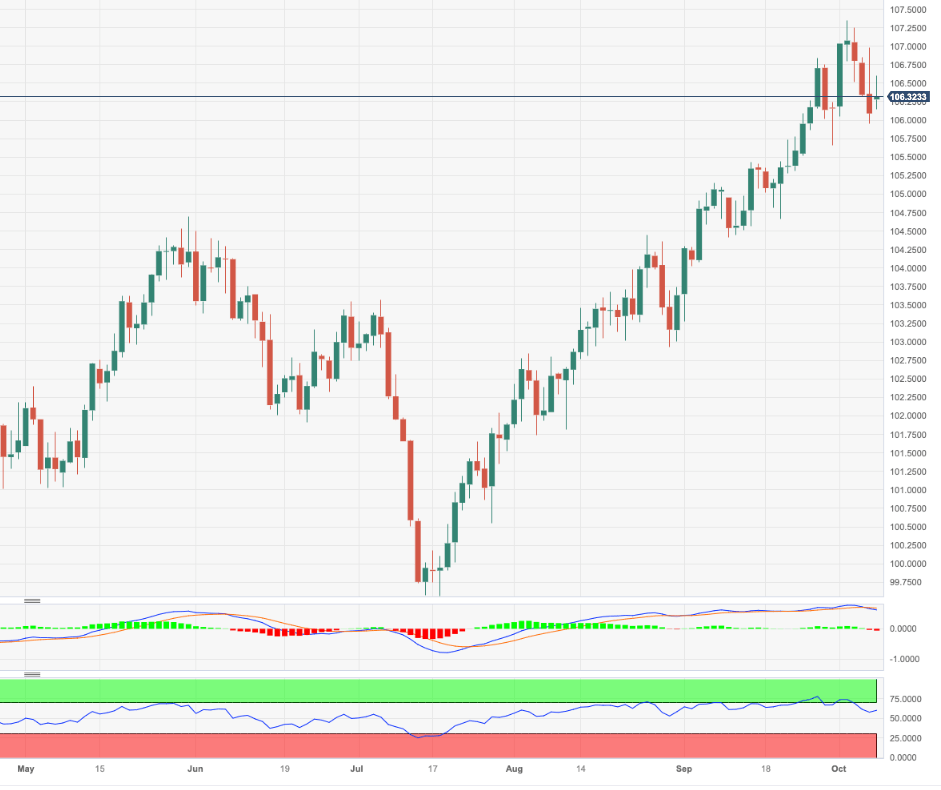

USD Index Price Analysis: Extra gains should revisit the YTD high

- DXY reverses three consecutive daily drops on Monday.

- The continuation of the rebound shifts the attention to the 2023 top.

DXY regains composure and manages to partially reverse the recent three-day decline so far at the beginning of the week.

Considering the ongoing price action, extra gains appear likely in the dollar for the time being. Once the index clears the 2023 top of 107.34 (October 3), it could encourage bulls to challenge the weekly peak at 107.99 (November 21 2022) just ahead of the round level at 108.00.

In the meantime, while above the key 200-day SMA, today at 103.17, the outlook for the index is expected to remain constructive.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.