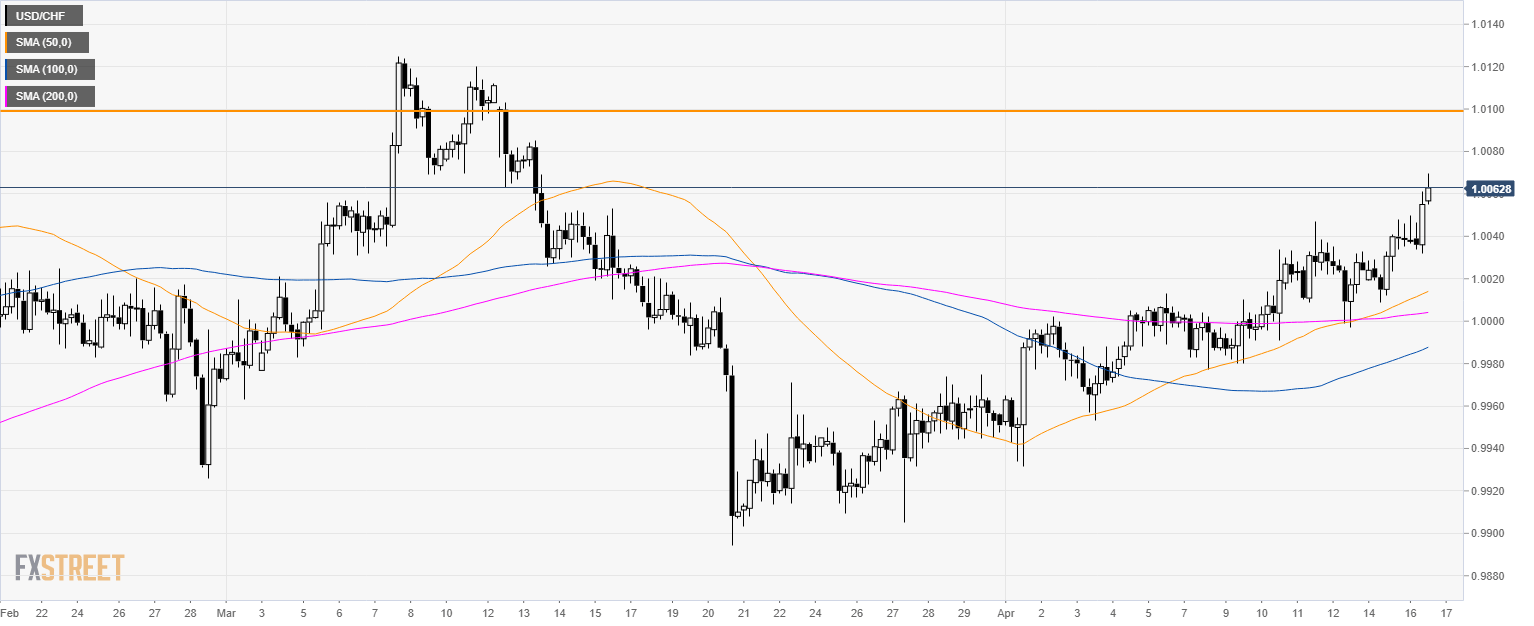

USD/CHF Technical Analysis: Greenback bulls en route to 1.0100 target

USD/CHF daily chart

- USD/CHF is trading above the 50-day simple moving average (SMA) and the parity level.

- As mentioned, the 1.0060 and 1.0070 level were important resistances to look at.

- The 50 SMA crossed above the 200 SMA.

USD/CHF 30-minute chart

- The path of least resistance remains to the upside. The next main target is seen at the 1.0100 level.

- Support is at 1.0050 and 1.0020 level.

Additional key levels

Author

Flavio Tosti

Independent Analyst