USD/INR surges as India-Pakistan conflict takes an ugly turn

- USD/INR lurched to one of its biggest single-day moves in recent history.

- Tensions are rising rapidly between India and Pakistan as military action spins up.

- The two regions have been caught in multiple conflicts over the Kashmir region over the years.

USD/INR surged to fresh highs on Thursday, bolstered by a fresh pummeling of the Indian Rupee (INR). India and Pakistan are spooling up a direct military conflict as the two countries continue to lay competing claims over the Kashmir region. A recent attack on civilians in India-controlled Kashmir last month has sparked a harsh response, despite repeated denials from Pakistan that the attack was sponsored or supported by the Pakistan government.

India and Pakistan each control sections of Kashmir, but both sides have laid full claim over the entirety of the region, and have fought at least three direct wars over the territory in the past. The latest uptick in military tensions is beginning to spread geopolitical tensions across the wider region. Both countries are nuclear-capable powers, and each country has launched escalating attacks in the latest conflict.

Geopolitical tensions on the rise amid escalating military strikes

Pakistan noted that India’s latest counter-attack hit several densely-populated areas within neighboring Punjab, and Pakistan has vowed to become “more assertive” in responding to Indian-led military strikes. The Indian Rupee is poised to shed 1.5% in a single day of trading as escalating wartime tensions begin to weigh on the region. The Sensex Index, a market-weighted stock index of 30 well-established equities listed on the Bombay Stock Exchange, tumbled over 400 points early Thursday, with losses concentrated in bank stocks, automotive shares, and fast-moving consumer goods (FMCG) equities.

USD/INR technical forecast

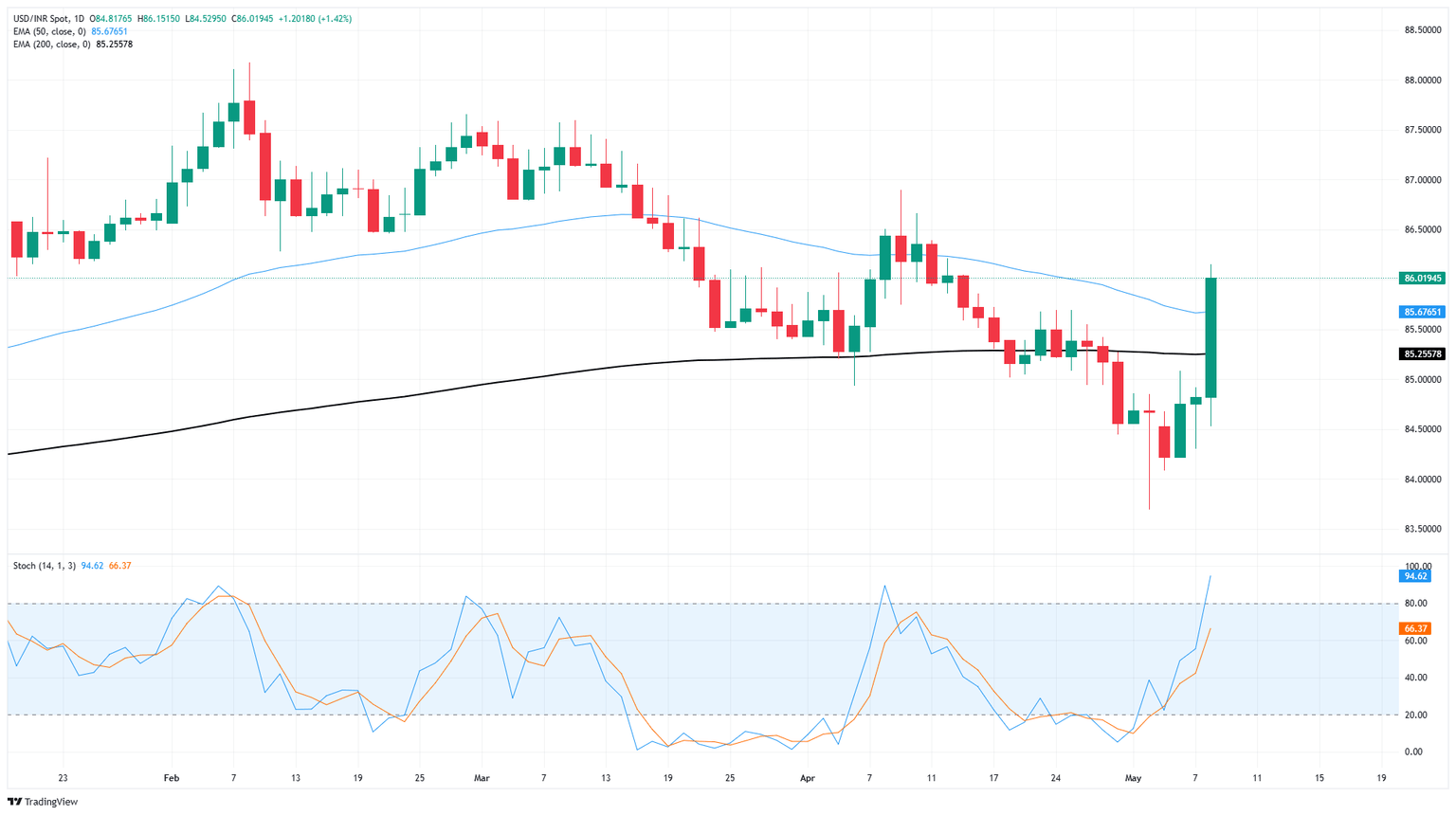

Despite steep intraday losses weighing on the Indian Rupee, USD/INR is still trading into familiar near-term chart territory. The pair is on pace for its largest single-day gain since late 2019 as the Greenback gains ground on the Rupee, and a sharp reversal of recent bearish momentum has pushed the pair back above its 200-day Exponential Moving Average (EMA) near 85.25.

USD/INR has climbed nearly 1.5% on Thursday, tapping a multi-week high north of 86.00.

USD/INR daily chart

Indian Rupee FAQs

The Indian Rupee (INR) is one of the most sensitive currencies to external factors. The price of Crude Oil (the country is highly dependent on imported Oil), the value of the US Dollar – most trade is conducted in USD – and the level of foreign investment, are all influential. Direct intervention by the Reserve Bank of India (RBI) in FX markets to keep the exchange rate stable, as well as the level of interest rates set by the RBI, are further major influencing factors on the Rupee.

The Reserve Bank of India (RBI) actively intervenes in forex markets to maintain a stable exchange rate, to help facilitate trade. In addition, the RBI tries to maintain the inflation rate at its 4% target by adjusting interest rates. Higher interest rates usually strengthen the Rupee. This is due to the role of the ‘carry trade’ in which investors borrow in countries with lower interest rates so as to place their money in countries’ offering relatively higher interest rates and profit from the difference.

Macroeconomic factors that influence the value of the Rupee include inflation, interest rates, the economic growth rate (GDP), the balance of trade, and inflows from foreign investment. A higher growth rate can lead to more overseas investment, pushing up demand for the Rupee. A less negative balance of trade will eventually lead to a stronger Rupee. Higher interest rates, especially real rates (interest rates less inflation) are also positive for the Rupee. A risk-on environment can lead to greater inflows of Foreign Direct and Indirect Investment (FDI and FII), which also benefit the Rupee.

Higher inflation, particularly, if it is comparatively higher than India’s peers, is generally negative for the currency as it reflects devaluation through oversupply. Inflation also increases the cost of exports, leading to more Rupees being sold to purchase foreign imports, which is Rupee-negative. At the same time, higher inflation usually leads to the Reserve Bank of India (RBI) raising interest rates and this can be positive for the Rupee, due to increased demand from international investors. The opposite effect is true of lower inflation.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.