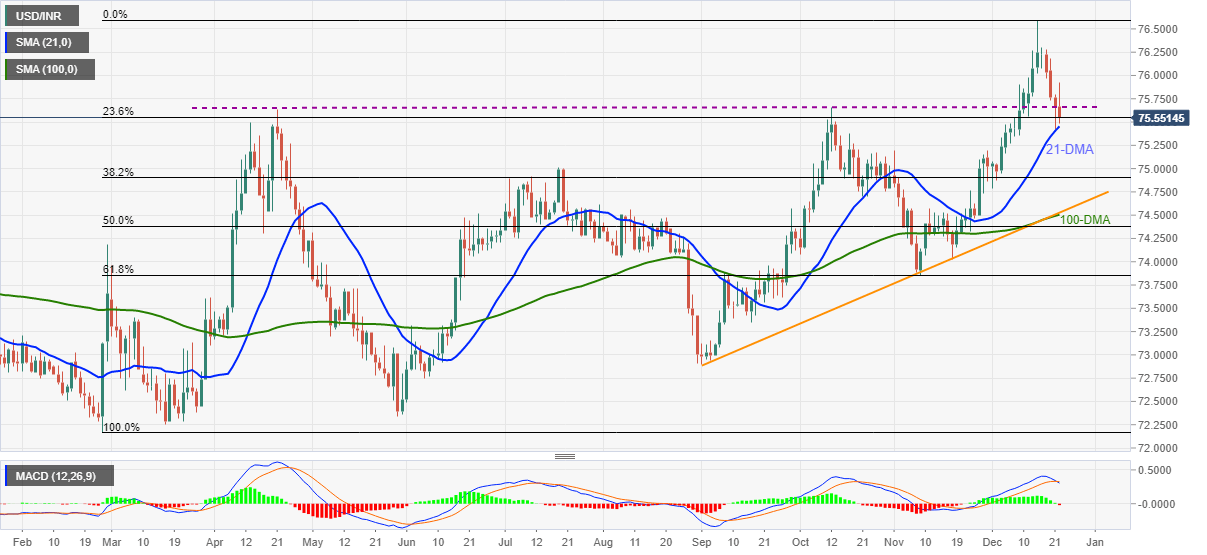

USD/INR Price Analysis: Indian rupee bulls need validation from 21-DMA

- USD/INR prints four-day downtrend, refreshes intraday low of late.

- MACD signals turn bearish for the first time since November 22, break of 75.65 adds to the bearish bias.

- Convergence of 100-DMA, ascending trend line from September appears a tough nut to crack for pair sellers.

USD/INR stands on the slippery ground near 75.50, down 0.22% intraday while printing a four-day fall heading into Wednesday’s European session.

The Indian rupee (INR) pair’s latest losses could be linked to its declines below the double-tops marked during April and October, around 75.65. Adding to the bearish bias is the recently flashed red MACD signal.

However, the 21-DMA level surrounding 75.45 challenges short-term downside ahead of directing the USD/INR bears to November’s high of 75.19 and July’s peak of 75.00.

It should be noted, however, that the pair’s weakness past 75.00 will be challenged by the 100-DMA and a three-month-old rising support line, near 74.50.

On the flip side, a daily closing beyond 75.65 will aim for the 76.00 threshold but the 76.30 level could test the USD/INR bulls afterward.

In a case where the pair buyers dominate past 76.30, the recently flashed multi-month high near 76.60 and the 77.00 will be in focus.

USD/INR: Daily chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.