USD/INR edges higher as continuous foreign outflows weigh on Indian Rupee

- The Indian Rupee extends the decline in Tuesday’s early European session.

- Negative domestic markets and relentless foreign capital outflows weigh on the INR.

- Investors await the outcome of the US presidential election for fresh catalysts.

The Indian Rupee (INR) extends its downside on Tuesday after closing at a new all-time low in the previous session. The downtick movement of the local currency is pressured by continuous foreign outflows from the equity markets due to jitters amid institutional players ahead of the outcome of the US presidential election and the US Federal Reserve (Fed) interest rate decision on Thursday.

Nonetheless, the likely foreign exchange intervention from the Reserve Bank of India (RBI) by selling US Dollar (USD) could help limit the INR’s losses. Looking ahead, investors brace for the winner of the US presidential election, which may not be known for days after voting ends. On Thursday, the Fed monetary policy meeting will be closely watched.

Daily Digest Market Movers: Indian Rupee remains vulnerable amid US election-related uncertainty

- The HSBC final India Manufacturing Purchasing Managers Index (PMI) improved to 57.5 in October from an eight-month low of 56.5 in September and was above a preliminary estimate of 57.4.

- "India's headline manufacturing PMI picked up substantially in October as the economy's operating conditions continue to broadly improve," noted Pranjul Bhandari, chief India economist at HSBC.

- "The polls suggesting that Harris may have her nose in front in a couple of swing states is causing a bit of profit-taking in the Trump trade,” noted Kenneth Broux, head of corporate research FX and rates at Societe Generale.

- According to the IMF, India is now estimated to overtake Japan as the world's fourth-biggest economy by FY2025. The IMF forecasts that India's GDP will rise to $4,340 billion next fiscal year.

- Financial markets are now pricing in nearly a 98% possibility of a quarter point reduction and a near 80% chance of a similar-sized move in December, according to CME's FedWatch tool.

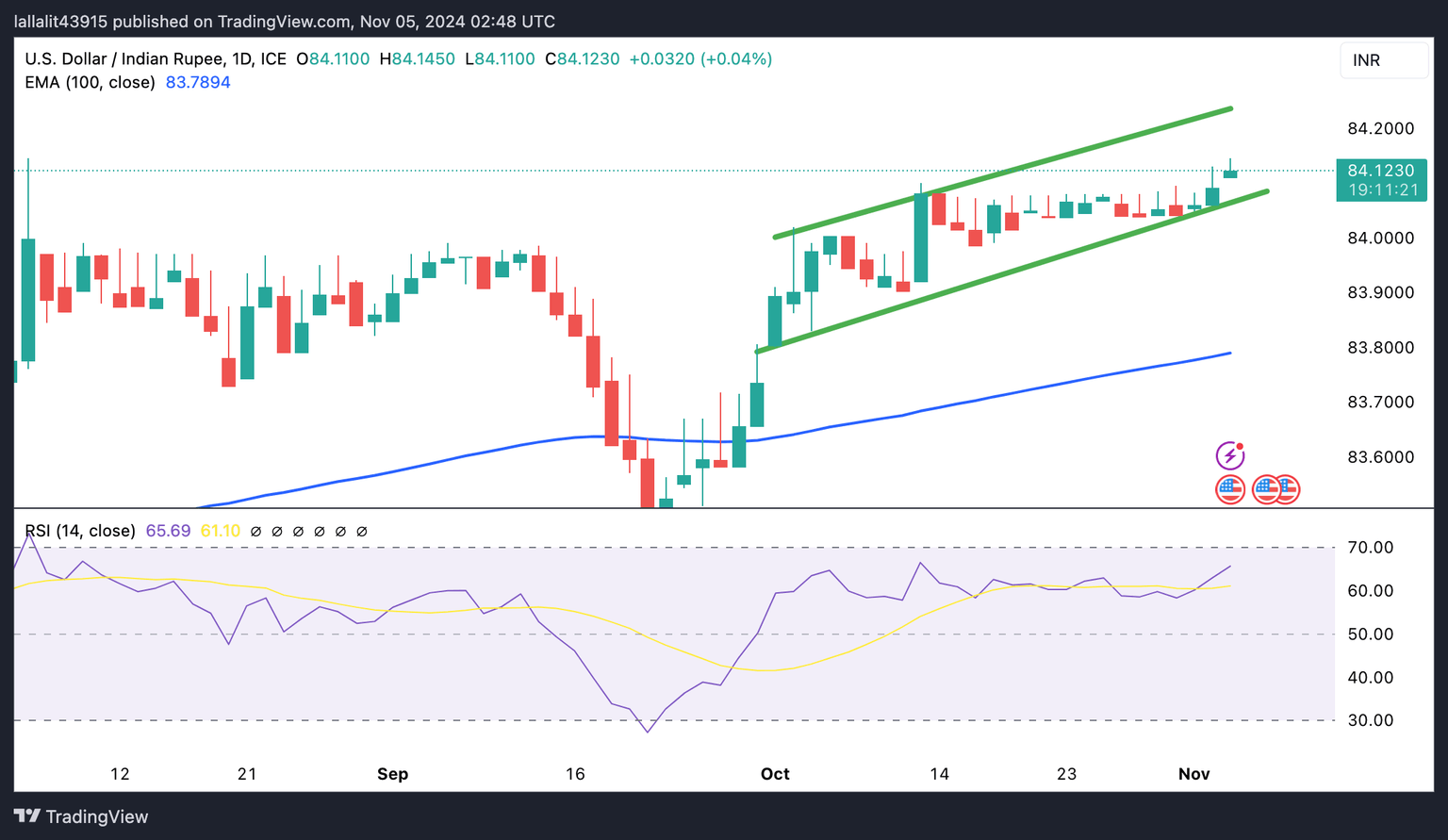

Technical Analysis: USD/INR keeps the positive outlook

The upper boundary of the ascending trend channel of 84.25 acts as an immediate resistance level for USD/INR. A clear bullish candlestick above this level could pave the way to 84.50, en route to the 85.00 psychological level.

On the flip side, a breach of the lower limit of the trend channel near 84.05 could attract enough bearish pressure to 83.78, the 100-day EMA.

RBI FAQs

The role of the Reserve Bank of India (RBI), in its own words, is "..to maintain price stability while keeping in mind the objective of growth.” This involves maintaining the inflation rate at a stable 4% level primarily using the tool of interest rates. The RBI also maintains the exchange rate at a level that will not cause excess volatility and problems for exporters and importers, since India’s economy is heavily reliant on foreign trade, especially Oil.

The RBI formally meets at six bi-monthly meetings a year to discuss its monetary policy and, if necessary, adjust interest rates. When inflation is too high (above its 4% target), the RBI will normally raise interest rates to deter borrowing and spending, which can support the Rupee (INR). If inflation falls too far below target, the RBI might cut rates to encourage more lending, which can be negative for INR.

Due to the importance of trade to the economy, the Reserve Bank of India (RBI) actively intervenes in FX markets to maintain the exchange rate within a limited range. It does this to ensure Indian importers and exporters are not exposed to unnecessary currency risk during periods of FX volatility. The RBI buys and sells Rupees in the spot market at key levels, and uses derivatives to hedge its positions.

India has run a trade deficit for most of its recent history, indicating its imports outweigh its exports. Since the majority of international trade takes place in US Dollars, there are times – due to seasonal demand or order glut – where the high volume of imports leads to significant US Dollar- demand. During these periods the Rupee can weaken as it is heavily sold to meet the demand for Dollars. When markets experience increased volatility, the demand for US Dollars can also shoot up with a similarly negative effect on the Rupee.

Higher inflation, particularly, if it is comparatively higher than India’s peers, is generally negative for the currency as it reflects devaluation through oversupply. Inflation also increases the cost of exports, leading to more Rupees being sold to purchase foreign imports, which is Rupee-negative. At the same time, higher inflation usually leads to the Reserve Bank of India (RBI) raising interest rates and this can be positive for the Rupee, due to increased demand from international investors. The opposite effect is true of lower inflation.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.