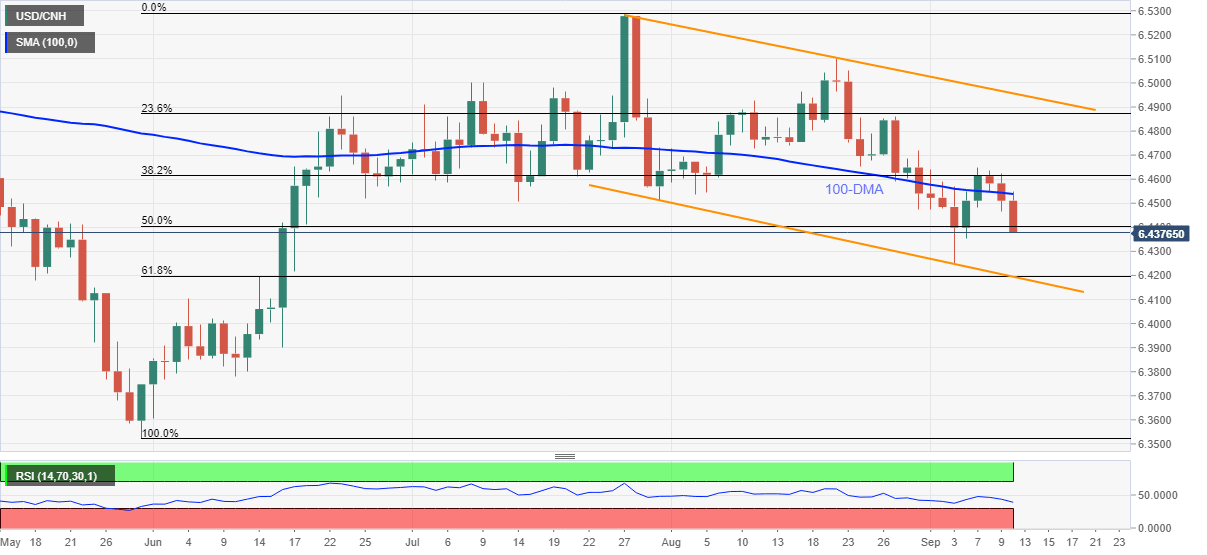

USD/CNH Price Analysis: Extends downside break of 100-DMA towards monthly low

- USD/CNH prints three-day downtrend, bears attack weekly bottom.

- Descending RSI line, not oversold, joins SMA breakdown to back the sellers.

- Convergence of six-week-old support line, 61.8% Fibonacci retracement becomes a tough nut to crack for bears.

USD/CNH takes offers around 6.4400, down 0.17% intraday during the three-day fall ahead of Friday’s European session. In doing so, the offshore Chinese currency (CNH) pair stretches the latest failures to stay past 100-DMA.

Given the descending RSI line joining the weaker prices despite being not oversold, USD/CNH is likely to remain pressured towards the monthly low, also the lowest since June 17, around 6.4245.

However, a clear downside break of 50% Fibonacci retracement of the May-July upside, close to 6.4400, becomes necessary to strengthen the bearish impulse.

Should the quote remains weak past 6.4245, a confluence of a six-week-old falling trend line and 61.8% Fibonacci retracement near 6.4200 will be the key to watch.

Meanwhile, recovery moves need to cross the 100-DMA level of 6.4540 to recall the short-term buyers and direct them to the monthly peak of 6.4650.

Following that, 23.6% Fibonacci retracement level and a multi-day-old falling trend line, respectively around 6.4870 and 6.4955, will be the key figures to watch before confirming any further upside.

USD/CNH: Daily chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.