USD/CHF ticks down on renewed US tariff threats, fiscal concerns

- USD/CHF posts mild losses as President Trump reignites tariff fears ahead of the July 9 deadline.

- The Swiss Franc strengthens as the US Dollar loses momentum on safe-haven demand.

- USD/CHF consolidates below 0.800 ahead of Trump’s ‘Big Beautiful Bill’ signing.

The Swiss Franc (CHF) is posting modest gains against the US Dollar (USD) on Friday, as renewed fiscal and trade concerns drive demand for safe-haven currencies.

The USD/CHF pair is drifting lower as investors weigh the long-term implications of the newly signed “Big Beautiful Bill” and a looming July 9 tariff deadline that threatens to re-ignite market volatility.

A signing ceremony will be held at the White House on Friday. While President Trump is celebrating the passing of the legislation, the tax and spending bill raises the US debt ceiling by a staggering $5 trillion. Although this helps avert a short-term government funding crisis, it adds significantly to long-term federal borrowing.

According to estimates from the Congressional Budget Office (CBO), the bill is expected to increase the US budget deficit by approximately $3.3 trillion over the next decade, roughly $1 trillion more than the figures provided in the version previously passed in the House.

The mounting deficit and debt burden have weighed on investor sentiment toward the US Dollar.

Increases in government debt raise concerns about long-term fiscal sustainability and inflation risks. This erosion of confidence can lead to selling pressure on the Greenback, particularly against low-yielding safe havens like the Swiss Franc.

Meanwhile, tariff-related tensions are refuelling market jitters. With a July 9 deadline approaching, President Trump has hinted that formal letters outlining new trade terms will be sent to foreign governments as early as today.

Treasury Secretary Scott Bessent failed to soothe markets on Thursday when he declined to confirm whether the administration would postpone the tariff deadline, stating only that “We’re going to do what the president wants, and he’ll be the one to determine whether they’re negotiating in good faith.”

This combination of fiscal expansion and trade policy uncertainty could create a supportive backdrop for the Swiss Franc. As a result, USD/CHF remains under modest pressure, with traders cautious ahead of next week’s developments on the tariff front and any further clues about the US fiscal trajectory.

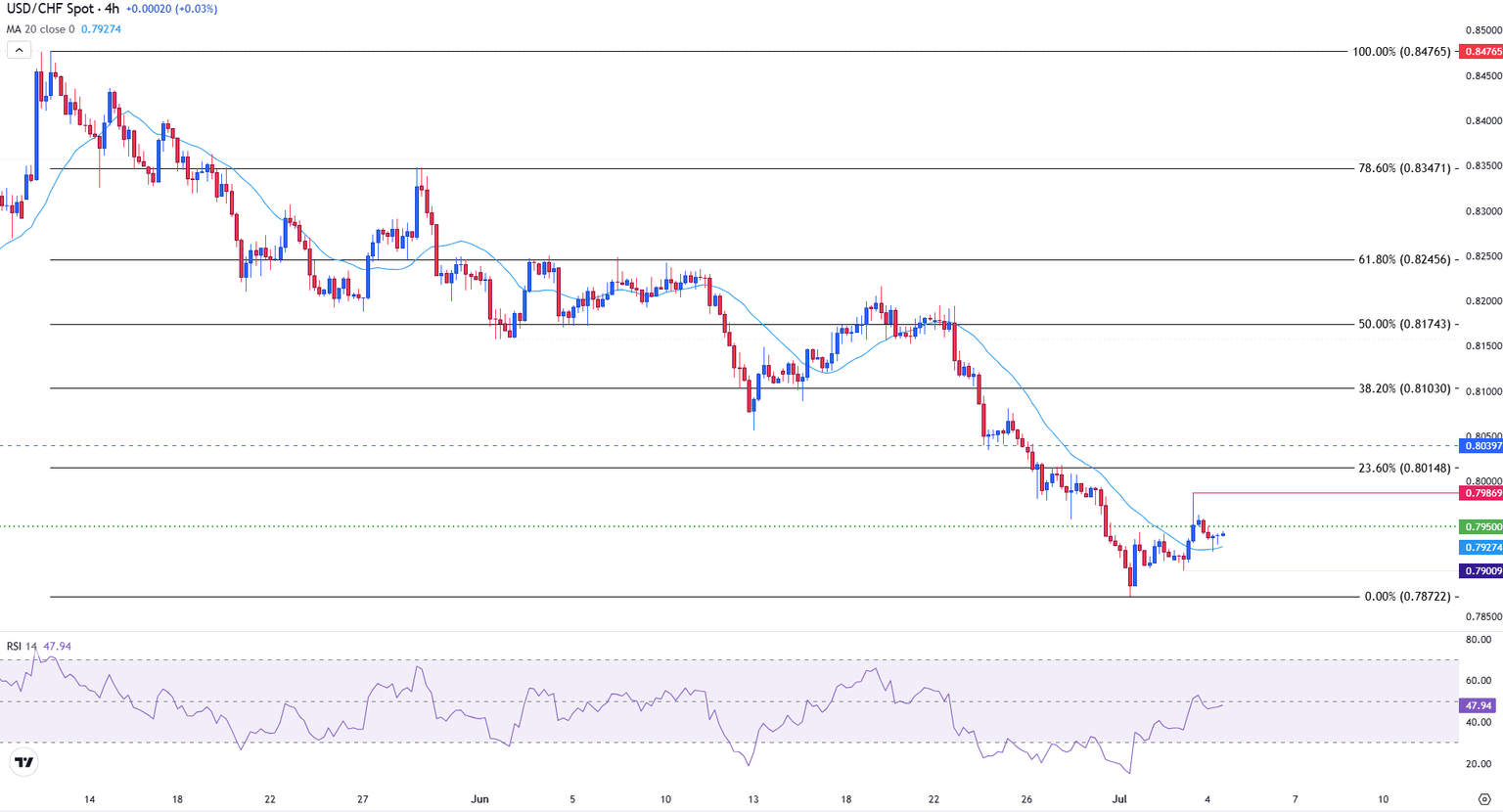

USD/CHF consolidates below 0.8000

The 4-hour chart illustrates a consolidation of USD/CHF price action above 0.7940. The shallow candles reflect indecision in light of the lack of liquidity from the US due to the Independence Day holiday.

While the 20-period Simple Moving Average (SMA) provides near-term support at 0.7927, the 0.7950 psychological level is acting as resistance.

Bears were swift to retaliate after USD/CHF bulls pushed prices to a high of 0.7987 on Thursday, below the next key psychological level of 0.8000.

The Relative Strength Index (RSI) at 48 reflects that momentum on the shorter-duration time frame remains near neutral territory.

On the upside, a move above Thursday's high and a break of 0.8000 could see USD/CHF rising to the 23.6% Fibonacci retracement level of the May-July decline near 0.8015.

Meanwhile, if US Dollar weakness persists, a break below Thursday's low around 0.7900 could see USD/CHF retest Tuesday's multi-year lows around 0.78722.

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Author

Tammy Da Costa, CFTe®

FXStreet

Tammy is an economist and market analyst with a deep passion for financial markets, particularly commodities and geopolitics.