USD/INR depreciates as RBI potentially intervene to support under pressure Indian Rupee

- The Indian Rupee remains under renewed pressure as geopolitical tensions escalate between India and Pakistan.

- India's announcement of neutralizing military threats along its northern and western borders has heightened risk aversion in domestic markets.

- The Reserve Bank of India is expected to step in, signaling its intent to curb excessive Rupee depreciation.

The Indian Rupee (INR) gains ground against the US Dollar (USD), recovering losses on Friday. However, the USD/INR pair opened with a gap up following approximately a 1% gain in the previous day. Traders will likely await India’s FX Reserves data later in the day.

The INR faced renewed pressure amid rising geopolitical tensions between India and Pakistan. India reported having neutralized military threats along its northern and western borders, triggering risk aversion in domestic markets. Market sentiment was further rattled by media reports of Indian drone strikes and Pakistan’s claims of shooting down drones, intensifying investor concerns and weighing on the INR.

A trader notes that it is highly likely the Reserve Bank of India (RBI) will intervene to signal its unwillingness to tolerate unchecked rupee depreciation. Without RBI support, he warns, there is a real risk of the USD/INR pair accelerating further to the upside.

The volumes on the Indian rupee options soared after India's strikes in Pakistan, suggesting that the currency may go through a volatile patch on the back of the heightened tensions between the two nuclear-armed neighbors. The surge in volumes did not reveal a notable directional bias. The split between call and put options remained fairly typical. This indicates that markets are "playing" volatility rather than positioning for a rupee depreciation, Reuters cited a senior forex trader at a bank.

The USD/INR appreciates due to a stronger US Dollar (USD), boosted by the Federal Reserve’s (Fed) hawkish stance, and rising crude Oil prices add pressure on the Indian Rupee. While the INR is expected to remain under stress, potential support from foreign institutional investor (FII) inflows could limit downside risk unless tensions intensify further across the Line of Control.

Indian Rupee appreciates despite a stable US Dollar

- The US Dollar Index (DXY), which measures the value of the US Dollar (USD) against a basket of currencies, is trading around 100.60, buoyed by strong US economic data. US President Donald Trump announced a “major” trade deal with the United Kingdom (UK), although key tariffs will remain at 10%, which limits market enthusiasm.

- US citizens filing new applications for unemployment insurance decreased to 228K for the week ending May 3. This print came in just below initial estimates and was lower than the previous week's unrevised tally of 241K. The report also highlighted a seasonally adjusted insured unemployment rate of 1.2%, while the four-week moving average increased by 1K to 226K from the prior week’s unrevised average. Moreover, Continuing Jobless Claims went down by 29K to reach 1.879M for the week ending April 26.

- President Trump has adopted a firm stance on China's trade policy, following the appointment of a new envoy to Beijing. While there are discussions around tariff exemptions, the administration appears cautious, with Trump stating that they are "not looking for so many exemptions."

- According to the Global Times, citing the Chinese Embassy in the United States, Beijing is unlikely to reduce tariffs ahead of the upcoming talks in Switzerland. This adds to market uncertainty and dampens risk sentiment.

- The Fed held interest rates steady at 4.25%–4.50% on Wednesday, but its statement acknowledged growing risks related to inflation and unemployment, injecting fresh uncertainty into markets. According to the CME's FedWatch Tool, market participants are still anticipating a quarter-point rate cut in July.

- Fed Chair Jerome Powell noted during the press conference that US trade tariffs could obstruct the Fed’s objectives for inflation and employment in 2025. Powell indicated that persistent policy instability may force the Fed to adopt a more patient, 'wait-and-see' stance on future rate adjustments.

- US Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer are set to meet with Chinese Vice Premier He Lifeng in Geneva over the weekend, marking the first high-level talks since the US imposed tariffs that escalated into a global trade dispute.

- India and Pakistan traded accusations over cross-border drone attacks on Thursday. According to the Indian Army, Pakistan’s armed forces carried out multiple strikes using drones and other munitions across India’s entire western border during the intervening night of Thursday and Friday.

- On Friday, Pakistan's government reportedly appealed to international partners, including the World Bank, for additional loans, citing "heavy losses inflicted by the enemy" after Indian military strikes on Wednesday. “Amid escalating tensions and a stock market crash, we urge international partners to help de-escalate,” read a post from the Economic Affairs Division on X, according to *The Economic Times*. However, the Ministry of Economic Affairs later denied posting the appeal, stating it “did not tweet” the message.

- The Indian government confirmed it had targeted air defence radars and systems at multiple locations in Pakistan, in retaliation for Pakistan's attempt to strike several military targets in northern and western India.

- Traders anticipate India’s 10-year government bond yield to remain in the 6.30%–6.40% range this week, with attention centered on bond purchases and geopolitical developments between India and Pakistan.

- The recent decline in yields is driven by expectations of further rate cuts and the Reserve Bank of India (RBI) maintaining surplus liquidity in the banking system through ongoing open market operations (OMOs), according to Reuters.

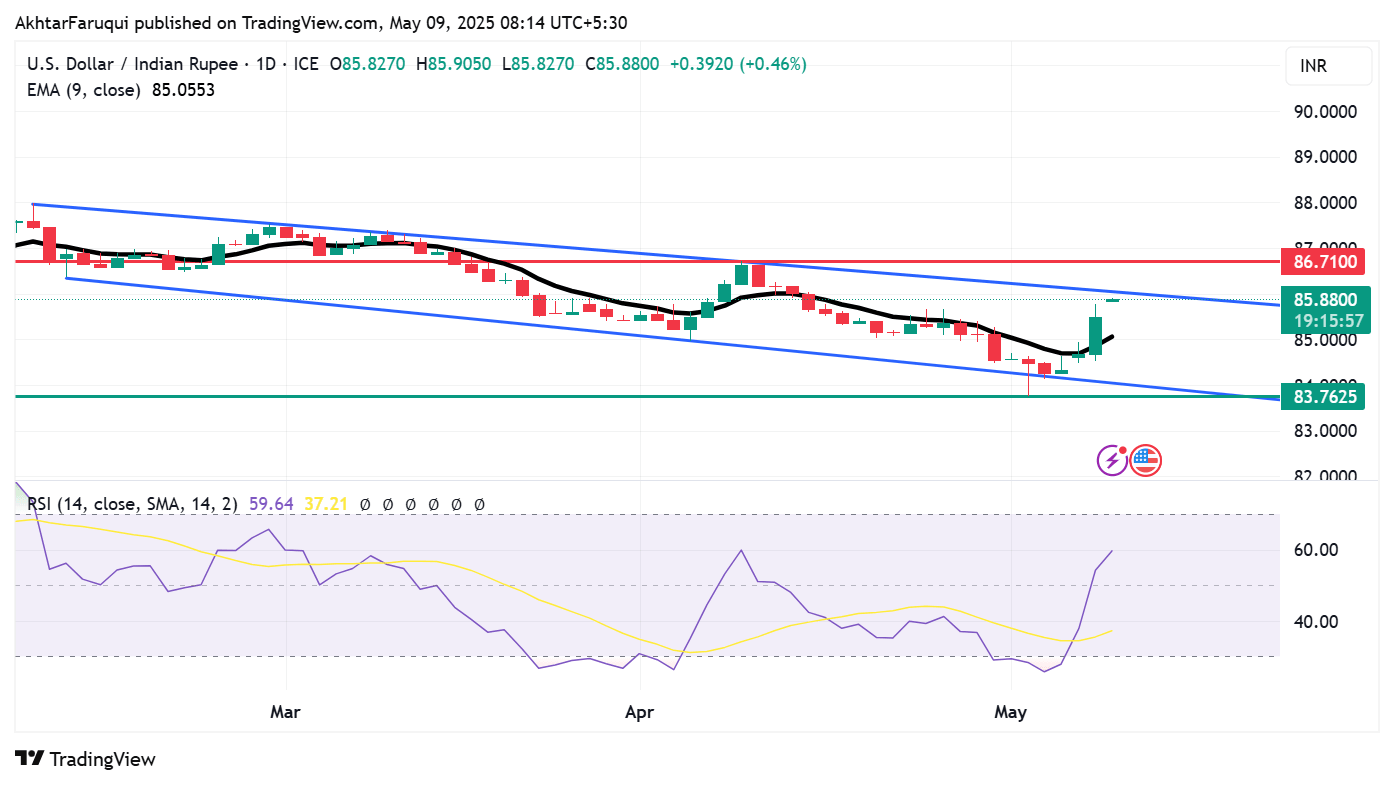

USD/INR retreats from levels near 86.00, ascending channel’s upper boundary

The Indian Rupee gains ground, with the USD/INR pair trading near 85.70 on Friday. Technical indicators on the daily chart maintain a bearish bias, as the pair remains confined within a descending channel. However, a shift in momentum is hinted at by the 14-day Relative Strength Index (RSI), which has climbed above the 50 level, suggesting emerging bullish sentiment.

Immediate support lies at the nine-day Exponential Moving Average (EMA) around 85.05, closely aligned with the key psychological level of 85.00. A decisive break below this zone could undermine short-term bullish attempts and open the door for a decline toward the channel’s lower boundary near 84.00. A breach of this level may intensify selling pressure, potentially driving the pair toward its eight-month low of 83.76.

On the upside, a move higher could see the USD/INR pair challenge the descending channel’s upper boundary around 86.10, with further resistance anticipated near the two-month high of 86.71.

USD/INR: Daily Chart

Indian Rupee FAQs

The Indian Rupee (INR) is one of the most sensitive currencies to external factors. The price of Crude Oil (the country is highly dependent on imported Oil), the value of the US Dollar – most trade is conducted in USD – and the level of foreign investment, are all influential. Direct intervention by the Reserve Bank of India (RBI) in FX markets to keep the exchange rate stable, as well as the level of interest rates set by the RBI, are further major influencing factors on the Rupee.

The Reserve Bank of India (RBI) actively intervenes in forex markets to maintain a stable exchange rate, to help facilitate trade. In addition, the RBI tries to maintain the inflation rate at its 4% target by adjusting interest rates. Higher interest rates usually strengthen the Rupee. This is due to the role of the ‘carry trade’ in which investors borrow in countries with lower interest rates so as to place their money in countries’ offering relatively higher interest rates and profit from the difference.

Macroeconomic factors that influence the value of the Rupee include inflation, interest rates, the economic growth rate (GDP), the balance of trade, and inflows from foreign investment. A higher growth rate can lead to more overseas investment, pushing up demand for the Rupee. A less negative balance of trade will eventually lead to a stronger Rupee. Higher interest rates, especially real rates (interest rates less inflation) are also positive for the Rupee. A risk-on environment can lead to greater inflows of Foreign Direct and Indirect Investment (FDI and FII), which also benefit the Rupee.

Higher inflation, particularly, if it is comparatively higher than India’s peers, is generally negative for the currency as it reflects devaluation through oversupply. Inflation also increases the cost of exports, leading to more Rupees being sold to purchase foreign imports, which is Rupee-negative. At the same time, higher inflation usually leads to the Reserve Bank of India (RBI) raising interest rates and this can be positive for the Rupee, due to increased demand from international investors. The opposite effect is true of lower inflation.

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.