USD/CNH Price Analysis: Pullback remains elusive beyond 6.7520

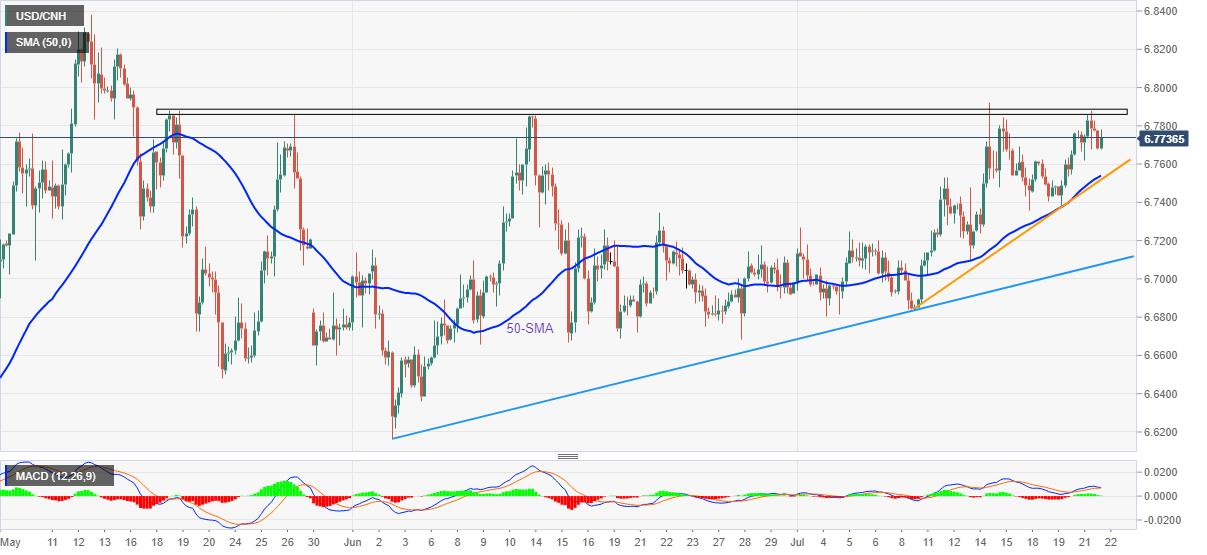

- USD/CNH again retreats from a two-month-old horizontal resistance area.

- Impending bear cross on the MACD keeps sellers hopeful.

- 50-SMA, two-week-old ascending trend line restricts the short-term downside.

- Bull can aim for yearly high on crossing 6.7890 hurdle.

USD/CNH holds lower ground near 6.7700 during Friday’s Asian session, after reversing from a two-month-old horizontal resistance area.

Considering the looming bear cross on the MACD and the pair’s inability to cross the key hurdle, USD/CNH prices are likely to decline further.

However, a convergence of the 50-SMA and a fortnight-long support line, near 6.7520, appears crucial for the USD/CNH bears to watch.

Should the quote offshore Chinese yuan (CNH) pair drop below 6.7520, it can direct sellers toward an ascending trend line from early June, near 6.7000 by the press time.

Meanwhile, a clear upside break of the 6.7870-90 hurdle needs validation from the 6.7900 round figure and the monthly high of 6.7920.

Following that, the mid-May high near 6.8200 can act as an intermediate halt during the rally targeting the yearly peak of 6.8385.

Overall, USD/CNH is likely to witness further downside. However, 6.7520 and 6.7890 are important levels to watch for the pair traders.

USD/CNH: Four-hour chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.