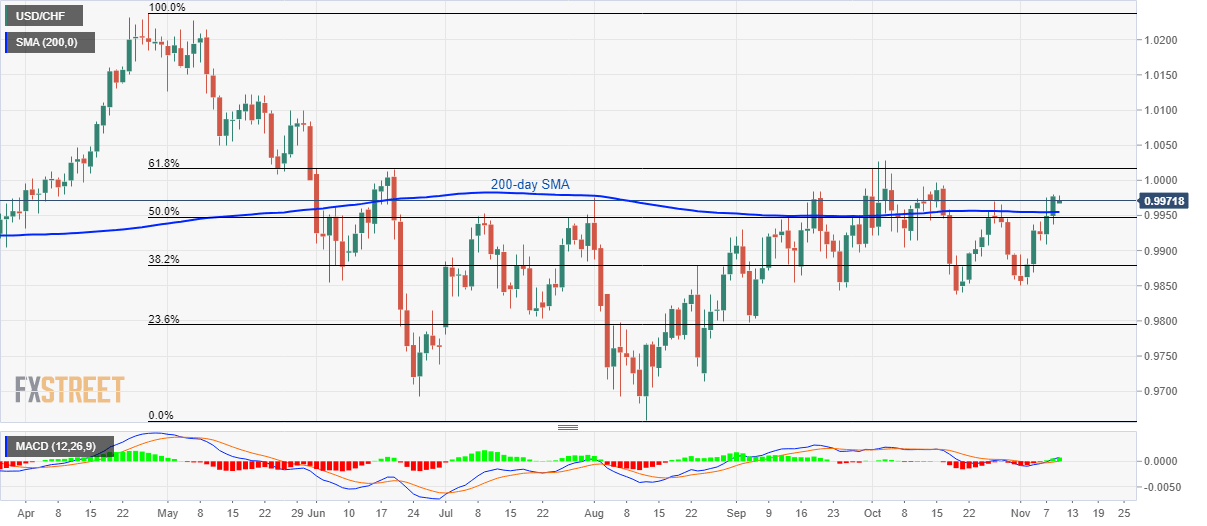

USD/CHF Technical Analysis: Positive beyond 200-day SMA, 50% Fibo.

- USD/CHF fails to cross mid-October high, 61.8% Fibonacci retracement.

- A downside break of 0.9948 could recall 0.9900 on the chart

- Bullish MACD keeps buyers hopeful.

The USD/CHF pair’s failure to rise beyond mid-October highs can’t be considered as it’s weakness unless the quote traders above 200-day SMA, 50% Fibonacci retracement of April-August downpour. The prices seesaw around 0.9970 during early Monday.

Also favoring the buyers are the bullish signals from 12-bar Moving Average Convergence and Divergence (MACD).

As a result, prices could keep targeting a sustained move beyond October 15 high around 1.0000, also clearing 61.8% Fibonacci retracement level of 1.0016, to question May-end top near 1.0100.

On the contrary, pair’s declines below 50% Fibonacci retracement level of 0.9948 could drag the quote to 0.9900 while the monthly bottom close to 0.9850 and the October 18 low of 0.9837 might please sellers then after.

In a case where bears keep the reins after 0.9837, 23.6% Fibonacci retracement level of 0.9795 will be on their radars.

USD/CHF daily chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.