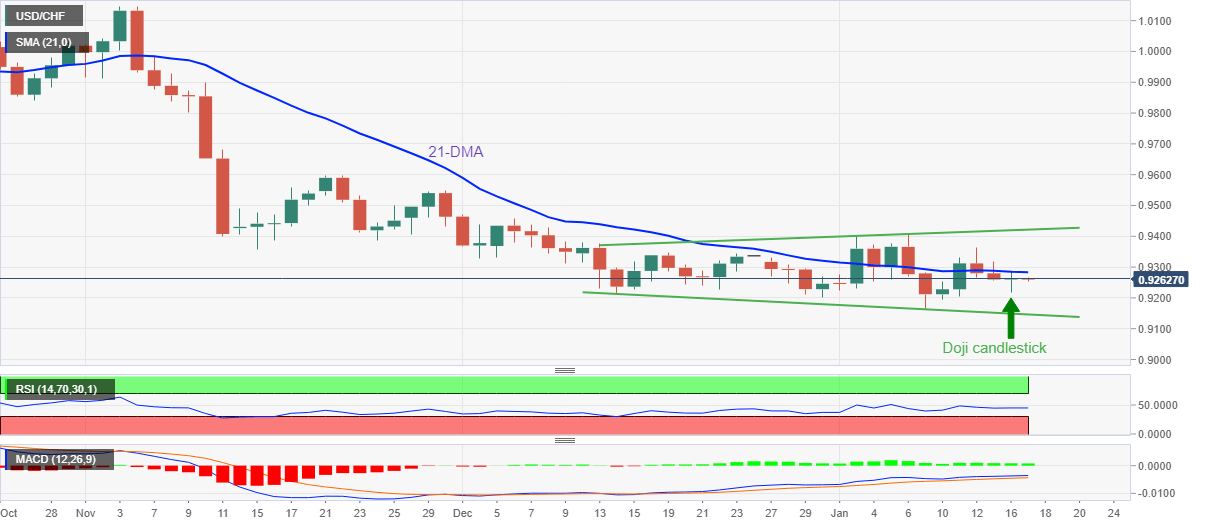

USD/CHF Price Analysis: Trend-widening chart pattern, Doji candlestick advocate volatility

- USD/CHF remains sidelined inside one-month-old megaphone formation.

- 21-DMA challenges recovery moves favored by Monday’s Doji candlestick.

- Sluggish RSI line signals more grinding but bullish MACD signals probe bears of late.

USD/CHF steadiness near 0.9260-65 as the Swiss Franc (CHF) traders struggle to justify the previous day’s Doji candlestick during early Tuesday. In doing so, the major currency pair remains inside a one-month-long megaphone trend-widening chart formation.

That said, the steady RSI (14) suggests further grinding of the USD/CHF prices but the bullish MACD signals challenge the pair buyers. Additionally probing the quote’s immediate upside is the 21-DMA resistance near 0.9285.

It should be noted that the stated megaphone’s top line, close to 0.9420 by the press time, appears a tough nut to crack for the USD/CHF bulls before retaking control.

Ahead of that, the November 2022 low near 0.9355 may probe the recovery moves past 0.9285.

Alternatively, the 0.9200 round figure and the monthly bottom around 0.9165 could restrict the short-term USD/CHF downside ahead of highlighting the stated trend-widening chart pattern’s lower line, close to 0.9145 at the latest.

In a case where the USD/CHF bears keep the reins past 0.9145, the 0.9100 round figure will precede the previous yearly low of 0.9091 to please them.

Overall, USD/CHF is likely to remain sideways even if the pair sellers appear to have run out of steam of late.

USD/CHF: Daily chart

Trend: Limited downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.