USD/CHF Price Forecast: Slips to 0.8020 as safe-haven boosts Franc

- USD/CHF extends losses after Powell signals rate cuts, boosting Swiss Franc’s safe-haven appeal.

- Pair consolidates between support and 50-day SMA, with RSI indicating sideways momentum.

- Break below support exposes further downside, while resistance capped by 100-day SMA.

USD/CHF extended its downtrend for the second straight day, down 0.16%, trading at 0.8020 after hitting a daily high of 0.8076. A flight to safety has favored the Swiss Franc as the Dollar digest the dovish tilt by the Fed Chair Jerome Powell, who opened the door for adjusting interest rates.

USD/CHF Price Forecast: Technical outlook

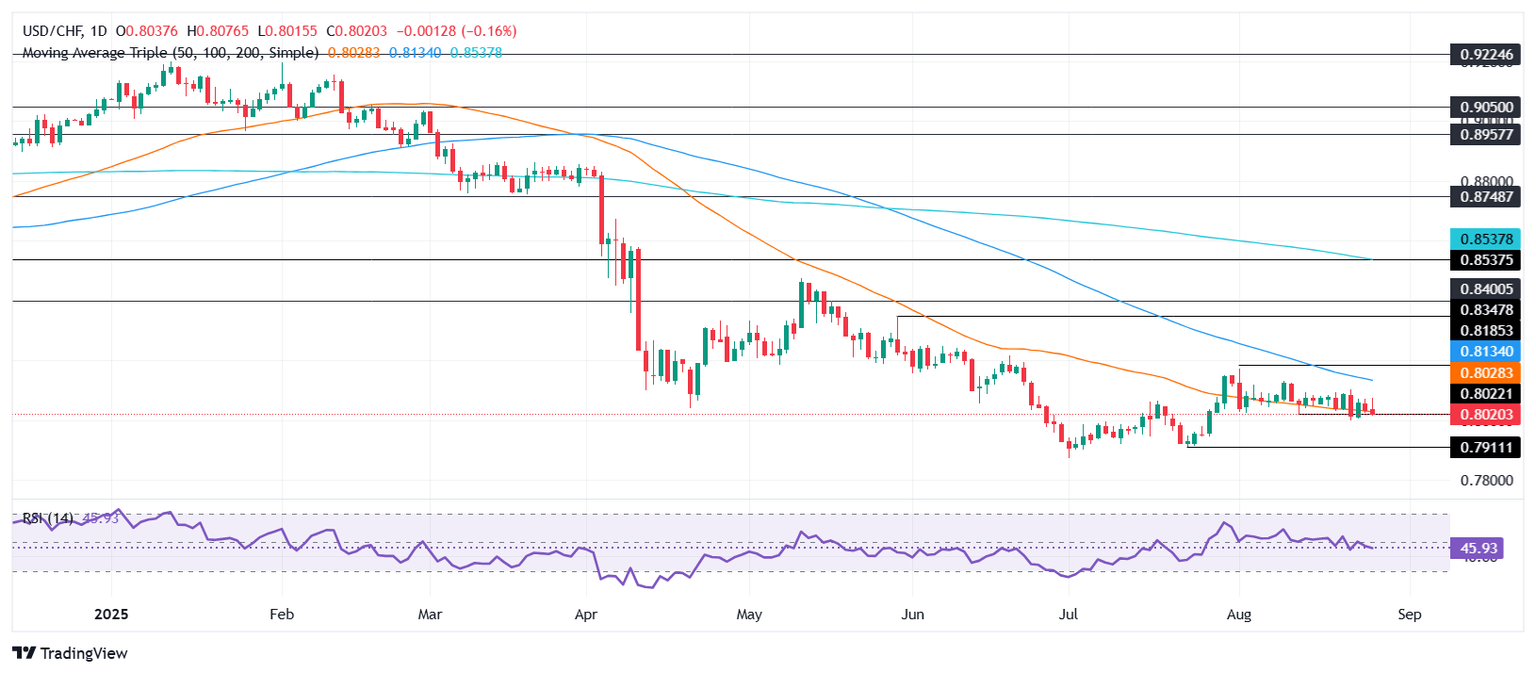

The pair is consolidating between 0.8000 and the 50-day Simple Moving Averages (SMAs), at 0.8025s, respectively, lacking a clear directional bias ahead of a busy economic calendar. The Relative Strength Index (RSI) sits near its neutral line, reinforcing the view of sideways trade.

On the downside, a retest of 0.8000—the recent lower low from July 28—remains possible. A drop below would target 0.7944 from July 28, then the July 23 cycle low at 0.7911. Conversely, a move above 0.8075 could pave the way toward 0.8100, with the 100-day SMA at 0.8139 acting as the next key resistance.

USD/CHF Price Chart – Daily

Swiss Franc Price This week

The table below shows the percentage change of Swiss Franc (CHF) against listed major currencies this week. Swiss Franc was the strongest against the Euro.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.72% | 0.15% | 0.35% | -0.27% | -0.22% | 0.18% | 0.08% | |

| EUR | -0.72% | -0.57% | -0.45% | -0.99% | -0.86% | -0.55% | -0.64% | |

| GBP | -0.15% | 0.57% | 0.00% | -0.43% | -0.35% | 0.03% | -0.08% | |

| JPY | -0.35% | 0.45% | 0.00% | -0.56% | -0.53% | -0.09% | -0.15% | |

| CAD | 0.27% | 0.99% | 0.43% | 0.56% | 0.10% | 0.48% | 0.35% | |

| AUD | 0.22% | 0.86% | 0.35% | 0.53% | -0.10% | 0.38% | 0.28% | |

| NZD | -0.18% | 0.55% | -0.03% | 0.09% | -0.48% | -0.38% | -0.10% | |

| CHF | -0.08% | 0.64% | 0.08% | 0.15% | -0.35% | -0.28% | 0.10% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Swiss Franc from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent CHF (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.