USD/CHF Price Forecast: Stalls below 0.8300 after Fed Minutes

- USD/CHF rises from a one-month low but struggles to breach key 0.83 resistance on Wednesday.

- Fed Minutes highlight rising stagflation risks, prompting traders to price in 45 bps of rate cuts.

- RSI turning higher hints at weakening bearish pressure; key support lies at 0.8200 and 0.8184.

USD/CHF halts its advance after posting back-to-back days of gains that pushed the pair to its weekly high of 0.8290. However, buyers remain in charge, even though the pair is near its opening price at 0.8270.

The release of the latest Federal Reserve (Fed) Minutes revealed that officials agreed that high economic uncertainty was enough to adopt a cautious stance regarding future adjustments to the Fed funds rate and acknowledged that stagflation risks had risen.

Following the announcement of the Minutes, money markets had priced 45 basis points (bps) of easing by the Federal Reserve.

USD/CHF Price Forecast: Technical outlook

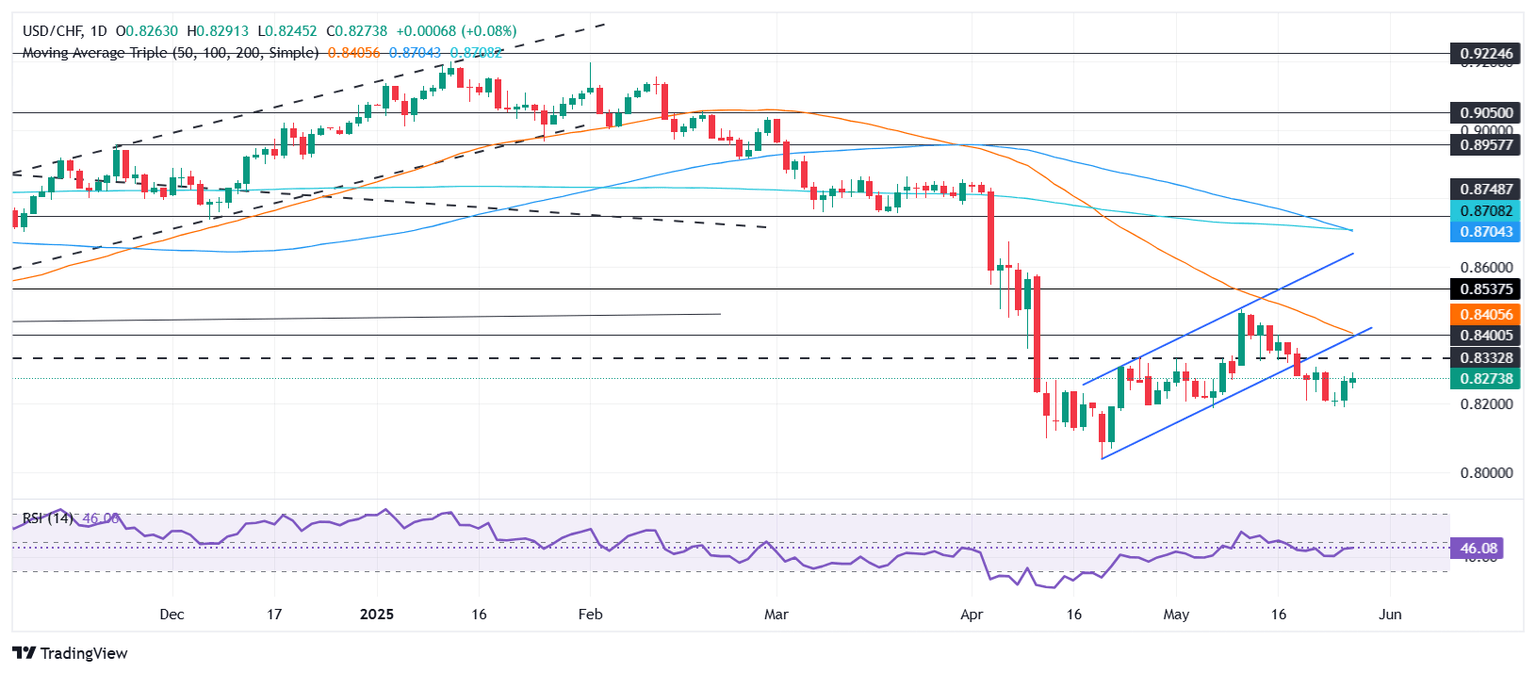

USD/CHF remains downward biased despite registering a leg up that lifted the pair from around two-month lows of 0.8184 to the 0.83 mark.

Momentum, as measured by the Relative Strength Index (RSI), suggests that the pair remains bearish, but the RSI aiming steadily up could signal that bears are losing steam.

Given the backdrop, USD/CHF first resistance would be the 0.83 psychological mark. Once surpassed, the next stop would be the May 1 high of 0.8332, followed by the 50-day Simple Moving Average (SMA) at 0.8399. On further strength, the next ceiling level would be the month-to-date (MTD) peak of 0.8475.

Conversely, further USD/CHF weakness could push the spot price to 0.8200 and below the monthly low of 0.8184.

USD/CHF Price Chart – Daily

(This story was corrected on May 28 at 20:29 GMT to say in the first bullet point that USD/CHF rises from a one-month low, not a two-month low)

Swiss Franc PRICE This week

The table below shows the percentage change of Swiss Franc (CHF) against listed major currencies this week. Swiss Franc was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.69% | 0.46% | 1.68% | 0.71% | 1.02% | 0.46% | 0.82% | |

| EUR | -0.69% | -0.22% | 1.01% | 0.02% | 0.33% | -0.22% | 0.11% | |

| GBP | -0.46% | 0.22% | 0.94% | 0.24% | 0.55% | 0.00% | 0.35% | |

| JPY | -1.68% | -1.01% | -0.94% | -0.95% | -0.67% | -1.23% | -0.85% | |

| CAD | -0.71% | -0.02% | -0.24% | 0.95% | 0.32% | -0.24% | 0.09% | |

| AUD | -1.02% | -0.33% | -0.55% | 0.67% | -0.32% | -0.59% | -0.20% | |

| NZD | -0.46% | 0.22% | 0.00% | 1.23% | 0.24% | 0.59% | 0.35% | |

| CHF | -0.82% | -0.11% | -0.35% | 0.85% | -0.09% | 0.20% | -0.35% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Swiss Franc from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent CHF (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.