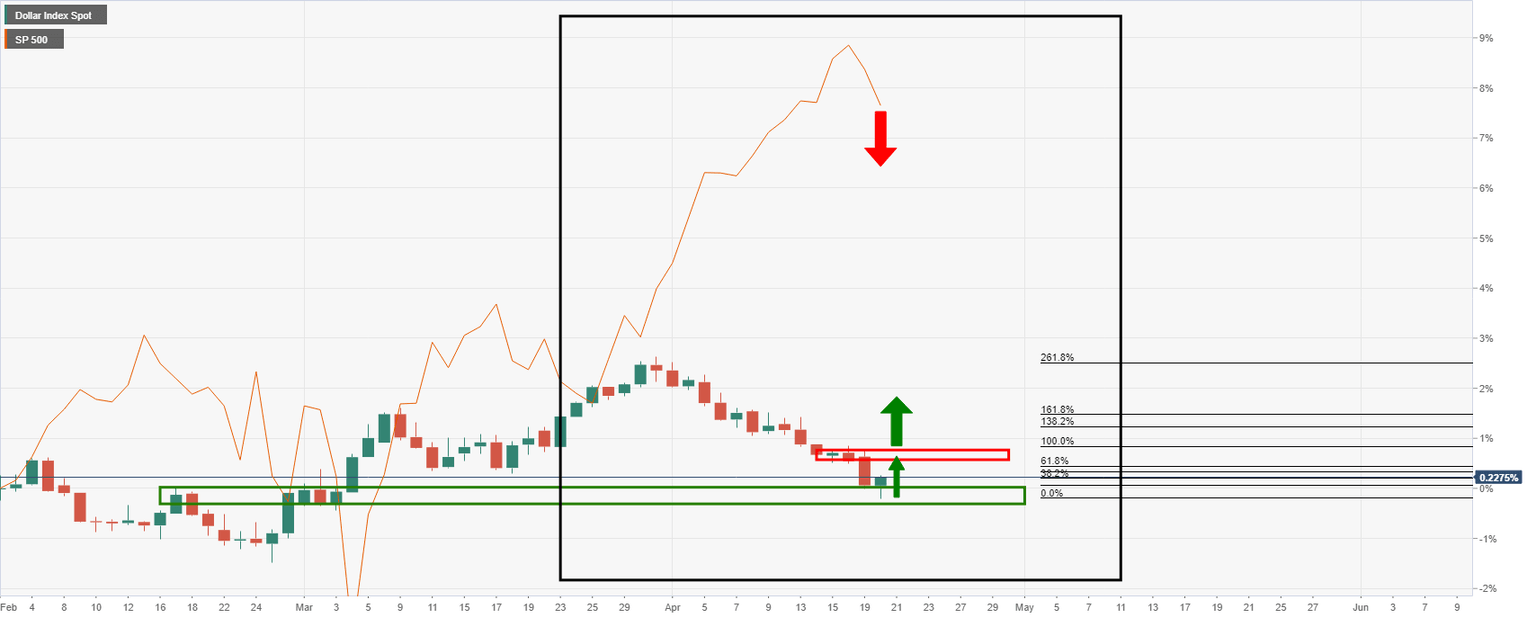

DXY/S&P 500 negative correlation

DXY attempts to recover as US stocks continue to bleed

The concerns that a surge in COVID-19 cases globally would lead to renewed restrictions hurt stocks on Wall Street and sent the VIX up by 11% to the highest level in April.

The Dow Jones Industrial Average moved deeper into bearish territory and was down by 0.8% to 33,821.30 by the bell. The S&P 500 lost 0.7% to 4,134.94 and the Nasdaq Composite was ending lower by 0.9% to 13,786.27.

Meanwhile, the US State Department made a statement that was warning that the COVID-19 pandemic continues to pose "unprecedented risks" globally and called on citizens to stay at home.

Its updated travel guidelines are advising citizens to avoid visits to "80% of countries worldwide," including India which has gripped the market's attention due to the surging cases of a new variant of the disease.

Nevertheless, the yen has picked up the bid in Asia as the US dollar struggles to maintain a bid as the global risk-off mood saw a flight to treasuries which flattened the curve and leaves yields down in the doldrums.

Overnight, the 2-year government bond yields fell and the 10-year government bonds also fell from 1.63% to 1.56%.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.