USD/CHF Price Forecast: Rejection at resistance risks fresh downside

- USD/CHF holds gains but stalls under key resistance, limiting upside potential.

- The 0.8540 level is a key decision point, as a break from it may trigger bullish continuation.

- Failure to clear resistance could lead to renewed selling, extending the downtrend.

The US Dollar (USD) is trading higher against the safe-haven Swiss Franc (CHF) on Friday, as markets continue to digest the ongoing developments in tariff negotiations, interest rate expectations, and broader risk sentiment. At the time of writing, USD/CHF is testing a critical layer of resistance at 0.838, posting a modest 0.28% gain on the day.

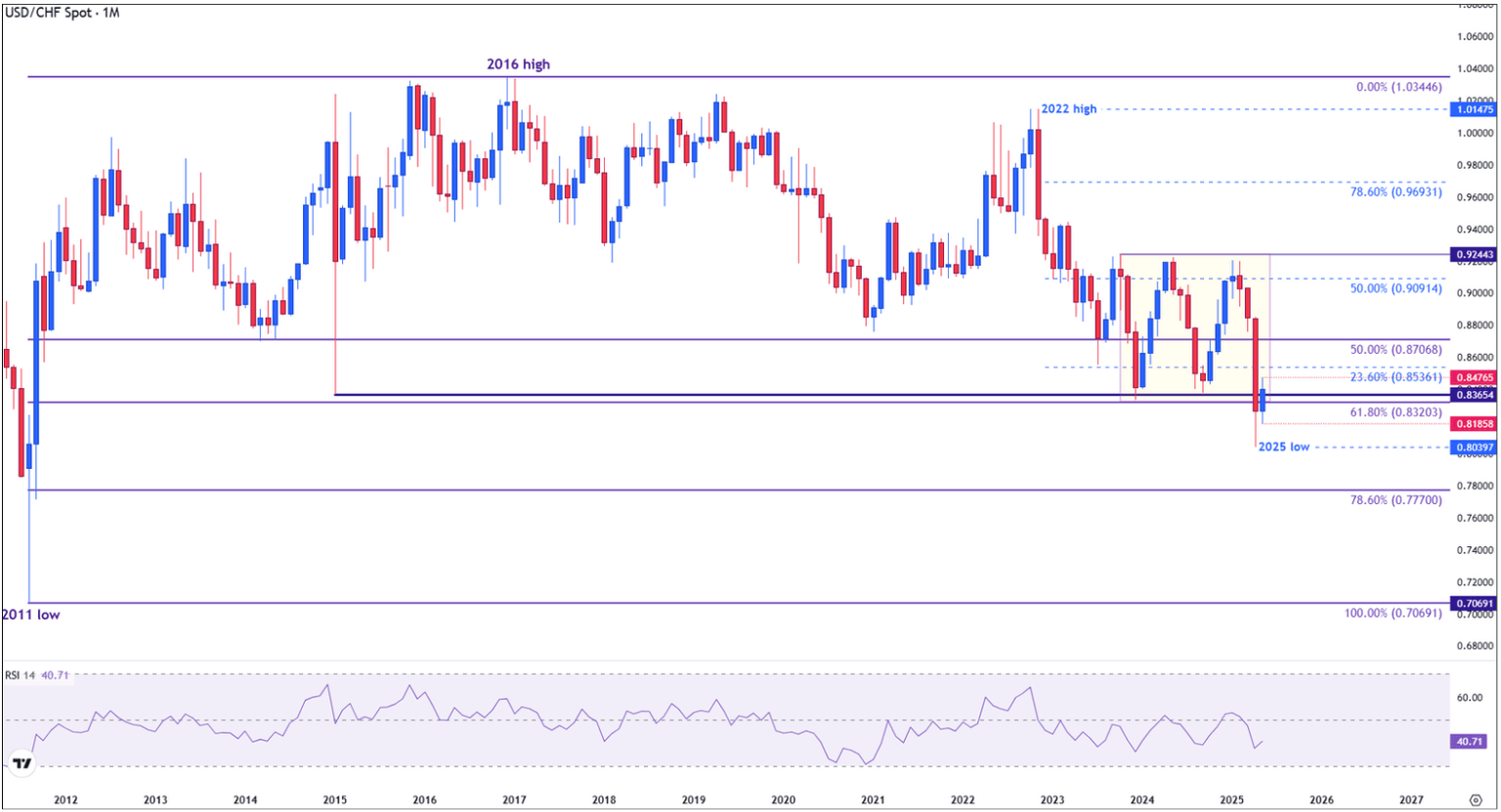

Long-term support base underpins the April USD/CHF rebound

USD/CHF found strong support on April 21 near 0.8040 — its lowest level since 2015 — and has since begun to recover. This bounce came just below a key long-term Fibonacci retracement level near 0.8320, which has historically acted as a major turning point for the pair. Notably, this same zone helped stabilize prices during the 2015–2016 consolidation, adding weight to its importance as a structural base.

The current rebound is approaching a key resistance zone around 0.8540. This level is important for several reasons: it marks the 23.6% Fibonacci retracement of the downtrend from the 2022 peak, it coincides with an old multi-year support from 2015 that broke earlier this year, and it aligns with the bottom of a trading range that held from mid-2023 to early 2025.

A monthly close above this area would indicate a deeper shift in market sentiment, potentially confirming a trend reversal. However, if price fails to break through, the broader downtrend remains in play, with renewed risk of a move back toward 0.7770 or even the long-term cycle low near 0.7070.

USD/CHF monthly chart

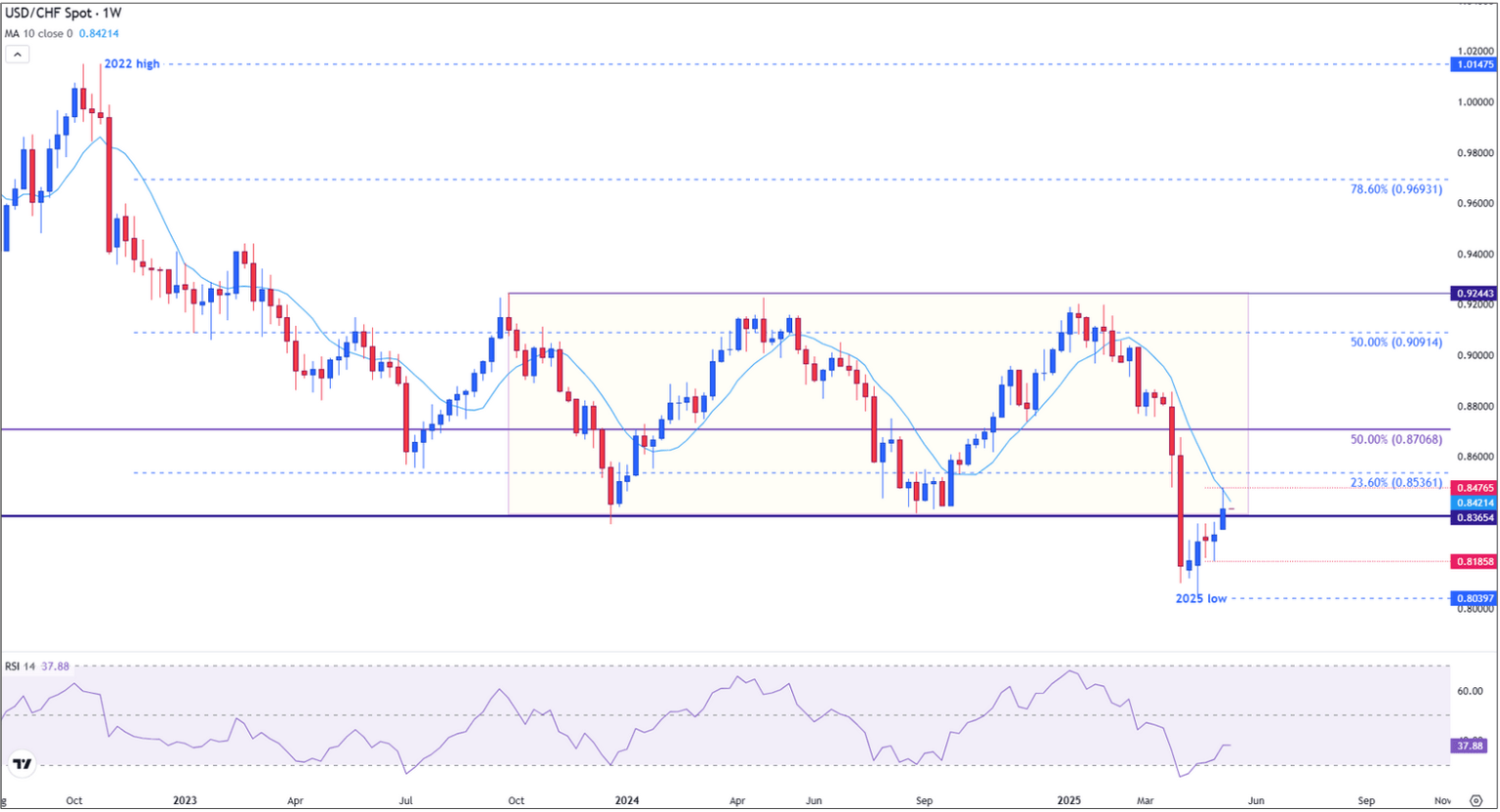

USD/CHF stalls as bulls attempt recovery from multi-year lows

On the weekly time frame, USD/CHF has posted three consecutive bullish candles, reflecting a recovery from oversold conditions. The pair is testing the 10-week Simple Moving Average (SMA) near 0.8419, which has acted as dynamic resistance since March. The broader 0.8419-0.8536 zone is technically dense, representing a former support region from 2023 that failed earlier this year.

The Relative Strength Index (RSI) has recovered to around 37.2, indicating easing bearish momentum. However, it remains well below the neutral 50 level, underscoring the tentative nature of the current rebound.

A confirmed weekly close above 0.8536 would represent a meaningful break in structure, opening upside potential toward the mid-point of the 2022-2025 decline at 0.8706.

USD/CHF weekly chart

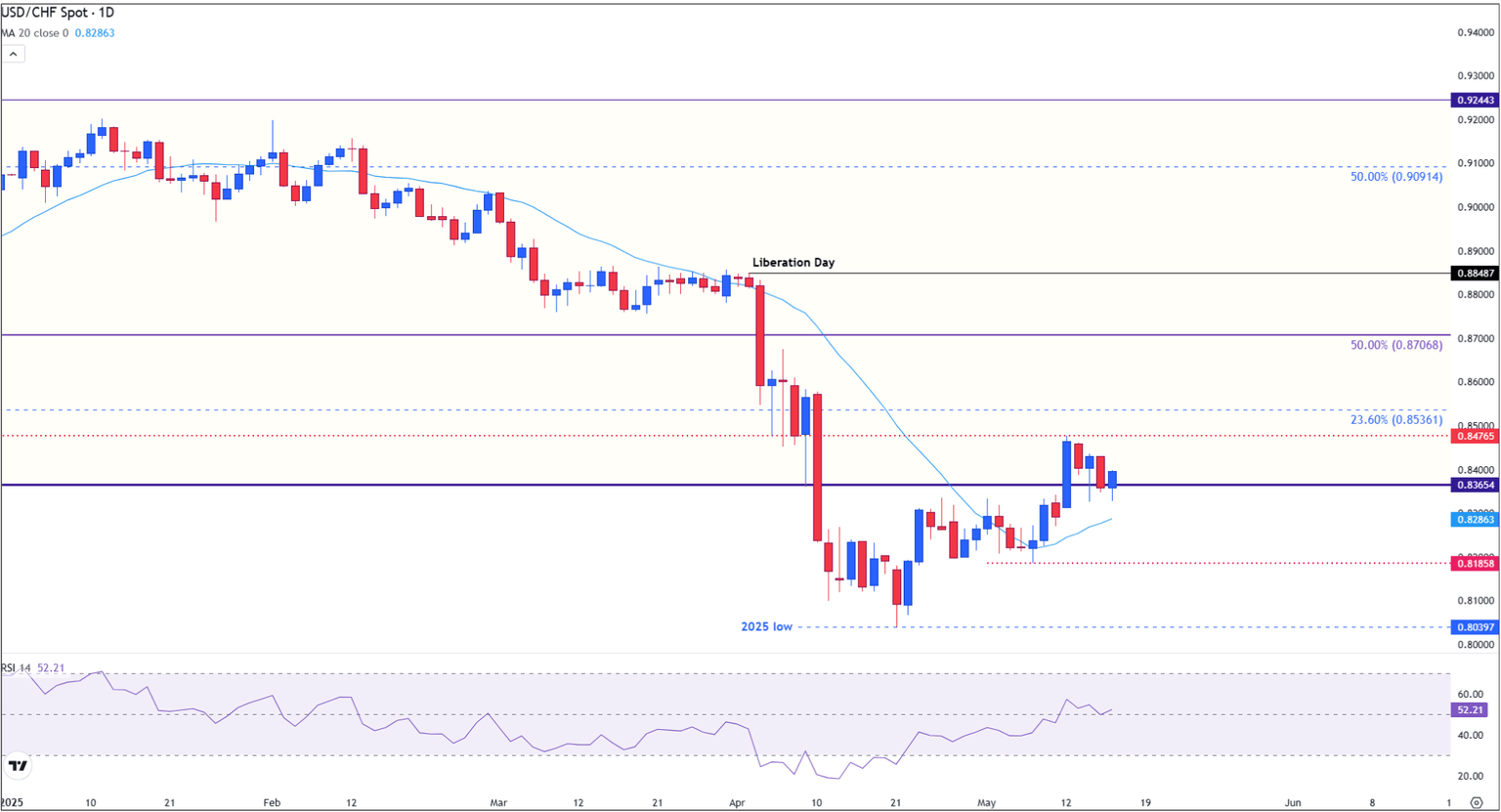

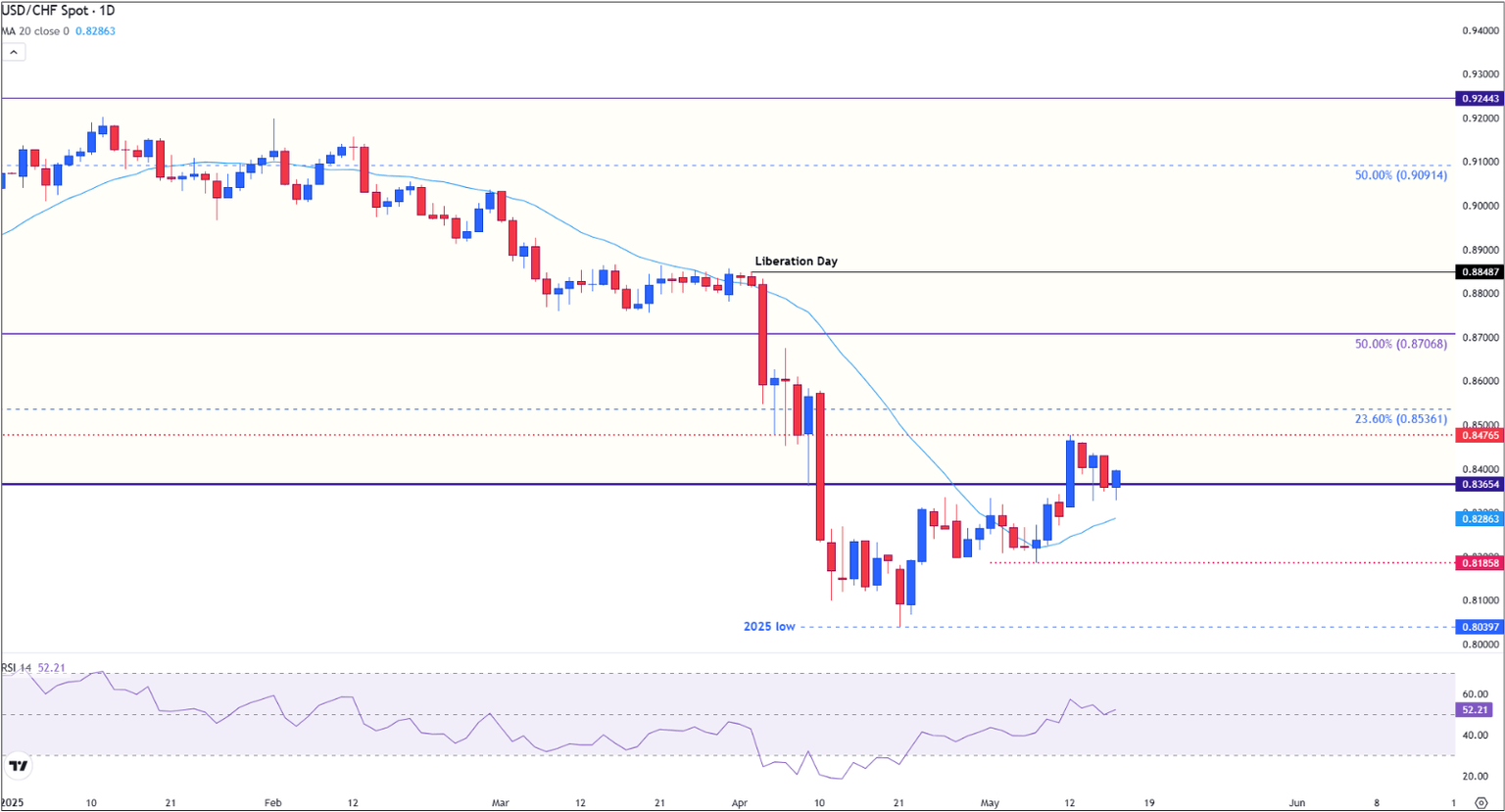

Consolidation signals hesitation below resistance

The daily chart shows that USD/CHF is consolidating just below the 0.8536 barrier after rallying from the April low at 0.8039. Price action remains supported by a rising 20-day SMA, currently at 0.8285, while a pattern of higher lows signals ongoing demand. Still, momentum is waning, with the Relative Strength Index (RSI) stabilizing near 51.2 – a neutral reading that reflects a balanced, but indecisive, market.

Without a breakout above 0.8536, the risk of a corrective pullback is growing. Immediate support is found at 0.8320, the long-term Fibonacci zone, followed by 0.8185. A confirmed daily close above 0.8536 would likely trigger follow-through buying and bring 0.8706 into view.

USD/CHF daily chart

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.34% | 0.31% | 0.20% | 0.19% | 0.23% | 0.12% | 0.43% | |

| EUR | -0.34% | -0.02% | -0.13% | -0.16% | -0.11% | -0.22% | 0.09% | |

| GBP | -0.31% | 0.02% | -0.10% | -0.13% | -0.09% | -0.19% | 0.11% | |

| JPY | -0.20% | 0.13% | 0.10% | -0.02% | -0.01% | -0.12% | 0.20% | |

| CAD | -0.19% | 0.16% | 0.13% | 0.02% | 0.02% | -0.06% | 0.25% | |

| AUD | -0.23% | 0.11% | 0.09% | 0.00% | -0.02% | -0.09% | 0.21% | |

| NZD | -0.12% | 0.22% | 0.19% | 0.12% | 0.06% | 0.09% | 0.30% | |

| CHF | -0.43% | -0.09% | -0.11% | -0.20% | -0.25% | -0.21% | -0.30% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Author

Tammy Da Costa, CFTe®

FXStreet

Tammy is an economist and market analyst with a deep passion for financial markets, particularly commodities and geopolitics.