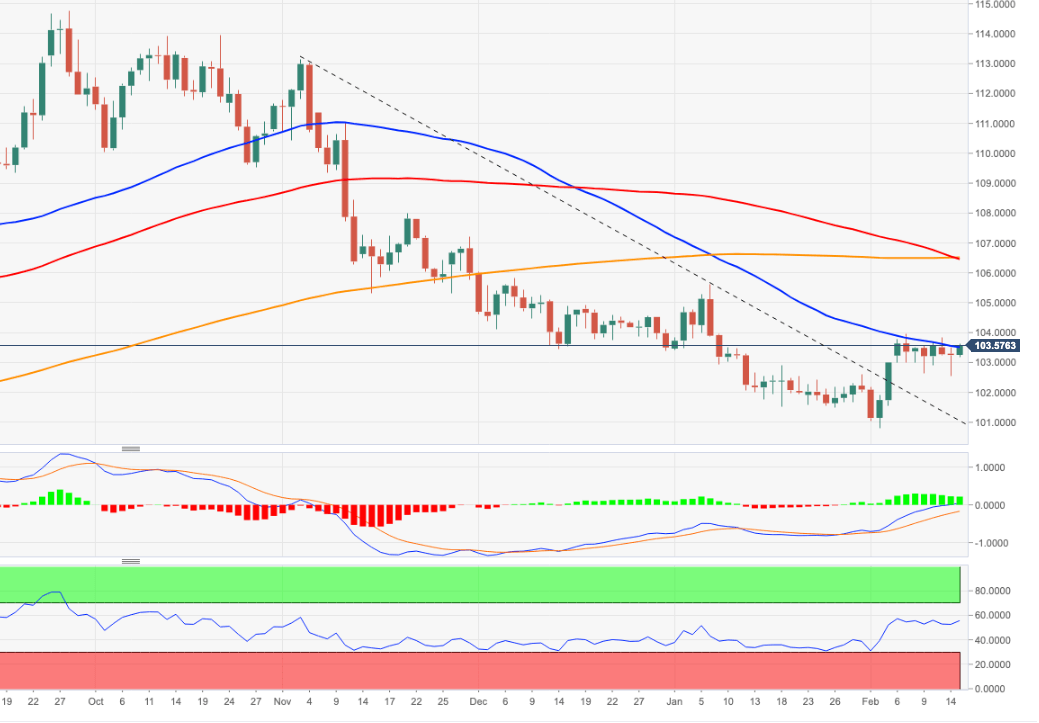

USD Index Price Analysis: Topside appears capped near 104.00

- The index maintains the erratic activity around 103.00 so far.

- The monthly high near 104.00 continues to cap the upside.

DXY reverses the recent 2-day retracement and regains the 103.60 region on Wednesday.

The ongoing price action leaves the door open to the continuation of the consolidative note for the time being. Occasional bouts of strength, however, are expected to remain limited by the proximity of the 104.00 zone, or February highs (February 7).

In the longer run, while below the 200-day SMA at 106.45, the outlook for the index remains negative.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.