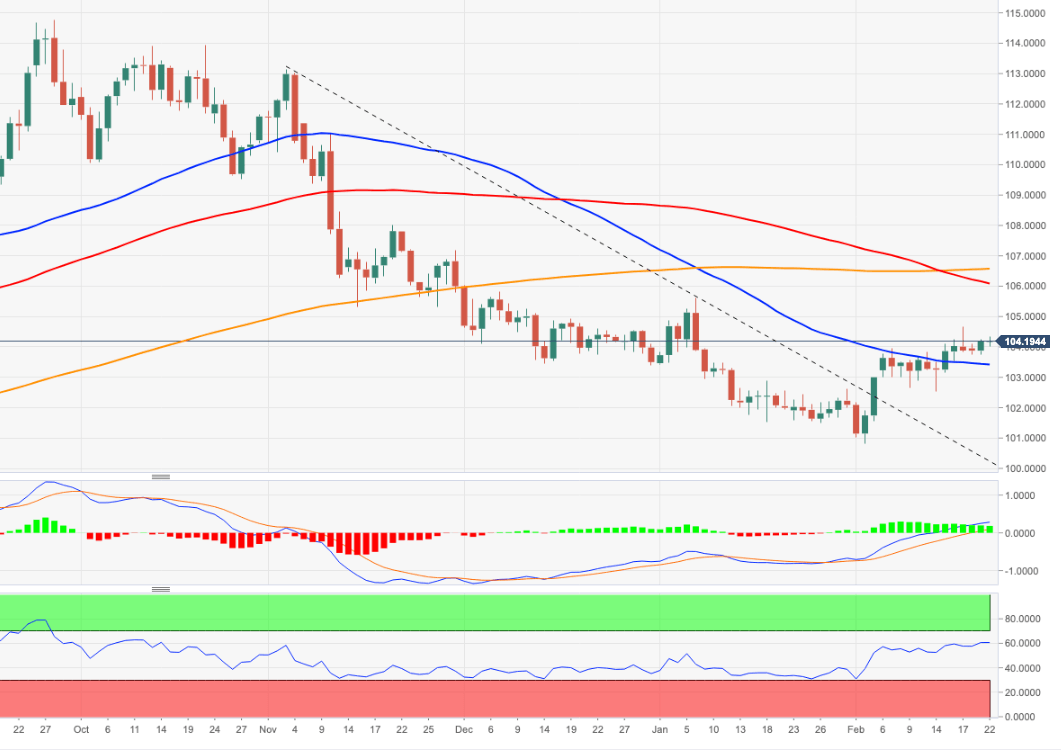

USD Index Price Analysis: Immediately to the upside comes 104.70

- The index manages well to keep the trade above the 104.00 mark.

- Extra gains are likely and could retest the 2023 top around 105.60.

DXY tries to extend the weekly recovery further north of the 104.00 barrier on Wednesday.

The ongoing price action favours the continuation of the uptrend for the time being. Further bouts of strength should clear the February high at 104.66 (February 17) to allow for a probable challenge of the 2023 top at 105.63 (January 6).

In the longer run, while below the 200-day SMA at 106.44, the outlook for the index remains negative.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.