USD Index Price Analysis: No changes to the range bound theme

- DXY recoups part of the losses seen on Thursday.

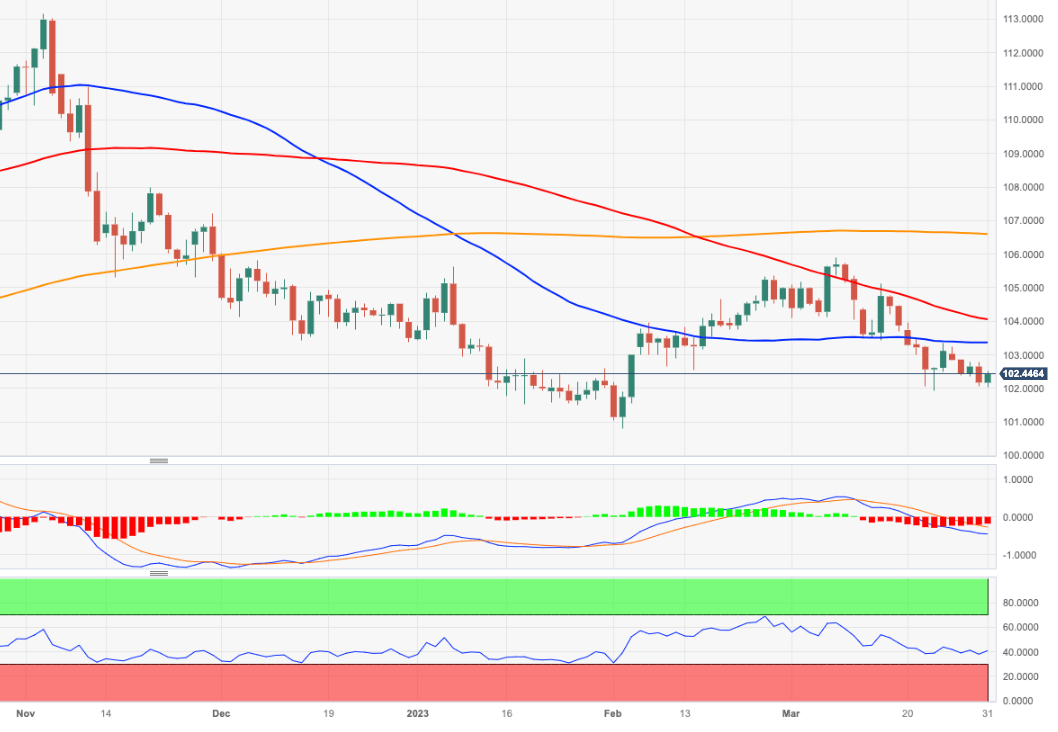

- Decent support emerges at the 102.00/101.90 band.

DXY manages to regain some balance and bounces off the earlier retracement to the 102.00 neighbourhood.

So far, it seems the index could extend the consolidative range amidst the broader bearish stance. That said, a drop below the monthly low at 101.91 (March 23) should open the door to a potential visit to the 2023 low around 100.80 (February 2).

Looking at the broader picture, while below the 200-day SMA, today at 106.55, the outlook for the index is expected to remain negative.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.